The World Bank has just released its new "Global Economic Prospects" report, describing how the COVID-19 pandemic has unleashed a "devastating blow" on the global economy -- shredding all hopes that a V-shaped recovery will be seen this year.

The report goes on to say the global economy will contract for the first time since World War II and emerging market economies will shrink for the first time in six decades -- the result of the global economic downturn is between 70 to 100 million people will be thrown into instant poverty.

The report investigates the depth and breadth of the economic impacts triggered by worldwide virus lockdowns in the first half of 2020, along with the socio-economic consequences thereafter. We make sense of this in the piece titled "Global Instability, Soaring Deficits And Civil Disobedience: Are We Back In The 1960s, And What Happens Next?."

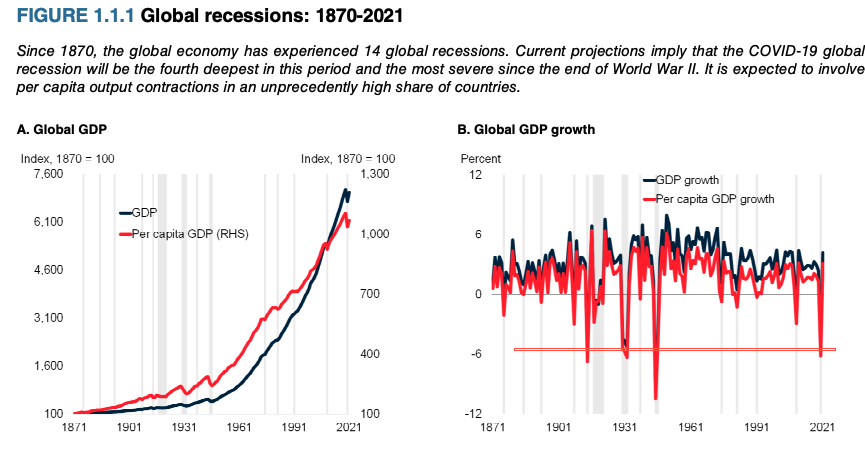

It said the 2020 baseline forecast for Global GDP would be a contraction of 5.2% -- the deepest global recession in eight decades despite unprecedented monetary and fiscal policy by central banks and governments. Emerging markets will shrink by at least 2.5%, the report said, adding that it will be the worst performance for the data since the early 1960s.

The virus-induced recession is the first since 1870 to be triggered solely by a pandemic. The speed and depth at which it hit developed and emerging economies suggest a sluggish recovery will be seen in 2020, with low probabilities of a V-shaped recovery this year. Additional rounds of stimulus to restart the global economy will need to be seen.

"While a global recovery is envisioned in 2021, it is likely to be subdued," the World Bank said.

The World Bank expects developed economies will contract by 7%, led by a 9.1% decline in growth for Europe this year. Breaking down the numbers, the US is expected to contract by 6.1% -- while China could post a 1% expansion.

The global lender proposed two alternative scenarios. The first is a COVID-19 second wave that triggers another round of travel restrictions that would result in the worldwide economy plunging by 8% this year. If the virus can be controlled and reopenings are continued through the back half of the year, the contraction would be around 4% -- still, this figure is twice the depth at which it was during the recession a decade ago.

"The global recession would be deeper if bringing the pandemic under control took longer than expected, or if financial stress triggered cascading defaults," the World Bank said.

As for the socio-economic impacts, the decline may push 70-100 million people into extreme poverty - the economic scarring of today's downturn will be long-lasting with a new era of high unemployment, low growth, and breakdowns in world trade and supply linkages.

The World Bank's latest report paints a "grave near-term outlook" -- and does not support a V-shaped recovery for this year.

But-but-but -- equity futures believe in the V-shaped recovery!

Commenti

Posta un commento