This has plunged the market's odds of a deal notably...

Source: Bloomberg

As we warned earlier today:

And McEligott explains:

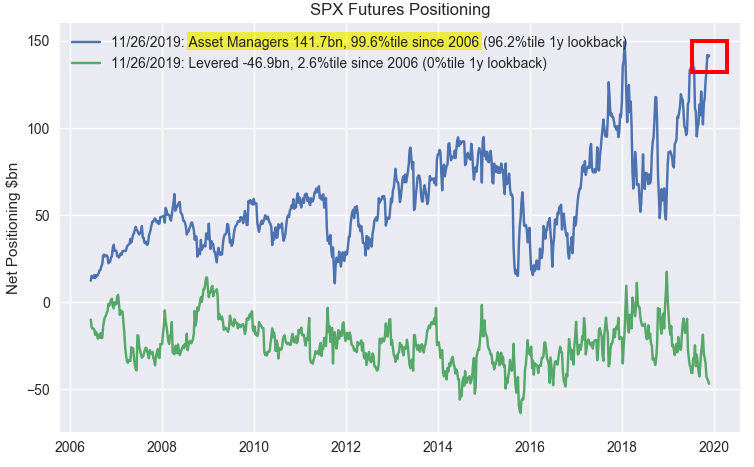

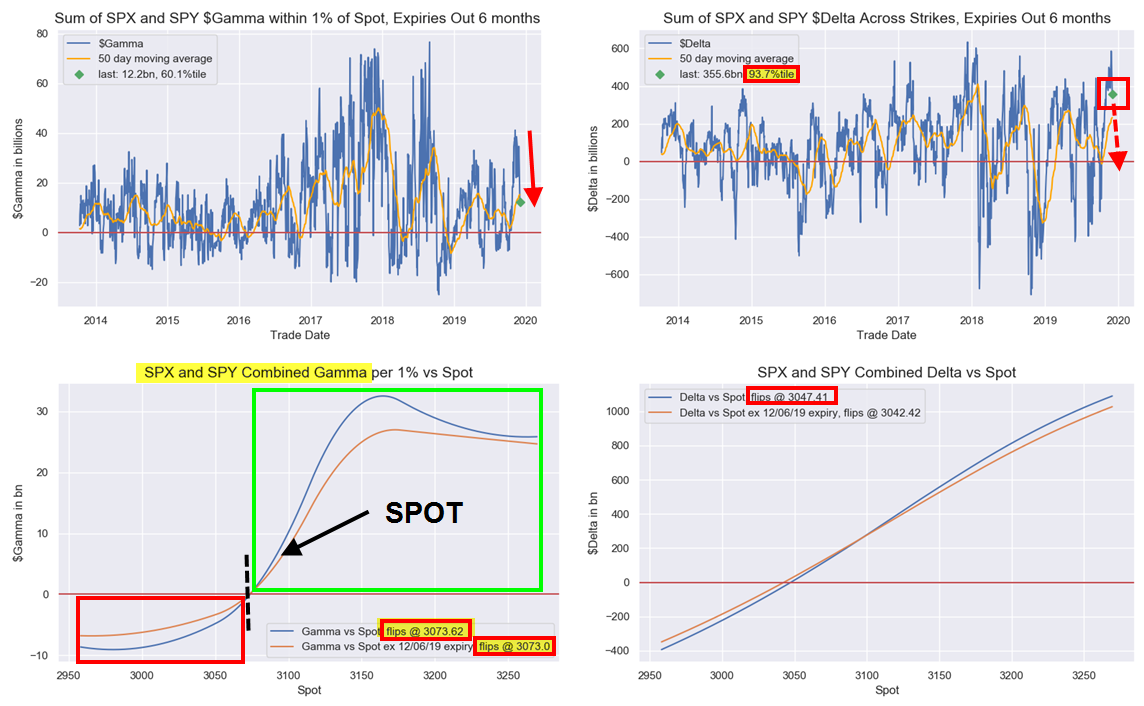

The interpretation of Trump's "better to wait until after the election" for a China trade deal comments is that the Hong Kong human rights bill sponsorship by POTUS has clearly caused agitated the Chinese side (plus this morning's Reuters report stating that the White House is considering kicking Huawei out of the US banking system), and in conjunction with the narrowing window to act on the Dec 15th tariff "fill or kill," is likely incentivizing monetization of of the +9% gain made in S&P since early October via profit-taking in recently Options- ($Delta still 94th %ile since 2013 even after yday's selloff) and Futures- (Asset Manager S&P Futures $notional position currently 99.6th %Ile since 2006 at $141.7B) positioning "extremes."

This "extreme positioning" into a dynamic where traders are incentivized to monetize into year-end—especially ahead of the Dec 15th "tariff risk"—has been at the core of my view over the past few weeks that there was a local / tactical "window for a pullback" into late November (start Dec ain't bad though).

As such, this risk-off dynamic is driving the bid in Rates / USTs (Reds and Greens +6 to +8 ticks, while we've seen Real Money and Central Bank buying flows in the front-end—thus the "bull steepening"), which too then will almost certainly result in a reversal later today of the US Equities factor dynamic experienced on Monday (Momentum down, Value up); instead, today's UST rally will then dictate a resumption of the "Momentum" bounce-back experienced over the past 3 weeks, as longs in "Duration" Equities ("Min Vol" Defensives and "Secular Growth") are set to rally, with "Cyclicals" are likely to again fall.

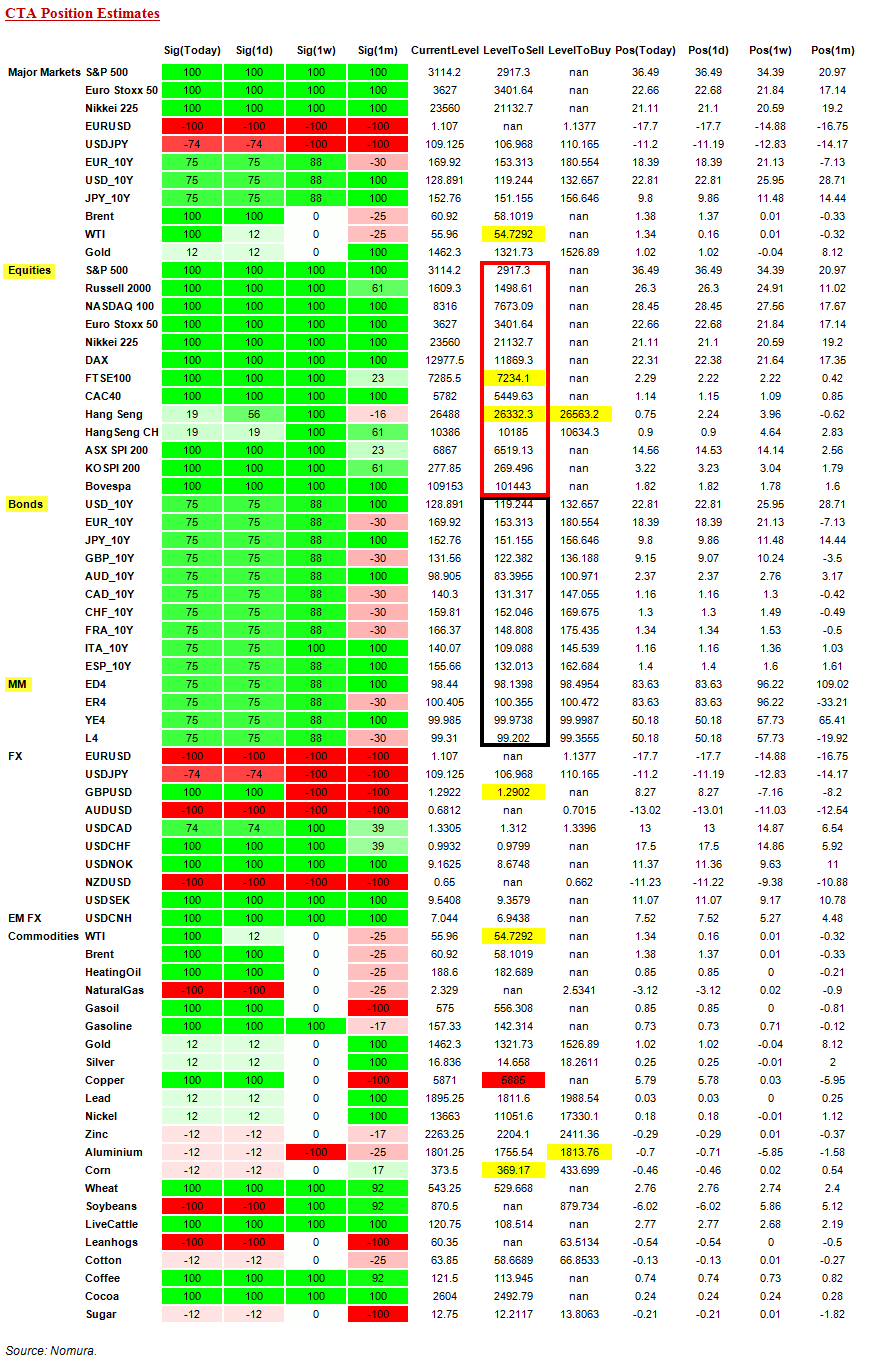

Touching on my constant refrain over the past two years—that being where a "macro shock" then acts as catalyst for Dealer Gamma "flip" and / or in conjunction with a Systematic Trend deleveraging impulse—we see a mixed-bag, as our Nomura QIS CTA model shows the majority of Equities futures positions remain "in trend" and ABOVE estimated deleveraging / "sell" levels.

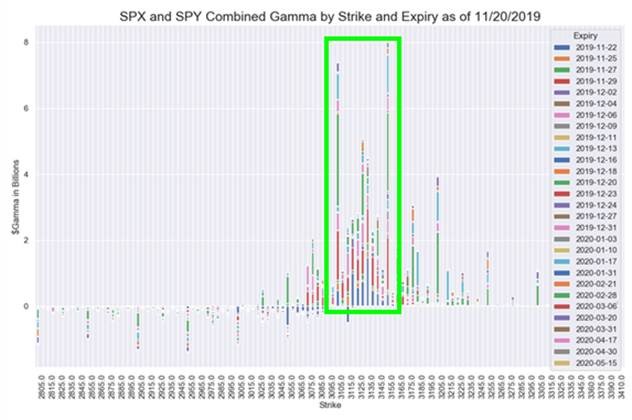

HOWEVER looking at SPX options, we see the Dealer $Gamma position nearing the potential "flip" level to "SHORT GAMMA" ~ 3073 (spot 3083 last), which would of course beget more selling the hedge the lower futures travel and further incentivize that massive Asset Manager futures "length" to monetize profits on the multi-month rally:

Both the Equities and Global DM Bond / Rates positions for CTA's remain firmly in "no man's land" relative to any sort of "deleveraging triggers"

Today's estimates for the S&P futures position for CTAs show no reduction of the current "+100%" signal until all the way under 2916 (which would see the signal drop to just "+25%")

In TY (current signal at "+75%" Long), we would not see any selling / deleveraging until all the way down at 121.41 as the DEEPLY "in the money / in trend" 1Y window ("Long") would "flip" and turn the signal entirely "-100%" Short—and that's not gonna happen, LOL

Back to Equities however, the larger risk today for a "sloppy" move lower in US Stocks would be via Dealer "Greek" exposures via Options positioning, as our analysis of the Dealer Gamma position across consolidated SPX / SPY options is just ~12 handles ABOVE a potential "flip SHORT" level ~3073—but in true "negative convexity" / "short Gamma" fashion, we are accelerating as we turn lower.

And sure enough, S&P Futs plunged through that critical level...

We are going to need a serious walk-back of Trump's comments to rescue this one... where's Kudlow!?

Commenti

Posta un commento