It's not 'coronabonds' yet, but on a day like this it doesn't matter.

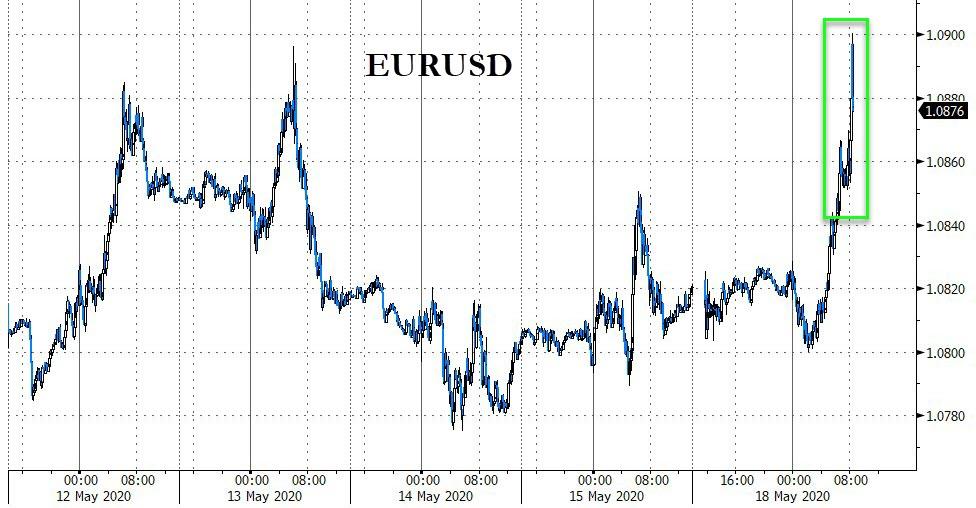

Reuters headlines from France's Macron and Germany's Merkel have sparked a panic bid for EURUSD, European stocks (and US stocks), and European peripheral debt.

The two core European leaders agreed to back a plan for a 500 billion-euro ($543 million) recovery fund to help the European Union weather the worst recession on record.

Merkel said the fund will be within the framework of the bloc's budget, which will have authority to borrow money.

Twitch Views Surge During Quarantine

EUR spiked...

Italian bonds were panic bid...

But, even as Germany and France find common ground, the world's largest trading bloc is far from reaching an agreement over a package to help stricken member states and this is not the official recovery plan which the European Commission is due to present May 27.

We await the response from Netherlands, who until now at least, have been a vocal opponent to commonly issued debt.

The plan, which will have to be endorsed by the European Parliament and national governments, would see most of the funds spent on public investments and reforms in the countries most deeply affected by efforts to contain the disease.

Commenti

Posta un commento