Explore what's moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast, Spotify or Pocket Cast.

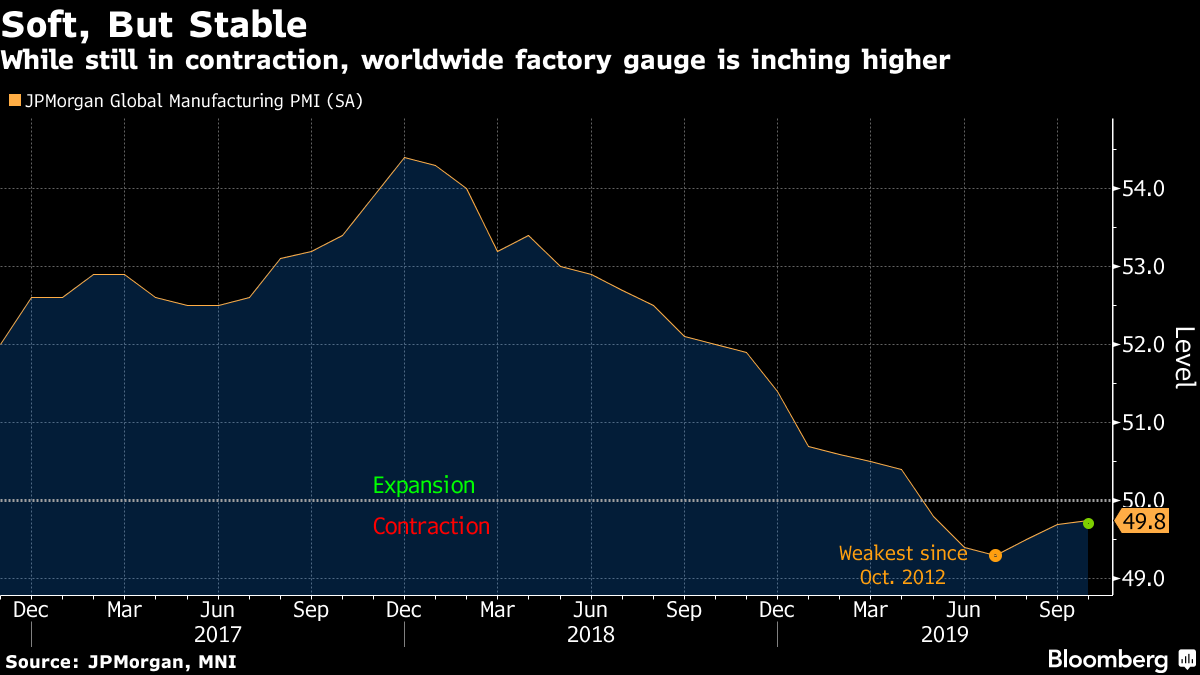

Europe's top central banker is urging larger fiscal responses from governments to invigorate economies, while rising commodities prices and slight improvements in a global manufacturing index indicate demand is stabilizing.

Following are some of the top charts that appeared on the Bloomberg terminal and Bloomberg.com this week. The scope of this weekly series, grouped by region, is a graphical depiction of an evolving world economy. Chart selection is based on financial market and national economy relevance, shifts in demographics and geopolitical events.

U.S.

Power Pay

Hungry for talent, U.S. companies in these higher-paying industries are ponying up

Source: Bureau of Labor Statistics

American workers in the industries where wages are well above the national average are commanding the biggest bumps in pay, the latest jobs report showed.

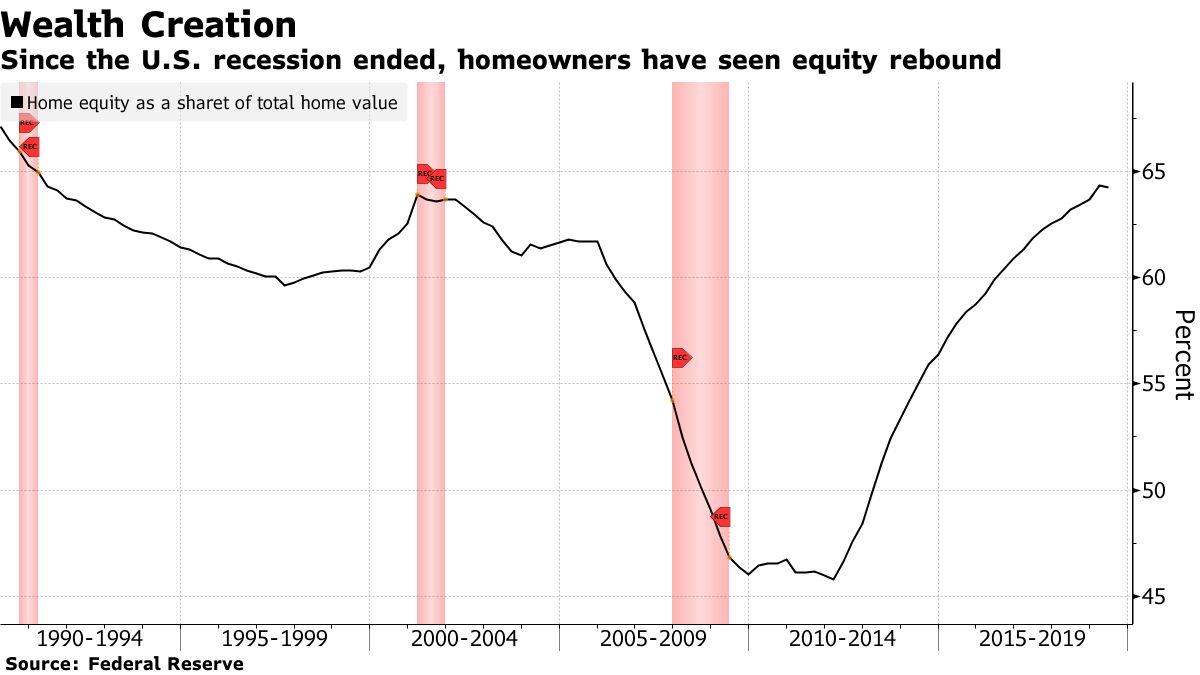

Home equity has increased by almost 20 percentage points over the last decade through a combination of relatively low interest rates which allow for faster mortgage amortization and a robust increase in property prices.

Europe

Surprise Split

November's BOE decision saw the biggest dovish dissent of Carney era

Source: Bank of England

Two Bank of England officials at Thursday's policy meeting wanted an immediate reduction in interest rates to combat threats to growth from Brexit and a weaker global economy.

Fiscal Stimulus

12 euro-area economies seen with budget balances exceeding 0.5% deficit

Source: European Commission November forecast

The European Commission's latest forecasts, released on Thursday, show them all having next year what European Central Bank president Christine Lagarde described in her confirmation testimony as space for stimulus.

Asia

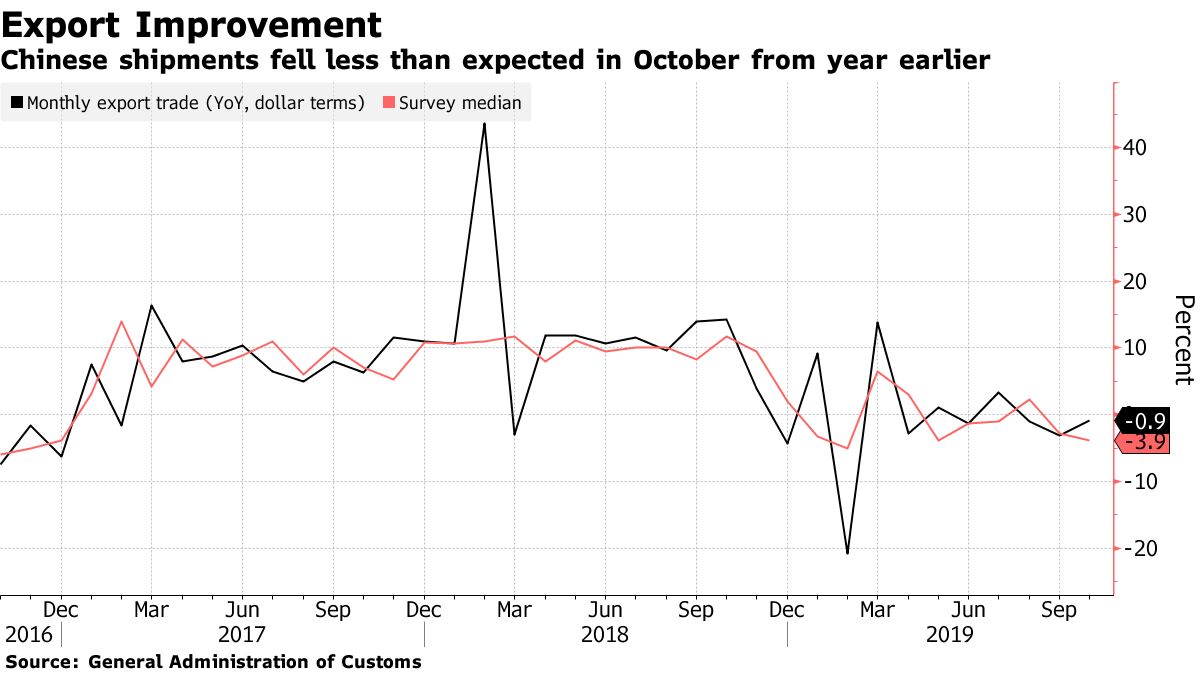

Exports from China in October fell less than expected, offering a tentative sign of stability in trade markets amid hopes of a interim trade deal between Washington and Beijing.

Social Costs

Hong Kong spends just under half of its budget on key social areas

Source: Hong Kong's 2019-2020 budget documents

Note: Figures based on 2019-2020 Hong Kong government estimates

Hong Kong officials looking for a fiscal solution to a months-long impasse with protesters are doing it on the cheap. While Hong Kong spends almost half its budget on social welfare, health and education, its annual spending lags it peers.

Global

While JPMorgan Chase & Co.'s global manufacturing index contracted for a sixth month in October, it inched closertoward positive territory as both output and orders firmed.

Commodities are enjoying a revival as optimism over a possible U.S.-China trade pact boosts prospects for demand, with gains in energy, base metals and crops.

— With assistance by Enda Curran, Eric Lam, Jake Lloyd-Smith, Tomoko Sato, Craig Stirling, Brian Swint, Alexandre Tanzi, and Jill Ward

Commenti

Posta un commento