- Trade war, slower consumption may hurt industrial investment

- Consumer spending will show whether sentiment has picked up

Sign up for Next China, a weekly email on where the nation stands now and where it's going next.

The Chinese economy likely stabilized in the first quarter of this year, but a closer look under the hood will be needed to tell whether that's just a temporary improvement or if the economy has hit bottom and is rebounding.

There's been plenty of positive news in the world's second largest economy in recent weeks, with an export rebound, a surge in credit, and improved business sentiment coming in March. The gross domestic product data, along with figures for retail sales, investment, industrial production and unemployment due for release Wednesday are forecast to continue that trend.

What Bloomberg's Economists Say

"China's 1Q GDP data are likely to show the economy is on a soft-landing trajectory. We are revising upward our GDP growth forecast for 1Q 2019 to 6.2 percent from 6.1 percent in light of the recent encouraging data."

Chang Shu and David Qu, Bloomberg Economics

Click here for the full note

Below are the important areas to look at in the data dump, beyond the headlines:

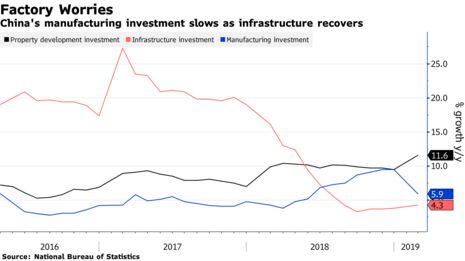

The government's stimulus efforts have been having an effect -- infrastructure investment stabilized and started recovering since late last year, while property spending ticked up in 2019. However, the sharp deceleration in manufacturing investment is raising concerns, as it had been a pillar of growth last year.

A continued slowdown would mean factories are more reluctant to expand production and upgrade equipment, and would also raise questions about the sustainability of the forecast rebound in output growth.

One reason for factories' reluctance to expand is probably the trade tensions with the U.S. While the two nations are closing in on a deal, the U.S. hasn't disclosed whether it'll remove existing tariffs on Chinese products.

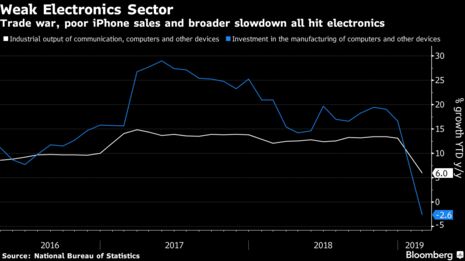

Poor Chinese sales of iPhones and weak global demand for phones and computers are also a factor, with the slump in semiconductor sales in China since September a sign of the industry's outlook. It's also worthwhile paying attention to the deceleration in the growth of electronic equipment delivered for export, which is a forward indicator for shipments and eventual overseas sales.

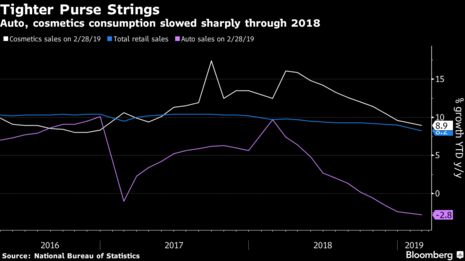

Chinese consumers already started tightening their purse strings last year. Auto sales fell in 2018 for the first time in almost three decades, and retail sales had the weakest start this year since 2002. How much that spending picked up in March, if it did, will be closely watched, with a special focus on sales of phones, cars, appliances and other big-ticket items.

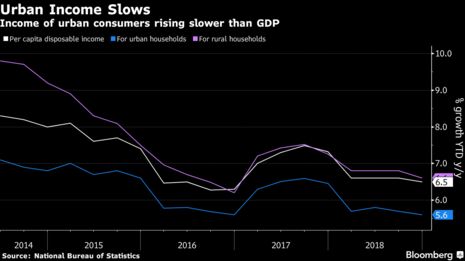

One factor in that retail slowdown is tepid income growth, especially in the cities which are meant to be driving the shift in the economy from investment to private consumption. Rising costs and weaker wage growth are making people's lives harder, and that will affect their demand for housing, goods, services, and also their propensity to save.

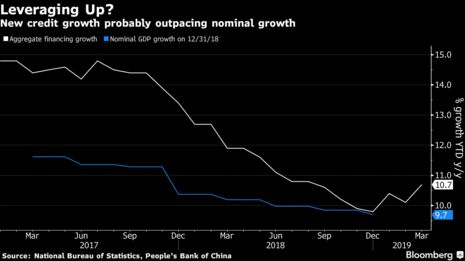

The government is now refocusing its deleveraging campaign and is instead aiming to stimulate growth. That stimulus and the credit expansion accompanying it is likely to spur debt growth. Nominal GDP, which isn't adjusted for inflation, probably grew slower than the rise in new credit in the first three months of this year, meaning the leverage ratio probably edged up.

That is not necessarily a bad thing, if a short-term increase in borrowing helps arrest the economic slowdown. But if credit growth continues to set records like it did in the first quarter while growth continues to slow or remains flat, the ratio will worsen and concerns about debt sustainability will return.

If that's combined with slower industrial output and weak income growth, the recovery we're seeing in the data may well prove to be temporary.

— With assistance by Xiaoqing Pi

Commenti

Posta un commento