Charting the World Economy: The U.S. Jobs Market Is On Fire

Explore what's moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast, Spotify or Pocket Cast.

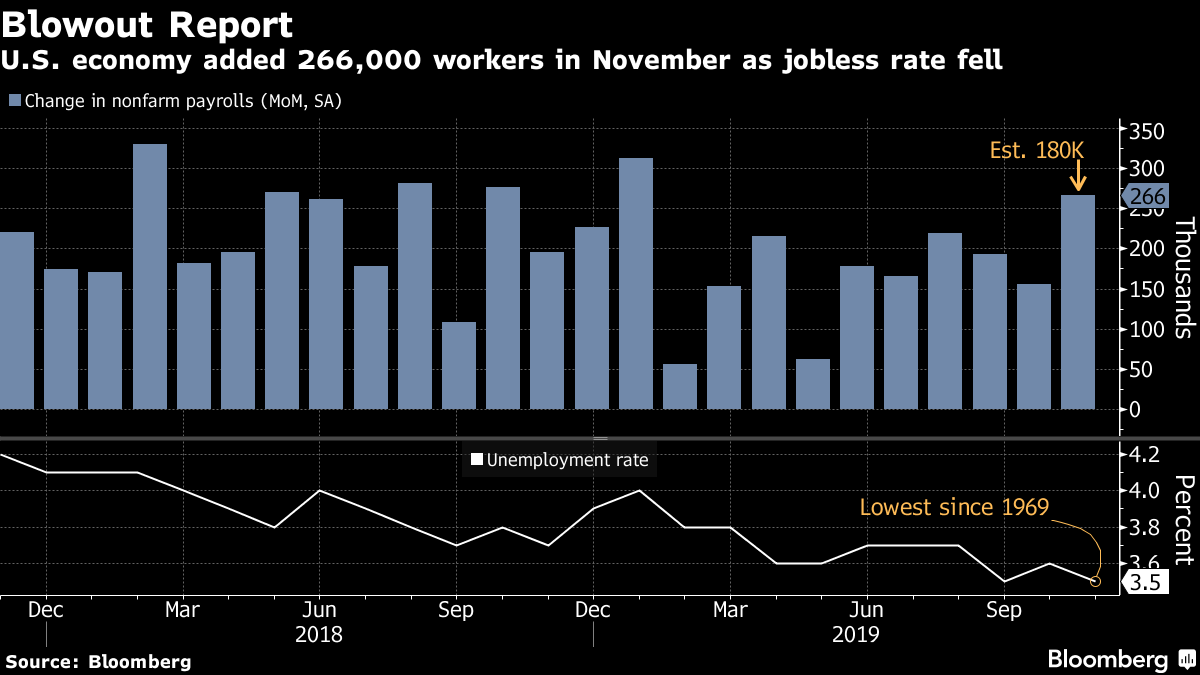

The last U.S. payrolls report of the decade was a doozy, beating expectations and doing its bit to keep the consumer in good health heading into 2020. That's good news given the various pressures still weighing on global growth.

Here's some of the charts that appeared on Bloomberg this week, offering a pictorial insight into the latest developments in the global economy.

U.S.

Advertisement

Scroll to continue with content

U.S. job gains roared back in November as unemployment matched a half-century low and wages topped estimates, giving the Federal Reserve more reason to hold interest rates steady after three straight cuts.

South Leads the North

Coincident indexes in 44 states project growth over the next half-year

Source: Federal Reserve Bank of Philadelphia

Note: Model includes variables that lead the economy: state-level housing permits (1 to 4 units), state initial unemployment insurance claims, delivery times from the Institute for Supply Management (ISM) manufacturing survey, and the interest rate spread between the 10-year Treasury bond and the 3-month Treasury bill.

West Virginia, a state President Donald Trump campaigned on reviving, is forecast to have the worst-performing economy in the nation over the next six months, Federal Reserve Bank of Philadelphia data show.

Europe

Small Spillovers

Growth boost from German public investment spending increase of 1% of GDP

Source: Bloomberg Economics, NiGEM

Note: *Graphic displays growth impact in percentage points

If Berlin relents on calls to increase public spending, growth would be stronger at home and abroad, though Bloomberg Economics' simulations suggest opening the fiscal floodgates wouldn't transform the wider euro-area economy.

Retail Reshuffle

Roles dominated by women have seen the most job losses in recent years

Source: Royal Society for the encouragement of Arts, Manufactures and Commerce analysis of U.K. Labour Force Survey

Note: Data shows major occupation groups within retail industry

The death of the U.K. high street is hitting women the hardest. You'll probably still hear a female voice at the grocery store checkout, but it's increasingly likely to be a machine.

Asia

Killing Pigs

Where disease outbreaks have occurred since 2014

Source: World Animal Health Information Database (OIE)

Note: Includes reports of disease in both wild and domestic pigs

For years, researchers across the world have sought for a way to breed better-tasting, stronger, and faster-growing pigs. Now, in the wake of a devastating global outbreak of African swine fever, the more crucial need is to safeguard food security, and keep hogs alive.

Emerging Markets

Room to Cut

Emerging-market central banks have real-rates buffer and will cut more

NOTE: real rate calculated as difference between key rate and current inflation

Source: Bloomberg

For years, low inflation looked like a classic rich-world problem. Plenty of developing economies now have some version of it too.

When Alberto Fernandez takes over the Argentine presidency on Dec. 10, he will inherit an economy running short of dollars, with rampant inflation and rising poverty. He'll probably have to renegotiate a $56 billion loan accord with the IMF, though the Fund has said it will withhold its next disbursement until there's more clarity around his economic plan.

World

New Record

Global debt on track to surpass $255 trillion in 2019

Source: IIF, BIS, IMF

A decade of easy money has left the world with a record $250 trillion of government, corporate and household debt. That's almost three times global economic output and equates to about $32,500 for every man, woman and child on earth.

A League of Their Own

China and Singapore scored significantly higher in reading than all others

Source: Organization for Economic Cooperation and Development

Note: *Map displays mean points for reading achieved by a country or economy. China score is for Beijing, Shanghai, Jiangsu and Zhejiang; Azerbaijan is for Baku

Chinese students far out-stripped peers in every other country in a survey of reading, math and science ability, underscoring a reserve of future economic strength and the struggle of advanced economies to keep up.

Advertisement

Scroll to continue with content

— With assistance by Anna Andrianova, Enda Curran, Katia Dmitrieva, William Horobin, Lucy Meakin, Kristine Servando, Scott Squires, Alexandre Tanzi, Maeva Cousin, and Jamie Rush

Commenti

Posta un commento