Record 41% Of European IG Bonds Have Negative Yields As ECB Buys Quarter Of All Eligible Corporate Bonds

As it was showed last week (in 20 charts) while 2020 was certainly an unforgettable year for stocks, it was actually credit where the real action was - or as Goldman put it "a year like no other" - for two reasons:

i) the direct injection of over $10 trillion in liquidity by central banks in the span of just weeks after the March crash had a direct goal of stabilizing the rates market where US treasury yields briefly became unhinged amid the wholesale liquidation, threatening the collapse of hundreds of trillions in rate-linked securities;

ii) the second, and more important reason, is that on March 23, Fed chair Jerome Powell crossed a rubicon that even Bernanke stayed away from when the Fed effectively soft-nationalized the entire bond market, announcing it would buy corporate bonds in both the primary and secondary market, including investment grade and junk bond ETFs.

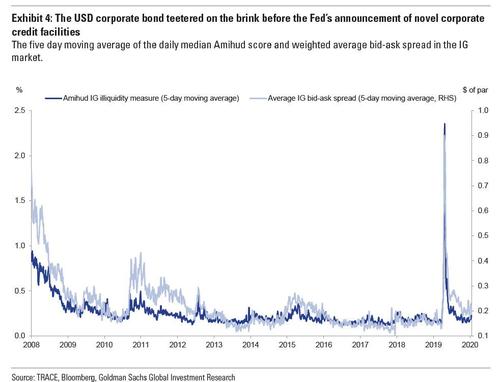

Naturally, apologists argue that the Fed had no choice, as the alternative was the collapse of western capital markets. As Goldman writes, the "pandemic pushed market microstructure to the brink of collapse" and at the height of the COVID-19 pandemic, "the USD corporate bond market teetered on the brink of collapse as liquidity dried up faster and more severely than it had during the Global Financial Crisis." The chart below shows just how dramatic these moves were - in just a few short weeks we went from a well-functioning and relatively liquid market, to the exact opposite as we entered non-linear territory. Then came the day which will live in free market infamy - March 23 - the day the Federal Reserve announced its "novel" Corporate Credit Facilities, and just as fast as liquidity had dried up, it returned.

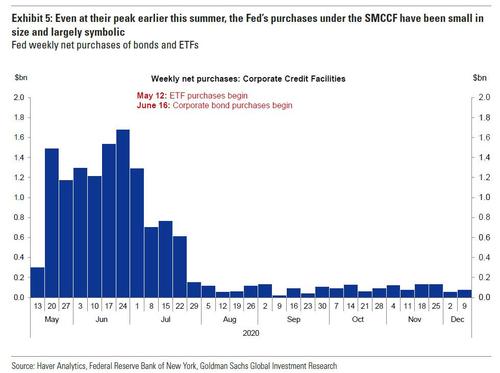

Yet while the Fed's announcement catalyzed a swift recovery of the new issue market – especially in HY, where activity had been paused for a few weeks in March, the Fed's flow of purchases has been largely symbolic – consistent with a lender of last resort posture - with Powell relying on the market's confidence that the Fed can and will step in "in size" if and when necessary to buy everything. Since the Fed's Secondary Market Credit Facility, or SMCCF, buying started in mid-May, a tiny $14 billion of bonds and ETFs have been purchased on a combined, cumulative basis.

Putting this amount in context: the size of the US Investment Grade market is more than $8 trillion while the SMCCF eligible universe has a total face value of $1.9 trillion (and $520 billion when applying the SMCCF program purchase limits, such as issuer constraints). As a testament to the Fed's jawboning, in recent months the amount of SMCCF purchases has been especially light, as the program nears its expiration on Dec 31, 2020, following the return of the CARES Act funds.

But while the Fed's corporate bond purchases may be modest, the same can not be said of Europe where first Mario Deaghi and then Christine Lagarde, have been on an epic spree.

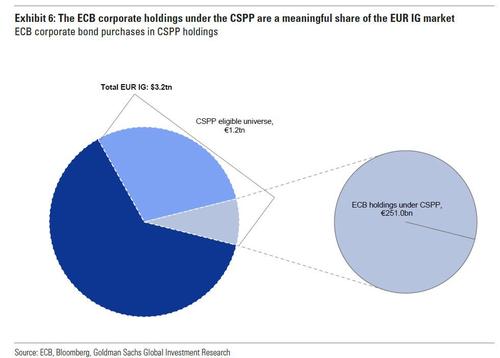

As a reminder, the ECB started purchasing corporate bonds well before the Fed in March (it did however accelerate its pace of purchases after the covid crash). As a result, the ECB now owns a record 8.5% of the entire EUR IG market. As Goldman calculates, the ECB continued to deploy its balance sheet in the corporate bond market, growing the size of its portfolio to €272 billion, €251 billion under the CSPP and an additional €21 billion under the PEPP. This compares to €185 billion at the start of the year, and is 24 more times than the Fed's purchases of corporate bonds. In other words, whereas the Fed successfully managed to jawbone the bond market into a state of confidence, where prices do not fall even when the Fed barely transacts, Europe has failed miserably, and bond market participants have now habituated to the ECB buying billions every week.

As a result, the ECB currently owns 23% of the eligible universe of securities and 8.5% of the broader universe of EUR IG corporate bonds outstanding.

Another way the Fed and ECB's take over of the bond market has differed is that while the Fed's footprinte are barely visible, the ECB's monthly flow of purchases over the past few months has averaged €6 billion (mostly under the CSPP); enough to absorb a significant share of net issuance. With the bond purchases set to continue until at least March of 2022 or "for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates", the ECB's growing presence in the market remains a strong "demand tailwind" according to Goldman... and of course Goldman is right - but the question is just how catastrophic will the crash be in the EUR bond market now that everyone is habituated to the ECB buying billions monthly, when Lagarde finally announces a taper of bond buying.

To be sure, the ECB can kick the can for a while longer, but with the central bank already owning a quarter of all eligible bonds, the day when the ECB runs out of bonds to buy is rapidly approaching.

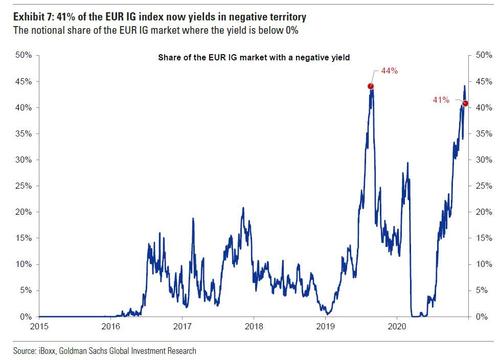

Meanwhile, thanks to the nationalization of the European bond market, a record-high level for EUR IG bonds with negative yields. As the chart below shows, as of December 15, 41% of the EUR IG iBoxx index yields in sub-zero territory; a level that matches the previous record in August 2019.

Even more impressive is the fact that more than 10% of the index now yields below -0.25%. As Goldman concludes, "negative yields will likely remain a fixture of the EUR IG corporate bond market in 2021, even if bund bond yields back up in response to solid growth next year. Combined with the decent demand tailwind from ECB purchases, this would keep search for yield motives strong" leaving the euphoric bank "comfortable" with our rating compression view. and its bullish market outlook, even as it lists 3 things that could destroy the bank's cheerful forecast.

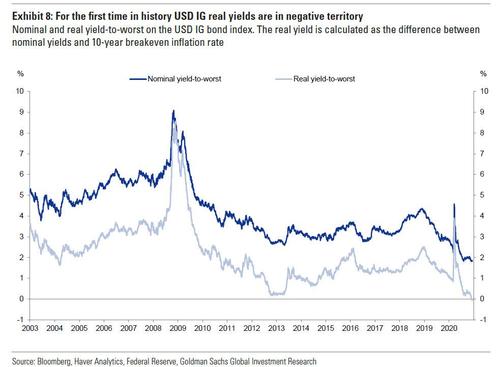

And while the US corporate bond market is still somewhat more normal than the one in Europe, it too is starting to Japanify, with USD IG real yields turning negative for the first time ever. This means that while most of the focus on negative yielding corporate debt has been concentrated on nominal yields in the EUR IG market, real yields on USD IG corporate debt have also turned negative for the first time in history.

Needless to say this is very bad news should inflation re-emerge because negative real yields have greatly increased the risk that a moderate inflation surprise could lead to all-out carnage in the bond market as all-in yield-based buyers puke everything.

Commenti

Posta un commento