The Inverted Yield Curve: Why It Will Not Lead To A Recession This Time

Historically, an inverted yield curve has invariably led to a recession.

We are currently experiencing an inverted yield curve.

We have two reasons for the current inverted yield curve: the central banks irrationally raising short-term interest rates and investors expect a recession because of the extended boom period.

The two reasons are not enough to lead to a recession, and other structural changes in the economy are pointing to a boom rather than a recession.

Investors can capitalize on the current situation if they believe that the inverted yield cure would not lead to a recession.

Summary and Paper Thesis

Although an inverted yield curve led to a recession almost without exception in the last 50 years within a relatively short period of time after the inversion happened, this paper asserts that the inverted yield curve that happened in March and April of 2019 will not lead to a recession this time. There are a few reasons for this conclusion, and these reasons include:

- The primary reason for the inverted yield curve is the irrational approach of the central banks to increase the interest rates.

- The adoption of Artificial Intelligence and Machine Learning (AI) in manufacturing and services would provide an ever-continuing increase in the productivity.

- The adoption of AI will reduce the possibility of high inflation.

- China/US relations will be fine; Both countries have no choice but to have a fair-trade deal.

- The government debt levels (relative to the GDP) are expected to start dropping with the increase in government automation combined with increased corporate profits.

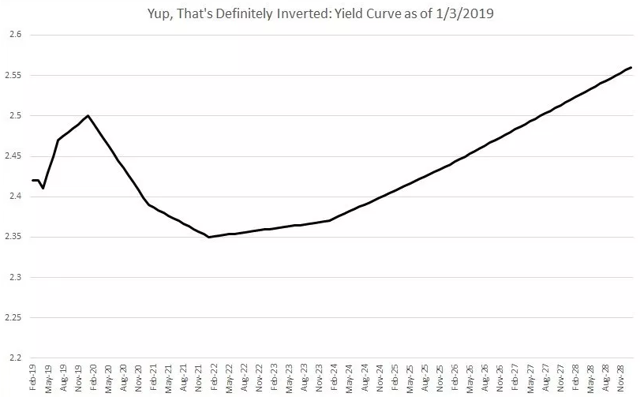

Source: Fat Tailed and Happy, January 3, 2019

The paper starts by explaining why inverted yield curves were used historically as a prediction of a recession and how we ended up with the current inverted yield curve. The paper then justifies the above reasons of why the inverted yield curve will not lead to a recession this time. Finally, the paper provides a strategy that investors can adopt to capitalize on this economic situation, and the types of companies they should be or should not be investing in.

What prompted this analysis?

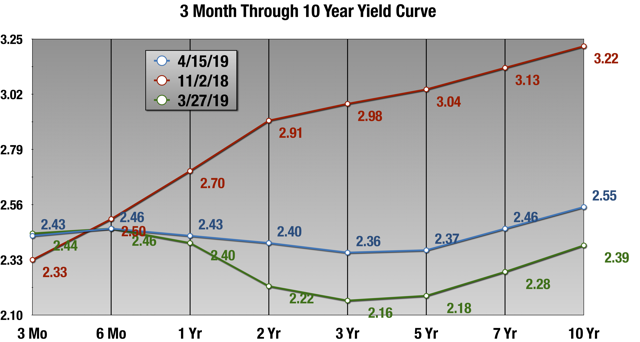

As soon as we had a solid 10-year US government note rate sitting firmly under the 3-month US government Treasury bill rate in March as shown in the next graph, commentators and researchers started talking about a potential recession.

Source: Trading Places Research (SeekingAlpha)

Interestingly, economists and financial analysts were split on whether the inverted yield curve would lead to a recession or not this time. I watched and listened to many commentators over the last 2 months, and read a relatively large number of articles, both older academic articles and concurrent economic articles about the inverted yield curve topic to try to figure out where we are heading. Seeking Alpha had some interesting articles including:

- Why An Inverted Yield Curve Is Important by Eric Conley

- April Yield Curve Update: Backing Off by Trading Places Research

- Yield Curve Inversion: Why This Time Is Different by Macro Ops

- What Is The Yield Curve Telling Us? By CME Group

Instead of looking at historical trends like many of the articles that I read, I focused here on more fundamental issues that substantiated the position that the inverted yield curve this time would not lead to a recession. As I reached my conclusion, I thought of sharing it through writing this paper.

What is the logic behind the concept that recessions follow inverted yield curves?

According to Jens H.E. Christensen in his October 2018 paper, "The Slope of the Yield Curve and the Near-Term Outlook":

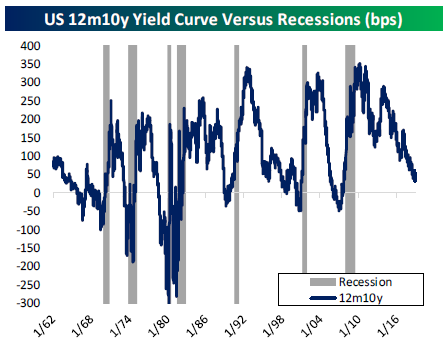

The yield spread between long-term and short-term Treasury securities is known to be a good predictor of economic activity, particularly of looming recessions. (…) An inverted Treasury yield curve—a negative term spread in which long-term securities earn a lower rate of return than short-term securities—has been well established as a reliable real-time predictor of future recessions.

Michael D. Bauer and Thomas M. Mertens in their August 2018 paper, "Information in the Yield Curve about Future Recessions" state that:

An inversion of the yield curve—when short-term interest rates are higher than long-term rates—has been a reliable predictor of recessions. The difference between ten-year and three-month Treasury rates is the most useful term spread for forecasting recessions—without any adjustment for an estimate of the underlying term premium. However, such correlations in the data do not identify cause and effect, which complicates their interpretation.

Based on the above two quotes, an inverted yield curve (shorter-term Treasury bill rates are higher than the longer-term notes) predicts a recession (or becomes a self-fulfilling prophecy that causes a recession). The question now is: what is the logic behind that?

If you are familiar with the logic of why an inverted yield curve is a prediction of a recession, you might like to skip this section and proceed to the next one.

Let's initially try to understand the logic behind the normal yield curve, the one that is sloping upwards from the 3-month yield with a positive continuous slope towards the 10-year yield, and how it may happen: There are two explanations for the normal yield curve.

First, the investors are expecting the risk-free (government Treasury bills, notes and bonds) interest rates to be rising. As a result, investors who are willing to lock in their interest rate now (longer-term investors) need to be compensated for their risk with a higher interest rate, thus having positive slope and the yield positively correlated with the term of the debt instrument.

Second, the longer maturities entail a higher risk for the investors, and therefore, the longer-term investors would demand a "risk and illiquidity premium" representing the higher interest rate. The reason for the higher risk is that the economy would be facing more uncertainties in the distant future compared to the near term, and the risk increases with the increase of the term. Again, this will result in having the yield positively correlated with the term of the debt instrument.

In general, even when the investors are expecting interest rates to decline, the "risk premium" (second reason) would be more substantial than the expected drop and this would result in a normal yield curve.

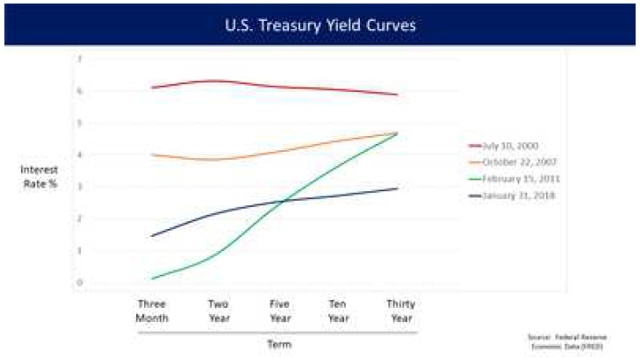

U.S. Treasury yield curves for different dates. The July 2000 yield curve (red line, top) is inverted. Source: Wikipedia

Now, let's discuss the logic behind an inverted yield curve. The argument that an inverted yield curve will lead to a recession results from the following logic:

- Investors think that the central banks have increased interest rates to a level that will stifle the economy and cause a recession. This is usually a self-fulfilling policy.

- Investors think that the boom market has lasted for a very long time, and that a recession is due soon, thus moving their investments to long-term debt instruments, driving the short-term rates to be higher than the long-term rates; Please note that we have been in a boom market without a recession for 10 years, much longer than the last 150-year average cycle of less than 5 years. (we will actually hit 10 years of expansion in May 2019, but to get to a recession, we will need another 9 months to "officially" have a recession , and accordingly, we are now in the longest boom period in recorded history.)

- Investors believe that the short-term risk is higher than the long-term risk, that is, a recession is coming soon, and long-term notes would provide a safe investment compared to the turmoil resulting from a recession.

- Investors think that the stock market will crash during the recession, and as a result they move the money to long-term bonds instead of equity (which is by default also long-term). This would effectively increase the demand on these bonds, increase their price and drop their yield.

In other words, if investors think that a recession is looming, they would choose long-term debt versus short-term debt. That is, the demand for long-term debt will increase resulting in lower yields and the demand for short-term debt will decrease resulting in higher yields. The following chart explains the traditional logic behind the inverted yield curve.

Source: Created by the author

As a summary, the inverted yield curve is primarily driven by market sentiment of debt investors who anticipate a looming recession.

Personal Opinion: Based on many years working in the investment community, I came to the conclusion that debt investors are far more sophisticated than equity investors when it comes to understanding the impact of the economic and political factors on their investments

Please note that, despite the above analysis, I was not able to find any research that determines with a high level of certainty whether the relationship between the inverted yield curve and an upcoming recession is a valid prediction, an invalid prediction, a spurious correlation or a self-fulfilling prophecy that results in a reverse bullwhip effect. This may be a good future research topic.

This paper assumes that the relationship between the current inverted yield curve and an upcoming recession is an invalid prediction and that an imminent recession will not materialize this time as shown in the next sections.

Why do we currently have an inverted yield curve?

As seen from the above section, the inverted yield curve is driven primarily by investors' sentiment that a recession is looming. However, I personally believe that the inverted yield curve of March/April 2019 is not the result of investors' sentiment, but rather the result of different reasons.

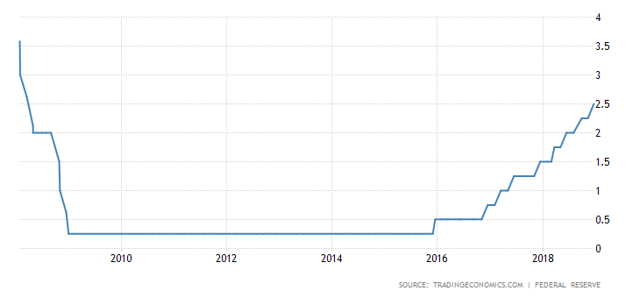

One of the reasons for the inverted yield curve is the fast and "irrational" increase of interest rates by central banks around the world as shown for the US in the next chart. If we look at the current "inverted" yield curve, we will find it inverted only on the short term, and that on the longer term it is a normal yield curve. This pattern substantiates the fact that the short-term yield has increased without dropping the long-term yield. In the case of investors' sentiment, the short-term yield would increase in conjunction with dropping the long-term (10-year yield).

Source: Trading Economics

Another reason for the current inverted yield curve is the fact that we have been in a boom for the longest period of time in recorded history, 10 years, without a recession. The business cycles have been less than 5 years over the last 150 years and six to ten years over the last 50 years as shown in the next chart.

Source: The Bespoke Report, 2019

The extended boom period beyond ten years has led some investors to anticipate a recession coming soon despite the lack of other fundamental indicators. This anticipation would result in increasing the demand on longer-term debt instruments thereby dropping the longer-term yield below the shorter-term yield.

Because of the lack of fundamental reasons for anticipating a recession, bond investors opted for investing in medium-term debt instruments (2-3 years) rather than long-term debt instruments (10-30 years). This explains the shape of our existing inverted yield curve where it is inverted only between the short and medium terms, and normal between the medium and long terms.

As shown in the explanation above, the above two factors would result in a yield curve pattern that is identical to the one we are currently experiencing.

Why is the inverted yield curve different this time?

The inverted yield curve traditionally indicates that a recession is looming. However, I personally predict that the March/April inverted yield curve should not lead to a recession because of the following five reasons:

(1) The primary reason for the inverted yield curve is the irrational approach of the central banks to increase interest rates.

The irrational increases of interest rates by central banks increased the short-term yields with no corresponding impact on the medium-term and long-term yields; this resulted in the inverted yield curve pattern we addressed earlier. In other words, the central bank actions caused an inverted yield curve on its own without any fundamentals or investors' sentiment.

I expect that this inverted yield curve will rectify itself very shortly. The central banks are not expected to continue increasing interest rates and may even start dropping them. This will result in flattening the yield curve between the short-term and medium-term, while keeping the yield curve with a normal pattern between the medium-term and the long-term.

(2) The adoption of AI in manufacturing and services would provide an ever-continuing increase in the productivity.

I recently wrote an article that focuses on the impact of AI on our economy: Governments and Central Banks Got It Wrong: Will They Learn? As a summary of what I presented in this article, the adoption of AI across physical systems, (aka, the fourth industrial revolution or Industry 4.0), will result in a continuous boom with no end in sight. According to the above-mentioned article:

Industry 4.0 will have a major impact on the productivity. This productivity gain will come from various concurrent fronts. Transportation costs, which constitute a major part of the cost of products will experience a huge drop as a result of using autonomous vehicles, optimization of the supply chain and the introduction of green energy combined with the reduction of the number of transportation accidents. The manufacturing and services automation will have a significant positive effect on the product quality which will translate into higher productivity; this quality improvement will continue as we adopt deep learning algorithms in the manufacturing robots. The sheer quantity and variations of products produced will be growing significantly as a result of the automation and the implementation of 3-D printing in the manufacturing process. In addition, the automation of the services around the manufacturing will continue as well, which would give rise to even higher productivity. Because of the continuous increase in the intelligence of computers resulting from deep learning, I do not see any end in sight for this growing economy.

In simple terms, AI will increase the productivity at a manner never seen before; because of the nature of AI where it can improve its capabilities autonomously (for example, autonomous cars improve their driving capabilities the more they drive), there is no end in sight for this improved productivity.

(3) The adoption of AI will reduce the possibility of high inflation.

Industry 4.0 will improve the productivity in a manner not seen before. This improved productivity will result in lower prices and virtually eliminating the possibility of higher inflation.

As mentioned earlier, one of the reasons for the inverted yield curve is the irrational raising of interest rates by central banks to keep inflation in check. A potential for lower inflation will remove the incentive for central banks to increase the interest rates, and may even result in lowering interest rates. The lowering of interest rates will result in flattening the yield curve and eventually turning it to be normal again.

While having a normal yield curve does not guarantee a boom, it removes one of the factors that may lead to a recession as a self-fulfilling prophecy.

(4) China/US relations will be fine; Both countries have no choice but to have a fair-trade deal.

Many commentators have been worrying that a trade war between China and the US, the largest two economies on our planet, would lead to a global recession, and have been closely monitoring the talks and the tweets related to these talks. Chuck Jones from Forbes has a nice article that shows how the Trump tweets about China impacted the stock market.

Because a fair deal is for the benefit of both parties, a prudent and reasonable person will always opt for a win-win situation instead of a lose-lose situation. Some people may argue that the heads of states in either or both countries are not "reasonable", and reviewing the profiles of the leaders of both countries, I disagree with this assessment at least from an economic perspective.

Personal Opinion: Even if the trade talks between China and the US fail, I believe that the likelihood that it would lead to a global recession is overblown. Both countries are large enough and have many other trading partners that their dependence on each other may be easily shifted to other countries with little economic impact. We have to remember that what we are talking about here is imposing tariffs on imported goods rather than an economic embargo. Worse case scenario is that the prices of some of the goods will increase by a small extent. This increase will be easily balanced by the price declines resulting from the adoption of AI in manufacturing and services in both countries.

Jamie Dimon, CEO of JP Morgan Chase confirmed the above point of view in his annual letter in April 2019. In his letter, Jamie indicated that: "We should only expect China to do what is in its own self-interest, but we believe that it should and will agree to some of the United States' trade demands because, ultimately, the changes will create a stronger Chinese economy."

Personal Opinion: I personally believe that the biggest risk on the US from the trade war between the US and China is not imposing tariffs from either side but rather imposing quotas on the exports of rare earth elements from China to the US. China currently controls 95% of the world production of rare earth elements and 30% of world reserves, and reducing/stopping their exports to the US can have a devastating effect on the manufacturing of many electronics and electrical industries in the US.

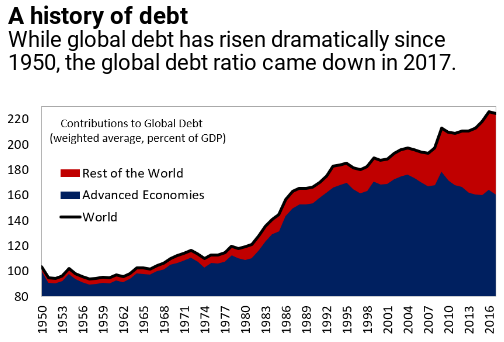

(5) The government debt levels (relative to GDP) are expected to start dropping with the increase in government automation combined with increased corporate profits.

The government debt levels compared to the GDP has already started dropping, and I personally expect it to continue to drop. The following chart from the IMF new 2019 data report shows that the trend in advanced economies is now starting to spill over to developing economies.

Source: IMF Global Debt Database

So, how does this drop in the global debt impact the booming economy? The drop will give governments more tools to fend off a potential recession by increasing its spending.

As a summary from the above few points, the inverted yield curve this time will be short lived, and will not result in a recession as some analysts predict because of the five reasons mentioned above in this section.

What is the strategy that investors should take with an inverted yield curve that does not lead to a recession?

When we have a split investment community with diametrically opposing views related to the economic aspect, investors can take one of these opposing views and adopt certain strategies which would result in abnormal positive returns if this point of view proves to be correct. Of course, if the investors' point of view proves to be incorrect, the loss can be substantial as well.

The following are some actions that the investors may selectively choose to adopt if they come to the conclusion that a recession is not looming despite the inverted yield curve:

(1) Switch the allocation to put a higher weight on equity investments versus debt investments.

Before and during a recession, investors flock to the safer debt investments instead of the riskier equity investments. Investors who believe that a recession is looming are already switching their equity investments to debt investments, which puts relative pressure on the equity prices while reducing the yield on debt instruments. Selling your debt instruments with a relatively low yield will realize some capital gains, which is beneficial from a taxation perspective. Buying equities at a depressed price is the basic principle of value investing, and I propose adopting this equity investment strategy based on the current economic situation.

(2) Reduce the debt allocation from medium term (2-5 years) and allocate the reduced amounts equally to short-term (one year or less) or long-term (10 years or more) debt instruments after keeping the long-term portion in cash for a short while.

This paper is proposing that the yield curve will be short-lived and will soon change to a flat or a normal yield curve. We also have to remember that the yield curve is inverted only between the short-term and medium-term debt instruments as shown earlier in this paper. With the flattening of the yield curve, and eventually turning to a normal yield curve, both the long-term debt instrument yields and the medium-term debt instrument yields are expected to rise, but the long-term yields are expected to rise faster. This paper anticipates that the short-term yields will remain intact or will marginally drop.

Adopting the above suggestion will realize some capital gains for the sold medium-term debt instruments, and position the portfolio to be investing in higher-yield debt instruments. The portion of the proceeds invested in short-term debt instruments will provide a relatively high yield that would most likely remain intact or would marginally drop. The cash will provide the resources to invest in long-term debt instruments as their yield increases, effectively buying the debt instruments at a discounted price.

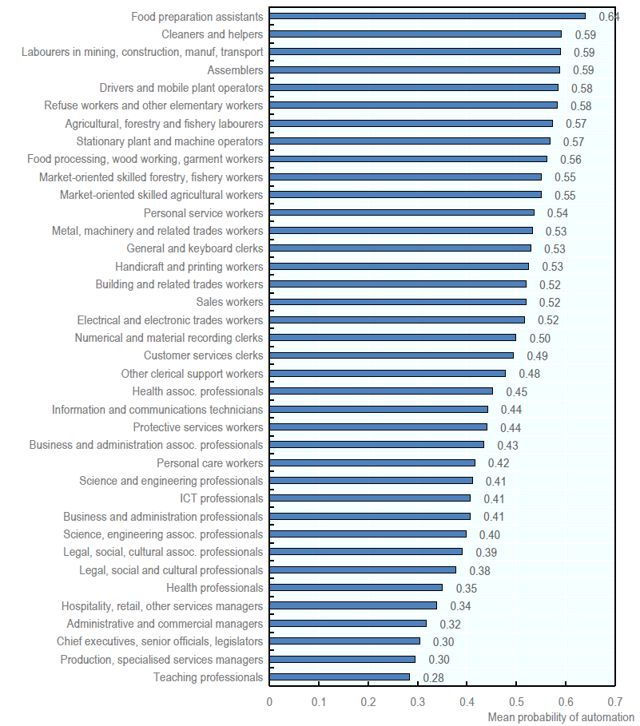

(3) Switch the equity investments allocation away from companies that are not investing in AI and focus equity investments on leaders in the key areas of AI.

The paper emphasizes that importance of AI in our new economy, and that the introduction of AI in the manufacturing and services areas will result in potential perpetual growth.

Companies that are not investing in AI or are investing and business areas that are expected to decline (as shown in the next chart) as the result of the introduction of AI should be sold, or even shorted.

Source: Nedelkoska, L. and G. Quintini (2018), "Automation, skills use and training", OECD Social, Employment and Migration Working Papers

To capitalize on this prediction, the investors need to look at companies that employ such types of workers and whether they are fundamentally changing their operations to employ AI or not. Just as an extreme example, assume there is a public legal or accounting firm that is not investing in AI, then selling your holdings of this company would be recommended.

I will refrain from mentioning specific companies here as I am expecting every investor to perform their own research. As you are conducting your research, please make sure that you do not just check whether AI is mentioned in the annual report or earning calls, as most companies now mention AI in their earning calls as shown in the next graph from CBINSIGHTS; I would rather suggest scrutinizing this mention and verifying whether they are actually using AI or not.

Source: CBINSIGHTS, On Earnings Calls, Big Data Is Out. Execs Have AI On The Brain

Source: CBINSIGHTS, On Earnings Calls, Big Data Is Out. Execs Have AI On The Brain

As for the leaders in the AI business, my last article from January spells out a brief analysis of some of these companies. That article summarizes the different areas and companies as follows:

- Leadership in AI Software: Alphabet (GOOG), Amazon (AMZN), IBM (IBM), Microsoft (MSFT), Palo Alto Networks (PANW)

- Leadership in hardware used in AI: Huawei, Nvidia (NVDA), Tesla (TSLA)

- Leadership in database management and Data Storage: Oracle (ORCL), Mongo (MDB), Dell EMC (DELL)

- Leadership in entertainment and original content: Netflix (NFLX), Disney (DIS)

Conclusion

We are currently experiencing an inverted yield curve between the short-term and medium-term yields and a normal yield curve between the medium-term yields and the long-term yields. An inverted yield curve has historically been a very good prediction for recessions.

However, I believe that this time it is different. The inversion is artificial primarily because of the irrational increase of the interest rates by central banks, and because we have been in the longest boom period in recorded history.

In addition to being artificial, there are no fundamentals that are pointing to a potential recession. The pervasive introduction of AI in manufacturing and services will lead to increasing productivity while keeping inflation in check. Governments are continuing to reduce their debts compared to the GDP, and this will give them more tools to fend off an upcoming recession.

Many analysts fear that the trade wars between China and the US would cause a global recession. I believe that the two countries will have no choice but to reach a fair-trade deal, and that this deal will be coming soon.

Investors can capitalize on the current situation if they believe that the inverted yield curve will not lead to a recession. Some of the actions they can take include allocating more of their assets to equity, switching their medium-term debt instruments to short-term and cash, investing their cash in long-term debt instruments when the long-term yields increase, and increasing their equity investments in companies that are leading the AI industry or are actively investing in AI to improve their operations.

Commenti

Posta un commento