The headline Markit Manufacturing PMI inched back into expansion with a final 50.3 print for August (after a 49.9 flash print), however, that is still the lowest since September 2009, with new export orders plunging at the fastest pace in 10 years.

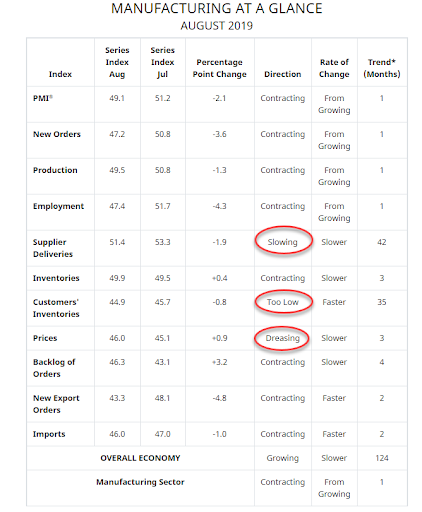

The headline ISM Manufacturing plunged into contraction, printing 49.1 (well below the 51.3 expectations) to the lowest since Jan 2016 as employment and new orders (seven year low) collapsed.

Source: Bloomberg

The word "Contracting" dominates the sub-components of the ISM report... but look at the comments - this is very odd!

ISM respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Respondents continued to note supply chain adjustments as a result of moving manufacturing from China. Overall, sentiment this month declined and reached its lowest level in 2019.

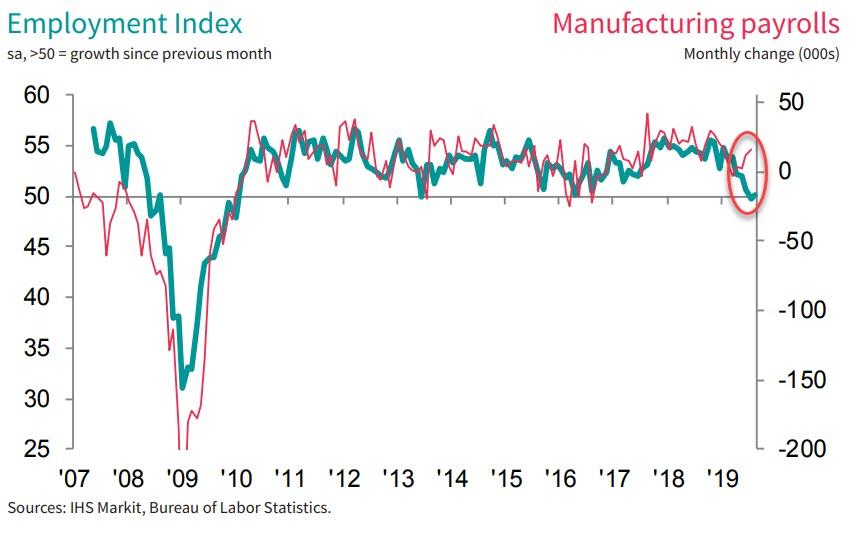

"Business is starting to show signs of a broad slowdown." (Machinery) "While business is strong, there is an undercurrent of fear and alarm regarding the trade wars and a potential recession." (Chemical Products)As Bloomberg notes, the latest downturn underscores how slowing global growth and an escalating U.S. trade war with China are taking an even bigger toll on domestic producers. Although manufacturing only makes up about 11% of the economy, there are concerns that entrenched weakness - and any layoffs that may result - could filter through to the rest of the economy and endanger the record-long expansion.

Chris Williamson, Chief Business Economist at IHS Markit said:

"The August PMI indicates that US manufacturers are enduring a torrid summer, with the main survey gauge down to its lowest since the depths of the financial crisis in 2009. Output and order book indices are both among the lowest seen for a decade, indicating that manufacturing is likely to have again acted as a significant drag on the economy in the third quarter, dampening GDP growth.

"At current levels, the survey indicates that manufacturing production is falling at an annualised rate of approximately 3%.

"Deteriorating exports are the key to the downturn, with new orders from foreign markets dropping at the fastest rate since 2009. Many companies blame slower global economic growth for weakened order books, but also point the finger at rising trade war tensions and tariffs.

"Hiring has stalled as companies worry about the outlook: optimism about the year ahead is at its lowest since comparable data were first available in 2012. Similarly, price pressures are close to a three-year low, as crumbling demand has removed firms' pricing power."

As Rabobank comments, what is clear from both surveys is that the US manufacturing sector has come to a standstill, most likely because of the global economic slowdown and the uncertainty about international trade policy.

This was also reflected in the Q2 decline in business investment. Sufficient reason for the Fed to start cutting rates in July. And this will not be the last. As we explained previously, by taking a risk management approach to trade policy uncertainty, the Fed is amplifying the effect of trade policy on monetary policy.

All President Trump needs to do is raise tariffs or take another protectionist measure to get the Fed to cut rates further. In fact, the Fed is enabling the US administration to be tough on trade as the central bank has promised to offset any expected negative impact on the US economy by cutting rates in advance. This means that the Fed is bolstering Trump's bargaining position in the 'game of chicken' between the US and China. This also makes it more likely that President Trump will continue to escalate the trade war.

And that makes it more likely that the Fed will have to make additional insurance cuts before the end of the year. Consequently, there is now a strong feedback loop between trade policy and monetary policy that will force the FOMC to make more insurance cuts in the near future, most likely in September and October.

The vicious circle this sets up does not bode well for any rational investor.

Commenti

Posta un commento