An odd week of "buy all the things" - Stocks up, VIX up, Bonds up; Dollar up, Gold up.

China shit the bed (worst week in 6 months), bonds bid on great growth (weak sales, inflation), semis suddenly puke after massive surge (SoKo GDP, Semi sales collapse, INTC, XLNX...), crude crushed on green shoots (Trump trumps OPEC as demand forecasts upheld), and gold gained on a higher dollar - none of these 'oddities' matter, stocks are at record highs and AMZN is awesome...

China's worst week in 6 months...

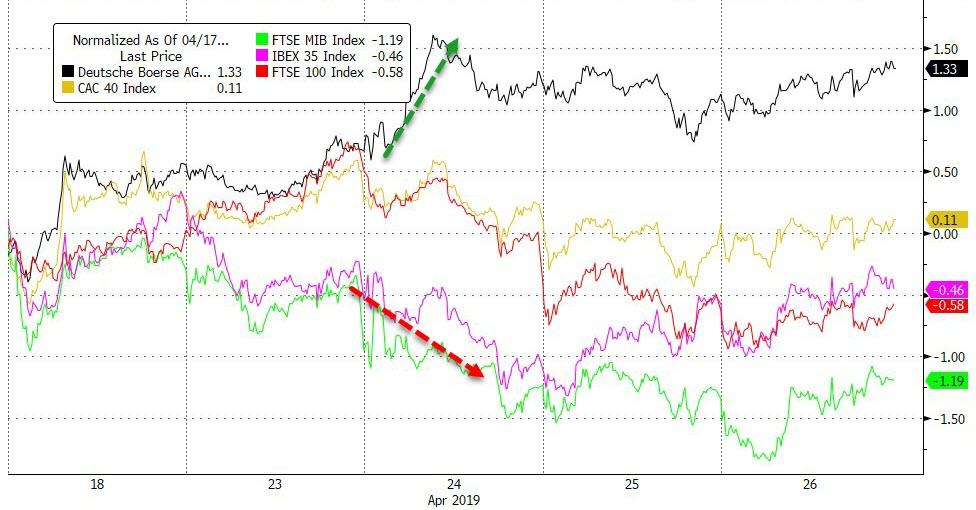

European markets were more mixed with Germany's DAX best, France just green but UK, Spain, and Italy in the red...

US equities initially shrugged off the blockbuster GDP print but then the machines embraced it as volumes collapsed...

And were mixed on the week with Dow Industrial and Transports in the red as Small Caps and Nasdaq outperformed...

Nasdaq's 5th weekly rise in a row, Dow and Trannies' first down week in 5 (despite a late-day panic to get green).

Europe and US remain around the same YTD as China leads (but is reverting)...

Volume continues to collapse...

S&P managed to hold above its prior record closing high of 2930.75 (but below record intraday high of 2940.91)...

VIX ended the week higher despite the S&P green...

Breadth continues to lag...

Semis finally hit a speed-bump with the second worst week of the year...

AMZN's beat and 1-day delivery lifted the stock and Nasdaq; but hammered TGT and WMT..

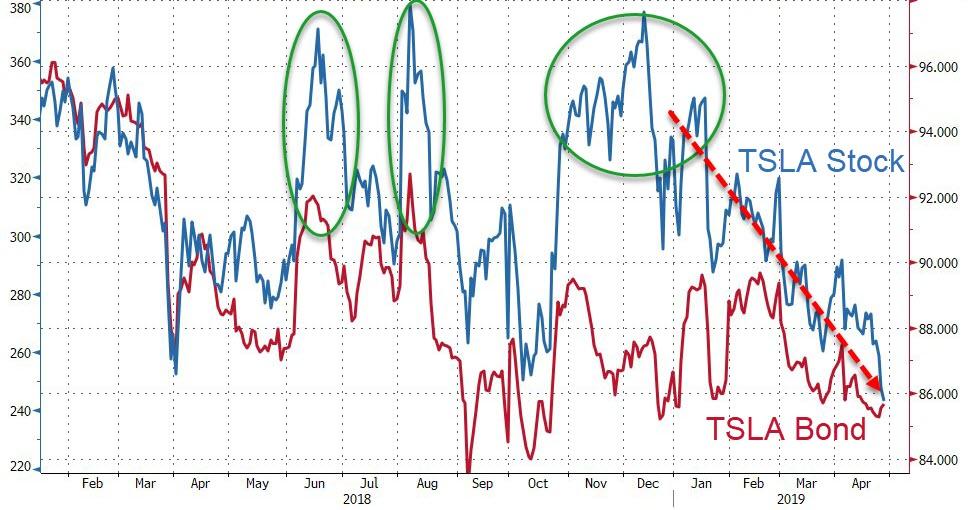

Tesla bloodbath'd back to 2-year lows, breaking to levels where Musk may face Margin Calls...

Catching down its ugly bond reality...

Ford overtook Tesla's market cap for the first time since April...

MSFT overtook AAPL and AMZN, nearing the trillion dollar market cap level...

Stocks and bonds bid on the week...

Despite the strong GDP print, Treasury yields tumbled on the day (and week)...

With 10Y Yield back below 2.50%!!

The Dollar ended higher on the week but lagged in the back half of the week, sliding notably after GDP...

Cryptos had an ugly week after plunging overnight on BitFinex fraud headlines...

WTI Crude suffered its first losing week in the last 8 weeks and gold had its best week since the start of Feb...

WTI tumbled on the day (worst day since Xmas Eve) after Trump's OPEC comments...

But held at its 50DMA (after breaking below a key retracement level)...

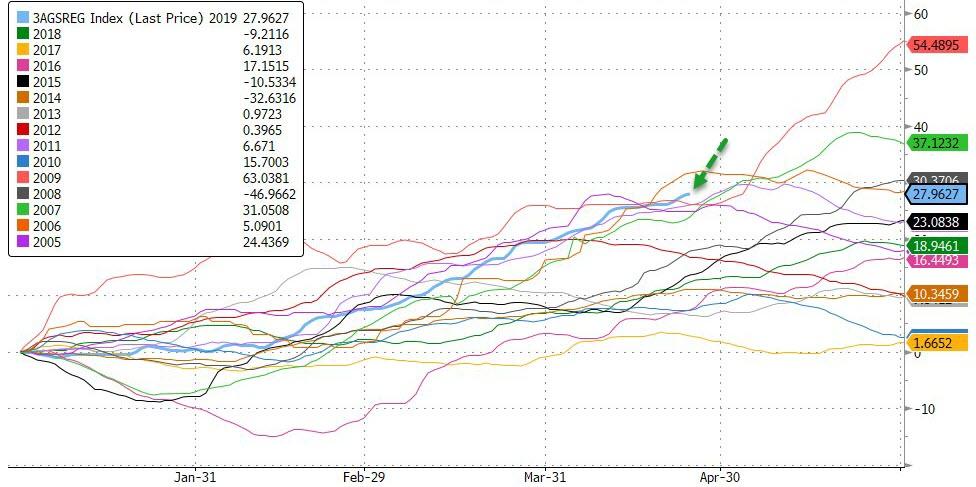

Note that 2019 has seen the fastest rise in gas pump-prices since 2006..

Gold had its best day in 6 weeks after bouncing off the 200DMA on Tuesday...

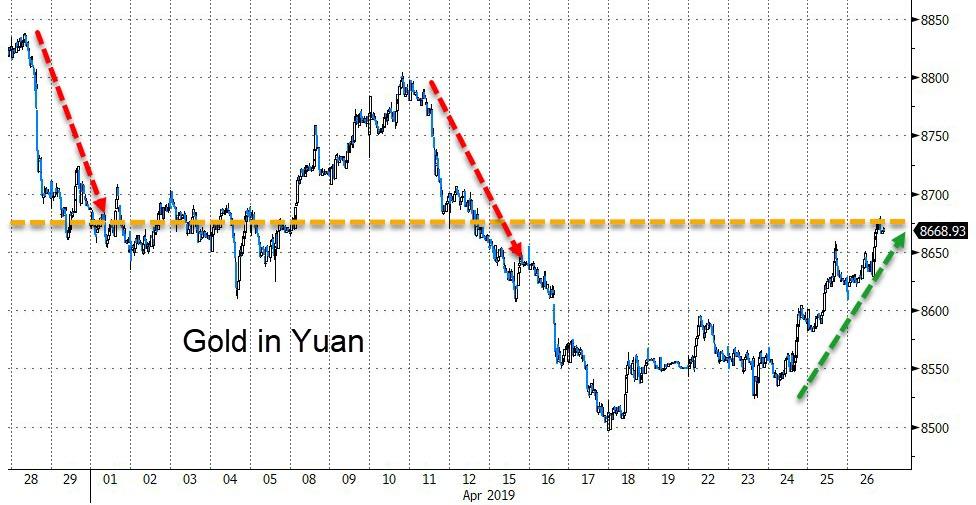

Gold also gained against the yuan - reverting back to the 8650-8700 range...

Finally, we wonder, with the tumble in global money supply, is the bounce over?

The proof of the underlying soft underbelly to GDP lies in the price. That 0.9% reading in the GDP price deflator was the lowest since the first quarter of 2016, but back then, oil prices were melting whereas in Q1 they soared.

This was a low-quality GDP report. All one-offs - lower imports, higher inventories & Pentagon spending. Real final private sales a puny 1.3%. Removing more lipstick from this pig shows cyclically-adjusted GDP contracting at a 2% annual rate; deepest decline in nearly a decade .

Commenti

Posta un commento