In retrospect, it was inevitable: after European growth hit a brick wall in October and early November after a second round of partial (or full) lockdowns were imposed, with even the ECB warning that Q4 GDP may turn negative after the record rebound in Q3, it was only a matter of time before the US - which is now experiencing a second round of creeping lockdowns across the coastal states - suffered the same fate.

As we showed earlier, the Citi econ surprise index has clearly pointed the way, having swung sharply lower (as one would expect after the biggest - and shortest - economic collapse since the Great Depression) in recent months, as the economy caught up to trendline on the back of trillions in fiscal stimulus.

Furthermore, with the US entering 2021 without any firm commitment for another much needed round of fiscal stimulus - which we hope everyone realizes is the only reason why the economy did not disintegrate in the summer and fall - even as the rising number of covid cases continue to dominate the economic outlook, the time for the realization that a double dip is imminent, was drawing close.

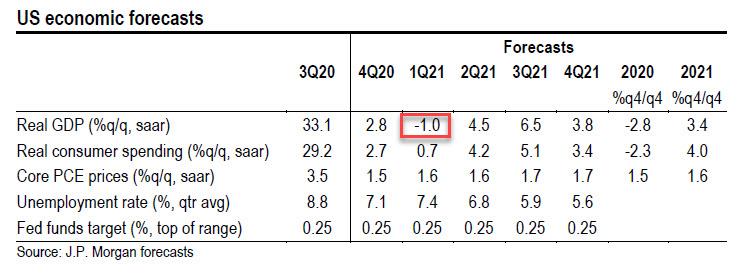

That time came this morning in a note from JPM chief economist Michael Feroli, who writes that while the economy powered through the July coronavirus wave, "at that time the reopening of the economy provided a powerful tailwind to growth. The economy no longer has that tailwind; instead it now faces the headwind of increasing restrictions on activity." Meanwhile, "the holiday season—from Thanksgiving through New Year's—threatens a further increase in cases. This winter will be grim, and we believe the economy will contract again in 1Q, albeit at "only" a 1.0% annualized rate."

In other words, the double dip is about to hit.

The good news is that even without a major stimulus, JPM sees the Q1 recession reverse quickly, because "the early success of some major vaccine trials increases our confidence that such medical intervention can limit the damage that the virus has inflicted on the US economy. (Alas, some lasting damage still seems inevitable.)" As such, JPM expects that by 2Q the vaccine will be available to health care providers, other essential workers, and at-risk populations. JPM then assumes "broader availability to the rest of the population by 3Q or 4Q" which means that while uncertainties abound, "if this timeline is broadly correct, a normalization of activity should give meaningful support to growth in mid-2021."

And while (the lack of) a vaccine is certainly a downside risk, another potential risk is that the fiscal stimulus which JPM expects will be released next year, also fails to materialize:

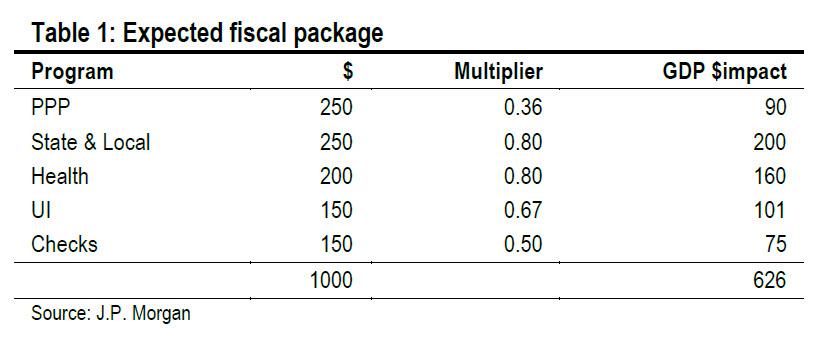

By a wide margin, the course of the virus has been the most important factor shaping the outlook. But fiscal policy has been firmly in second place. This year's unprecedented fiscal support was crucial in jump-starting the current recovery. We expect more fiscal action next year—with a baseline assumption of $1 trillion by the end of 1Q. If realized, this would further support the case for strong growth in 2Q and 3Q.

This assumption appears overly optimistic assuming we enter 2021 with an even more polarized political climate than ever before (which judging by the unexpected Treasury-Fed right overnight is right on schedule) suggesting that the real risk is we get zero (or a token) fiscal stimulus in early 2021, something JPM also concedes is a distinct possibility:

If instead we get no further fiscal support, this year's massive fiscal thrust is set to turn to fiscal drag. For example, Figure 4 presents the fiscal impact measure developed at the Hutchins Center at the Brookings Institution. If we get the fiscal support we expect, that drag gets dampened and pushed back, allowing a vaccine more scope to boost growth.

Commenti

Posta un commento