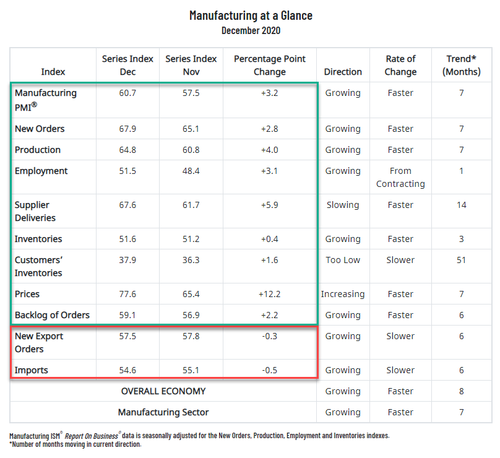

As hard data has declined aggressively, Manufacturing PMI is at its highest since 2014 while ISM's Manufacturing survey prints at 60.7 - smashing expectations of 56.8 and well above the 57.5 in November...

Source: Bloomberg

Labor market difficulties at panelists' companies and their suppliers will continue to restrict the manufacturing economy expansion until the coronavirus (COVID-19) crisis ends.

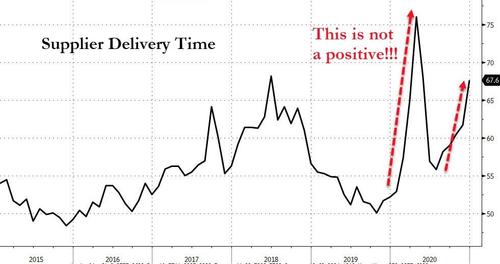

And this is why ISM soared - Supplier Delivery Times are rising fast...

...and as far as the models are concerned that must be an indication of huge demand... rather than disruption in the global supply chain

Source: Bloomberg

Source: Bloomberg

We await the correction from ISM to "fix" this issue and downwardly revise ISM once again.

Commenti

Posta un commento