And no one—including the nation's formidable banking and auto industries—is ready for it.

Anniversaries can be painful for Germany, and this year is full of pivotal ones. It's the centenary of the Treaty of Versailles, which imposed punitive reparations on the country at the end of World War I and laid the foundation for the next conflagration. It marks 75 years since the D-Day invasion, which led to the toppling of the Nazis 11 months later. And it's 30 years since the Berlin Wall fell. That symbol of the Cold War's demise is also a reminder of the post-reunification divisions—financial, social, and political—that persist between the country's east and west.

This year is shaping up to offer another uncomfortable milestone: the moment Europe's biggest economy is forced to come to terms with its shortcomings. Germany today feels like it's living out the final days of an era; there's an air of impending change for which no one seems prepared. The country remains wealthy and politically stable, but it's hard to escape a sense that Germans are complacent about the threats to the foundations of their prosperity.

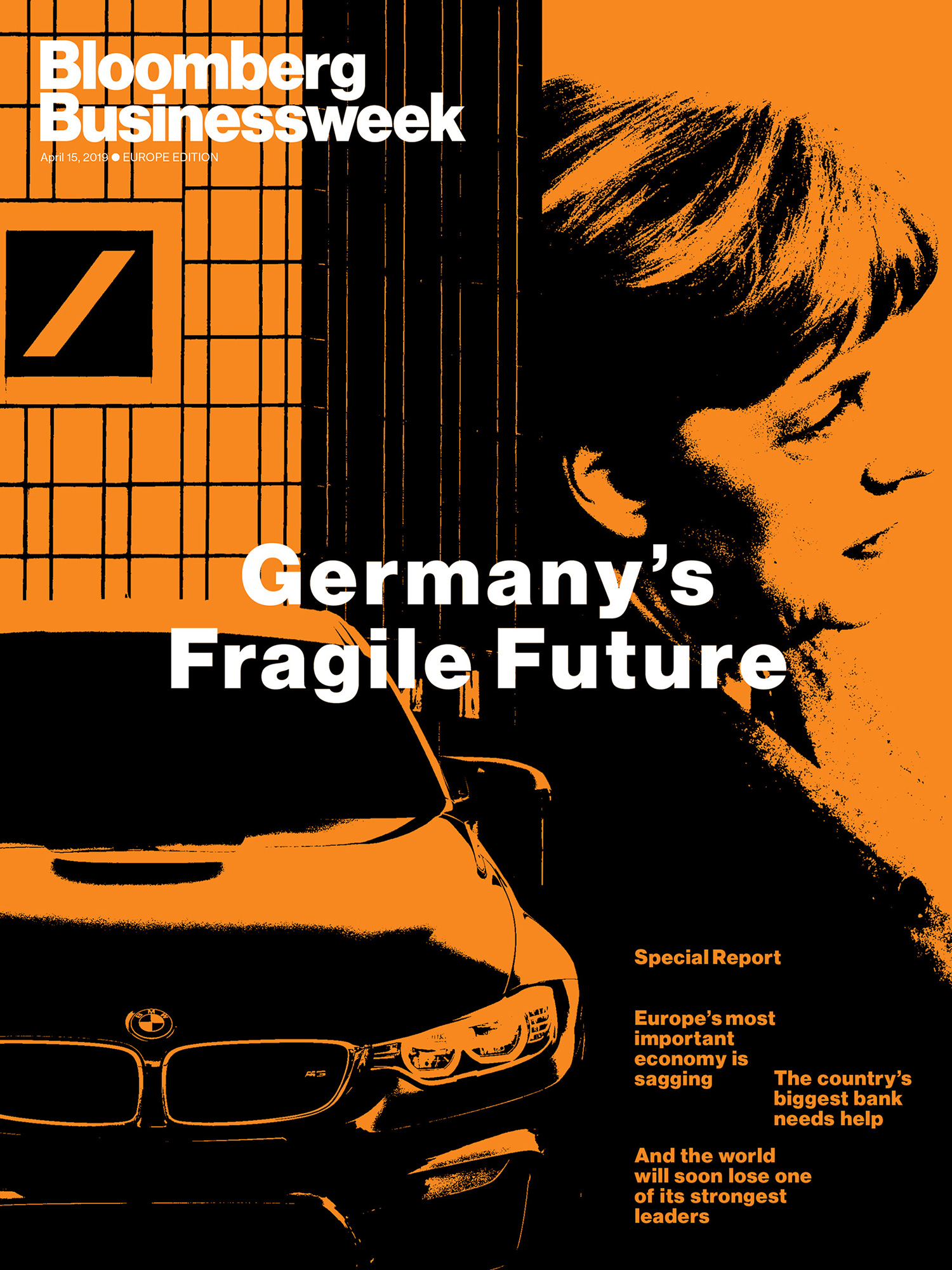

Photo illustration: 731; Photos: Bloomberg/Getty/BMW

The twilight of Angela Merkel's long chancellorship is at the center of this atmosphere. She's led the country through global crises—the 2008 collapse, the Greek meltdown, the influx of refugees, and various threats to the euro. Merkel was the champion of austerity, and yet her stewardship of the German economic engine kept the continent stable. Her handpicked successor, Annegret Kramp-Karrenbauer, is a mostly unknown quantity. Her main achievement so far is fending off an anti-Merkel candidate to head the Christian Democratic Union party.

Beyond politics, there's a technological revolution that will likely mean the end of the internal combustion engine. The German auto industry—from BMW to Mercedes and Porsche—directly employs 800,000 people and has an export value of more than €240 billion ($269 billion), according to the German Association of the Automotive Industry. Volkswagen AG remains the world's biggest automaker by sales volume, its admissions of emissions cheating notwithstanding. But the country that developed the first modern car in 1886—a Benz, more than two decades before Henry Ford's Model T—has been slow to shift to electric vehicles. That casts doubt on how much longer Germany can maintain its dominance of the global luxury-car market in the face of competition from China and elsewhere.

Then there's the sclerotic banking sector. The Finance Ministry's attempts to press once-mighty Deutsche Bank AG to merge with Commerzbank AG may save neither. Without a viable banking behemoth, where will German enterprise look for financing?

None of this bodes well for the country's outward-facing economy. The world's third-biggest exporter, Germany is more exposed than its competitors are to the headwinds of a global trade war. The outlook for growth this year has been slashed amid an alarming slump that's dragging down all of Europe. Meanwhile, fellow Group of 20 nations from Brazil to Italy are following Donald Trump in turning inward and adopting nationalist programs. Germany is isolated, exposed to overseas agendas that are echoed—faintly but worrisomely—in its own homegrown populism.

Yet it's not all gloomy. Berlin is booming, and the benchmark DAX stock market index is up about 13 percent so far this year, as investors shrug off signs of economic weakness. The legions of small and midsize companies that make up the mighty Mittelstand remain innovative and highly specialized in premium niche areas. Germany is the third-most-automated country in the world. The shift to clean energy has turned the nation into a global center of renewables technology.

There's another anniversary this year: Postwar Germany's constitution came into force 70 years ago in May, and four months later the first federal government was elected, with Konrad Adenauer at its head. The economic miracle—Wirtschaftswunder—was just around the corner. If Germany can recover that spirit, this year may yet mark one more turnaround.

Commenti

Posta un commento