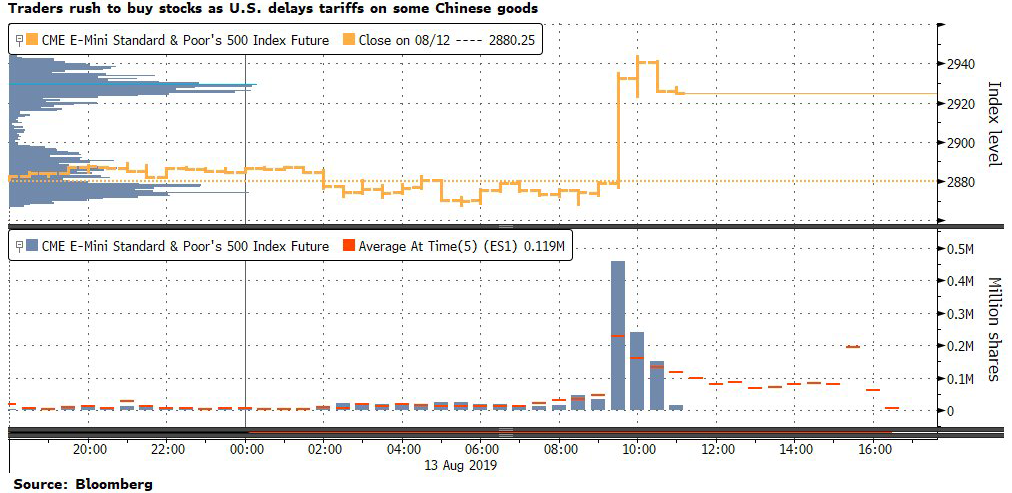

Almost 130,000 September e-mini S&P contracts changed hands over five minutes starting at 9:45 a.m. in New York, five times the average for similar periods over the past month, data compiled by Bloomberg show.

"We go from sipping from the water fountain to drinking from the fire hose," said Larry Weiss, head of equity trading at Instinet LLC in New York.

"The headlines certainly exacerbate intraday volatility, as summertime volumes present us with a decline in institutional and retail liquidity."

"The headline comes out, everybody reacts, algos chase and the volume goes up," said Joseph Saluzzi, Themis Trading LLC partner and co-head of equity trading.

"People need to digest the real news and don't understand what it is, it doesn't matter."

But the surge in both prices and volume is starting to fade...

Yuan stalled and dropped at 7.00/USD

And The Dow stalled at the key Fib 61.8% retrace levels again...

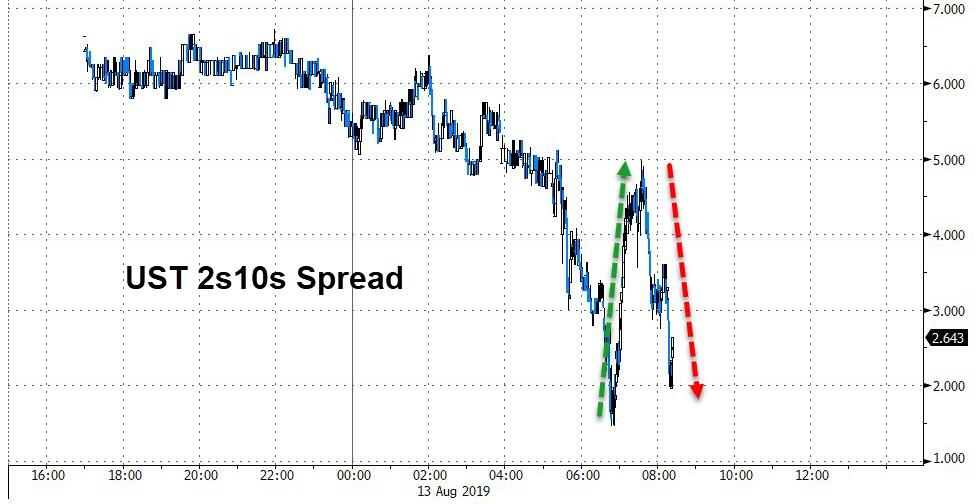

Additionally the Treasury yield curve is flattening once again...

"Judging by our analysis of futures 'lot size imbalance,' we'd reasonably assume large covering of dynamic hedge 'shorts' from leveraged funds," said Charlie McElligott, a cross-asset strategist at Nomura. He said he also saw "large buying from asset managers as well."

The short-covering appears to be over.

* * *

USTR just released a statement confirm that the tariffs will go ahead on Sept 1st but tariffs on some products will be delayed until Dec 15 on the basis of health, safety, and national security.

...some tariffs will take effect on Sept. 1 as planned, "certain products are being removed from the tariff list based on health, safety, national security and other factors and will not face additional tariffs of 10 percent," the U.S. Trade Representative's offices said in a statement Tuesday.

"Further, as part of USTR's public comment and hearing process, it was determined that the tariff should be delayed to December 15 for certain articles," the statement continued.

"Products in this group include, for example, cell phones, laptop computers, video game consoles, certain toys, computer monitors, and certain items of footwear and clothing."

USTR has released the list on its website:

- Here are the products subject to tariffs on Sept 1st

- Here are the products subject to tariffs on Dec 15th.

The market appears to have seen "delay" and "Dec 15" and panic-bid.

AAPL is soaring...

And Yuan has exploded stronger (biggest day since 2016), back below 7/USD...

Source: Bloomberg

Market participants are claiming Trump blinked and did not want to see stocks fall anymore? Does this sound like someone who is ready to fold?

Donald J. Trump✔@realDonaldTrump

Through massive devaluation of their currency and pumping vast sums of money into their system, the tens of billions of dollars that the U.S. is receiving is a gift from China. Prices not up, no inflation. Farmers getting more than China would be spending. Fake News won't report!52.4K2:49 PM - Aug 13, 2019Twitter Ads info and privacy24.9K people are talking about this

But the market has it wrong! This is just "some imports" - not a delay of the $300bn/10% tariffs.

It seems to us like US is delaying tariffs on items which could send consumer price inflation higher, crushing Trump's hopes for further Fed rate-cuts.

There is still hope...

Donald J. Trump✔@realDonaldTrump

As usual, China said they were going to be buying "big" from our great American Farmers. So far they have not done what they said. Maybe this will be different!42.2K4:10 PM - Aug 13, 2019Twitter Ads info and privacy17.7K people are talking about this

As we detailed earlier, after a weak open, US equity markets are panic-bid following a headline from China's MOFCOM that US and China plan to speak by phone again in two weeks (before the Sept 1st tariffs)...

...and that's enough to ignite algo momentum...

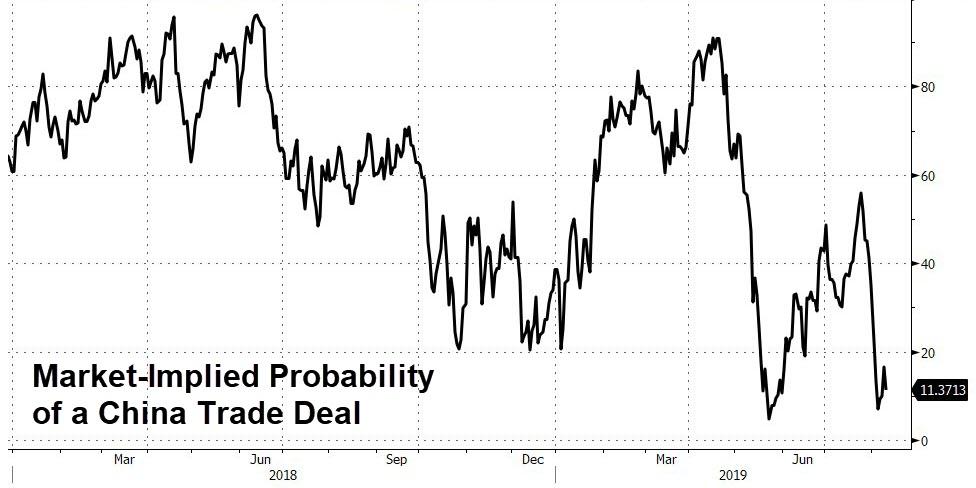

So "talks" mean progress? Have you not been paying attention for the last two years?

As a reminder, the market remains unconvinced that a trade deal is on the cards...

Commenti

Posta un commento