See TME's daily newsletter email below.

Even Worried Wilson seems to think that we are "almost there"...

At least judging from this quote: ..."From our standpoint, the set-up is becoming more clear. Stocks have been de-rating for almost a year now as investors began to anticipate the inevitable tightening from the Fed given the robustness of the recovery and building imbalances...we think this de-rating is about 80% done at the stock level with the S&P 500 P/E still about 10% too high (19.5x versus our 18x target). In other words, the de-rating is more complete at the stock level than at the index level, at least for the high quality S&P 500." Never a good idea to hold on for that last 10% on the downside...(Wilson, Morgan Stanley Equity Strategy)

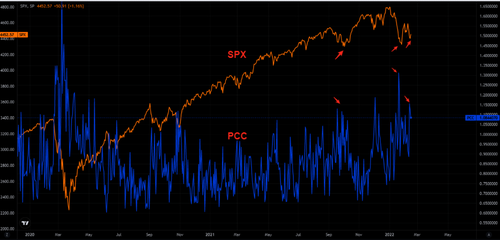

"Hedges only cost money bro"

Well, if you buy puts at local market lows, hedges tend to lose value quickly, especially as the crowd tends to overpay for protection in terms of volatility (and get the direction wrong). Do we see people puke puts from here?

Source: Tradingview

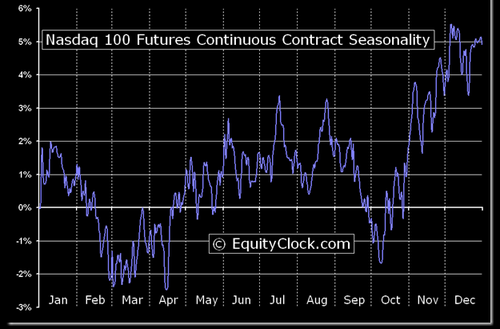

NASDAQ - getting there?

Equity markets lack direction at the moment, but seasonality sees both NASDAQ and SPX catching some bids soon. Add to it what Citi writes today: "Futures positioning is already net short across most markets, with the Nasdaq 100 the most extended net short ever seen." and we should probably ask ourselves: what is the next pain trade?

Source: Equity Clock

Are there "any" downside risks to oil in 2022?

JPM is bullish oil, but they outline a few possible downside risks worth considering:

1. US Shale - ~50% chance that production can add 1mm – 1.2mm barrels per day, removing $7/bbl in fair value;

2. US/Iran resolution – would add supply from Iran, creating an $8 - $14/bbl discount; and,

3. Increased Venezuelan production – lifting of Iranian sanctions provides a template for Venezuela to seek a deal

The oil pairs trade du jour...+9%

Just in time when equity people turned experts on Russia and war, everything decided reversing: RSX +5.5%, oil -3.7% on the day. We suggested the return of this trade yesterday (here), and although we didn't believe it would return this much in a day, we see a further potential for a "compression" of this spread.

Source: Refinitiv

Bond volatility - just in time...

...when every equity sales trader starts sending us the MOVE chart, it decided reversing lower. The spread between MOVE and VIX remains huge and despite the fact bond volatility is elevated, we can't get excited about VIX here. VIX longs here are only for the people that believe this market will crash. VIX is not cheap enough to buy, nor extremely expensive to sell, but we like overwriting strategies and selling strangles here as yield enhancement strategies for directional views.

Source: Refinitiv

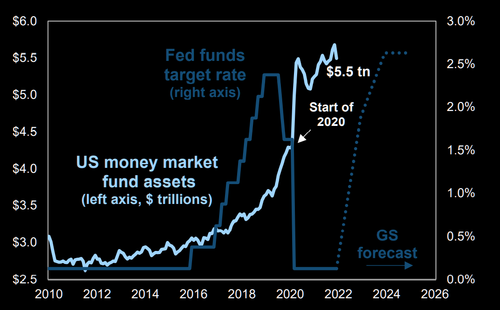

Nice "cash on the sidelines" cushion

Money market mutual fund assets total $5.5 trillion

Source: Goldman

HYG - time to bounce?

HYG has been brutally sold over past weeks as things in rates world have gone very "dynamic". We are not calling for the "fundamental" low in HYG, but a bounce could be setting up. HYG is oversold, the RSI is showing some positive divergences lately and the spread vs SPX is huge. People have been buying puts in the HYG like there is no tomorrow and downside vols are very expensive. If you believe in a bounce here (and wouldn't mind to get long down at 81.35), the March 82/84 risky looks attractive. You receive around $0.65 for this position.

Source: Refinitiv

Source: Refinitiv

Source: Refinitiv

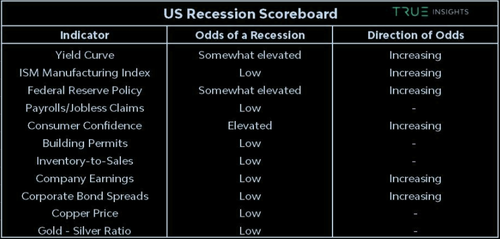

Recession indicators

"While the 10-year – 2-year and 10-year – 3-month yield curves have the best track record in forecasting US recessions (more so than other parts of the yield curve), more indicators exhibit some recession forecasting power. However, in most cases, these indicators do not point to an immediate recession, as is shown in the table below"

Source: True Insight

Two fundamental Bitcoin reversals

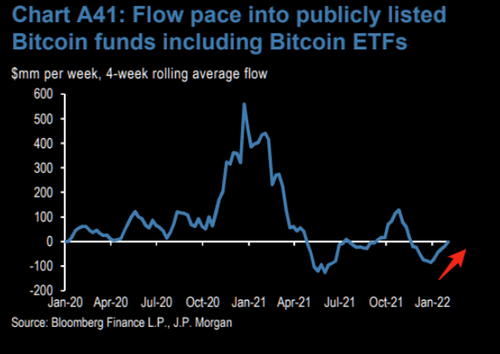

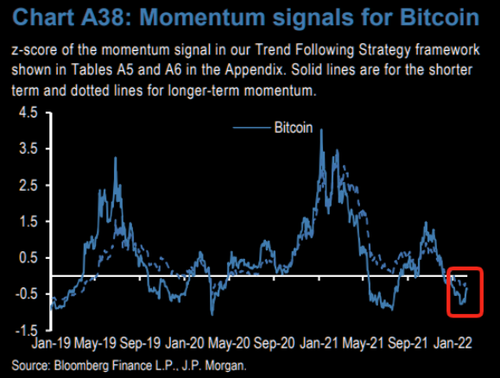

Inflows have been on the rise lately. Nothing spectacular, but still...Second charts shows JPM's momentum model reversing. Enough of the one way traffic we saw from November highs. From a short term technical point of view BTC has a big resistance area around 45/46k.

Source: JPM

Source: JPM

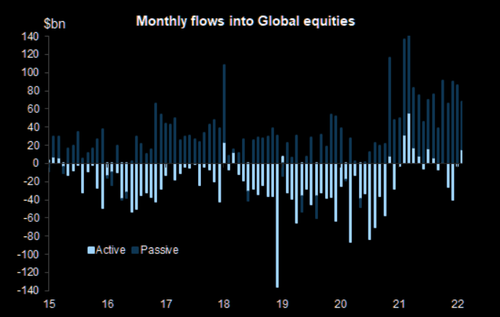

Inflows keep flowing in

At a nice steady tune of >$50bn per month into global equities.

Source: EPFR

Charting the World Economy: The U.S. Jobs Market Is On Fire - Bloomberg https://www.bloomberg.com/news/articles/2019-12-06/charting-the-world-economy-the-u-s-jobs-market-is-on-fire Charting the World Economy: The U.S. Jobs Market Is On Fire Zoe Schneeweiss Explore what's moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast , Spotify or Pocket Cast . The last U.S. payrolls report of the decade was a doozy, beating expectations and doing its bit to keep the consumer in good health heading into 2020. That's good news given the various pressures still weighing on global growth. Here's some of the charts that appeared on Bloomberg this week, offering a pictorial insight into the latest developments in the global economy. U.S. Advertisement Scroll to continue with content ...

Commenti

Posta un commento