As the midsummer sun rises, those traders who are not on vacation brace for an extremely busy week that includes the first of two big central bank meetings in the remainder of this month with the ECB meeting, as well as a barrage of US corporate earnings. The latest flash PMIs around the world and Q2 GDP in the US are the data highlights while earnings season really starts to ramp up in the US. In the UK we'll also get official confirmation of who the next Prime Minister is. But the highlight of this week will be the much anticipated ECB meeting on Thursday.

At Sintra last month Draghi laid the foundations to make further policy easing feel less conditional, although Wall Street is split on when Draghi will actually make a formal announcement with Deutsche Bank believing that September is the natural occasion for the big decisions and details however some preparation is anticipated at the meeting next week. They expect the "or lower" easing bias to be reintroduced into rates guidance and that this will be the prelude to a 10bp deposit rate cut and tiering in September. They also expect a further 10bp cut in December. They also believe we will see upgraded forward guidance used to underline the ECB's "absolute commitment" to the price stability mandate.

If the Council is unable to strengthen forward guidance sufficiently, a new wave of QE may be required. If so, analysts would not be surprised by new QE of €30bn per month for a minimum 9-12 months split equally between public and private assets and with a commitment to relax the limits if necessary.

Politics will also play a key role this week with Theresa May's successor to be announced on Tuesday (spoiler alert: Boris Johnson) and the formal handover to take place on Wednesday.

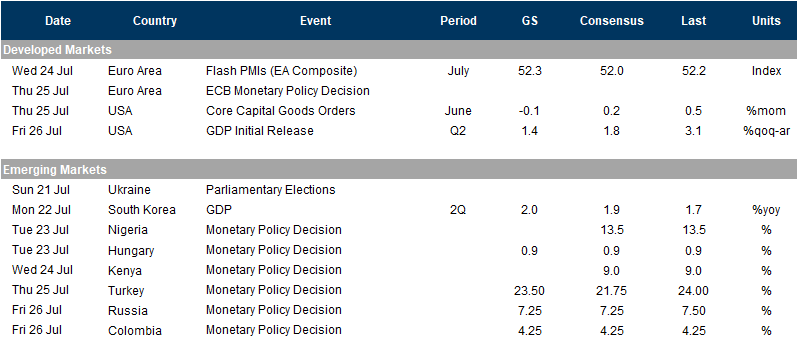

One day prior to the ECB on Wednesday we'll get the flash July PMIs in Europe. The last few months have seen some stabilisation in the data with the manufacturing PMI for the Euro Area hitting 47.6 in June (vs. 47.7, 47.9 and 47.5 in the three months prior). The consensus expects a 47.8 reading for July. As for the services reading the consensus expects a 53.5 print which compares to 53.6 last month. We'll also get country level PMI data for Germany, France and also the Japan and the US.

Meanwhile, earnings season ramps up this week with 145 S&P 500 companies due to report and 10 of the Dow 30. The highlights include Harley Davidson, Coca-Cola, United Technologies and Visa on Tuesday, Boeing, Caterpillar, Ford, Facebook and AT&T on Wednesday, Amazon, Google and Intel on Thursday, and McDonalds and Twitter on Friday. At the time of writing we've had earnings reports from 69 of the S&P 500 companies so far with 78% beating on earnings and 64% on sales.

As for the rest of the data, the advance Q2 GDP reading in the US on Friday will be in the spotlight with the consensus expecting a +1.8% reading following +3.1% in Q1. We'll also get June existing home sales on Tuesday, June new home sales on Wednesday, the preliminary June durable and capital goods orders data on Thursday along with the June advance goods trade balance. In Europe the only other data worth noting is the July IFO survey in Germany on Thursday and CBI survey data for July in the UK on Monday and Thursday.

Finally, other things worth keeping an eye on include Pakistan PM Imran Kahn making his first trip to the White House to meet with President Trump on Monday, the UK Lib Dem Party choosing their new leader on Monday, the IMF's latest World

Economic Outlook update on Tuesday, and former Special Counsel Mueller testifying before the House Judiciary and Intelligence committees on Russian election interference on Wednesday.

Summary of key events in the week ahead, courtesy of Deutsche Bank's Craig Nicol:

- Monday: A very quiet day for data with only the June Chicago Fed national activity index in the US due for release. Halliburton will report earnings.

- Tuesday: Data releases include final June machine tool orders in Japan, July CBI survey data in the UK, July consumer confidence for the Euro Area and the May FHFA house price index, July Richmond Fed survey and June existing home sales data all in the US. Companies reporting earnings include Harley Davidson, CocaCola, United Technologies and Visa. The next UK PM is expected to be announced while the IMF will release the latest World Economic Outlook.

- Wednesday: The July flash PMIs in Japan, Europe and the US will be the main data focus. Away from that July confidence indicators are due in France, June M3 money supply data due for the Euro Area and June new home sales data due in the US. Earnings highlights include Boeing, Caterpillar, Ford, Facebook and AT&T. Former Special Counsel Mueller will testify before the House Judiciary and Intelligence committees on Russian election interference.

- Thursday: The ECB monetary policy meeting will likely be the focal point of the day. As for data, in Europe we get the July IFO survey in Germany and CBI survey data in the UK. In the US the preliminary June durable and capital goods orders data is due in the US along with June wholesale inventories, July Kansas Fed survey and latest jobless claims data. As for earnings, Amazon, Google and Intel will report.

- Friday: The focus of the data will be the advanced Q2 GDP revisions in the US. Prior to this the only data due in Europe is the July consumer confidence print in France. Earnings releases are also due from McDonald's and Twitter.

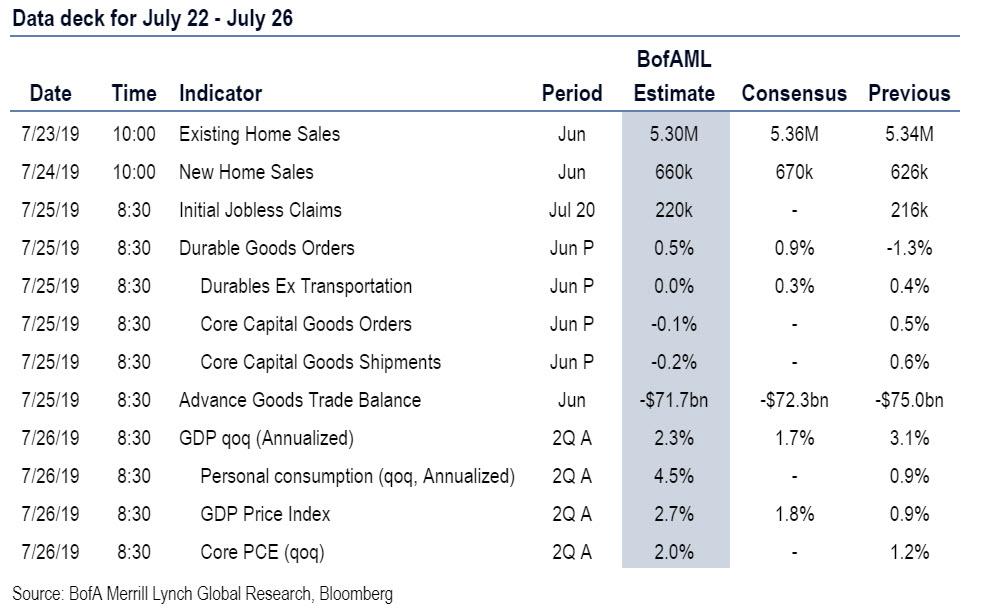

Finally, looking at just the US, Goldman notes that the key economic data release this week is the Q2 advance GDP report on Friday. There are no scheduled speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, July 22

- There are no major economic data releases scheduled.

Tuesday, July 23

- 09:00 AM FHFA house price index, May (consensus +0.3%, last +0.4%)

- 10:00 AM Richmond Fed manufacturing index, July (consensus +5, last +3)

- 10:00 AM Existing home sales, June (GS flat, consensus -0.2%, last +2.5%): After rising 2.5% in May, we estimate that existing home sales were flat in June. Existing home sales are an input into the brokers' commissions component of residential investment in the GDP report.

Wednesday, July 24

- 09:45 AM Markit Flash US manufacturing PMI, July preliminary (consensus 51.0, last 50.6)

- 09:45 AM Markit Flash US services PMI, July preliminary (consensus 51.8, last 51.5)

- 10:00 AM New home sales, June (GS +4.0%, consensus +5.4%, last -7.8%): We estimate that June new home sales rebounded 4.0% in June following a 7.8% decline in May, reflecting mean-reversion and a pick-up in mortgage applications.

Thursday, July 25

- 8:30 AM Durable goods orders, June preliminary (GS -0.3%, consensus +0.7%, last -1.3%); Durable goods orders ex-transportation, June preliminary (GS -0.1%, consensus +0.2%, last +0.4%); Core capital goods orders, June preliminary (GS -0.1%, consensus +0.2%, last +0.5%); Core capital goods shipments, June preliminary (GS -0.2%, consensus -0.2%, last +0.6%): We expect durable goods orders declined by 0.3% further in June, partly reflecting a further decline in commercial aircraft orders. We estimate core capital goods orders decreased by 0.1% and core capital goods shipments pulled back by 0.2%, as global manufacturing trends remain soft.

- 08:30 AM Advance goods trade balance, June (GS -$73.9bn, consensus -$72.4bn, last -$74.5bn): We estimate that the goods trade declined slightly to $73.9bn in June, following a rise in outbound container traffic.

- 08:30 AM Wholesale inventories, June preliminary (consensus +0.4%, last +0.4%): Retail inventories, June preliminary (consensus +0.2%, last +0.5%)

- 08:30 AM Initial jobless claims, week ended July 20 (GS 220k, consensus 219k, last 216k): Continuing jobless claims, week ended July 13 (consensus 1,693k, last 1,686k): We estimate jobless claims increased by 4k to 220k in the week ended July 20 after increasing by 7k in the prior week.

Friday, July 26

- 08:30 AM GDP, Q2 advance (GS +1.4%, consensus +1.8%, last +3.1%); Personal consumption, Q2 advance (GS +3.8%, consensus +4.0%, last +0.9%): We estimate a 1.4% increase in the initial release of Q2 GDP (qoq ar). We expect strength in personal consumption (+3.8%), but soft business fixed investment (-0.7%) and a 1.8pp drag from inventories.

Source: Deutsche Bank, Goldman, Bank of America

Commenti

Posta un commento