When that happens, while March/April economic data will rise only modestly compared to the previous month, it will be a veritable explosion compared to the shutdown a year ago. This is the so-called "base effect" and while many economists will ignore it, especially when it comes to inflation data, the impact for many will be jarring especially when investors see charts that have gone, for lack of a better word, vertical.

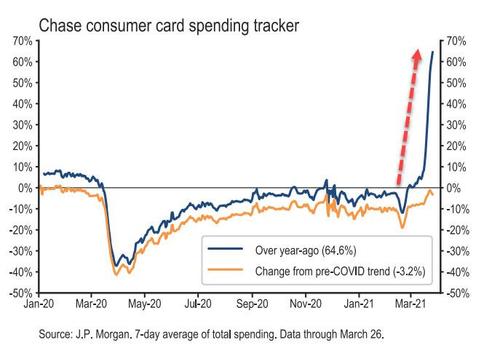

To preview the annual change base effect that is coming in everything from retail sales, to income and spending, to housing data, to jobs and unemployment, we have pulled some of the most representative real-time indicators available from JPMorgan and Bank of America, starting with what is perhaps the most illustrative chart of all: JPM's spending tracker on the bank's own consumer (debit and credit) cards.

Here the 65% surge in spending is not because of an actual surge in spending March, but because spending last March imploded. Which is why to normalize for the post-March 2020 shock, banks will likely show not just the Y/Y chart, but also a chart comparing to 2-year ago or, better yet, a pre-covid blended trend as JPM has done in the chart above.

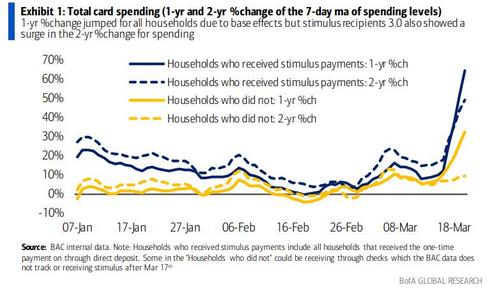

Bank of America published a similar chart, showing a huge jump in Y/Y card spending, especially among households who received stimulus payments - and this time on both a 1 and 2 year basis - while household that did not receive stimulus saw a roughly 30% jump in Y/Y spending due to the base effect, and only a modest increase in 2Y spending.

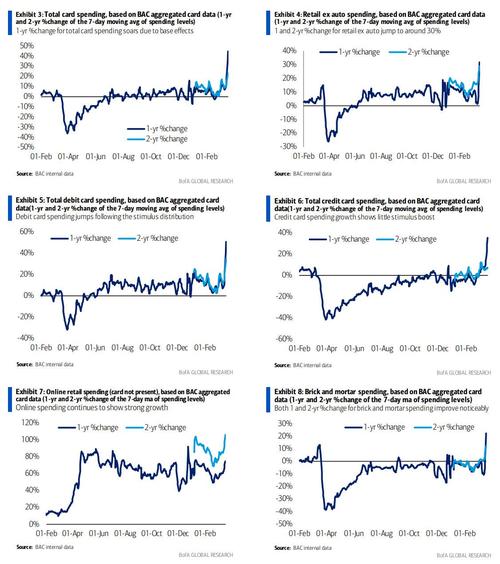

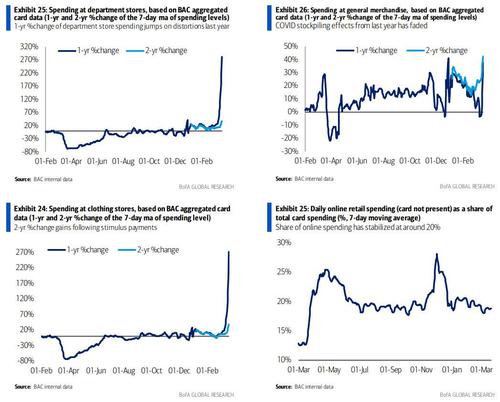

Here are some other charts showing how the 1-Year, but not 2-Year change, has gone vertical:

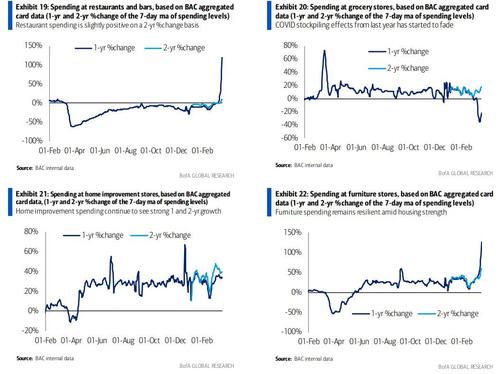

... And some more.

... And even more...

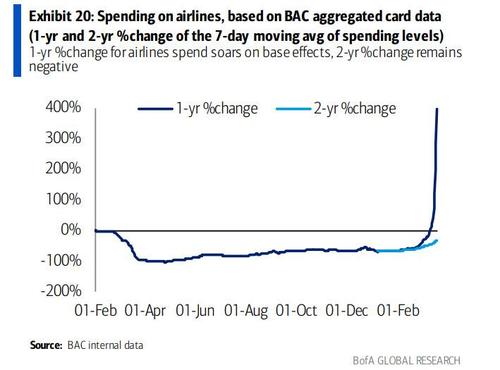

But nowhere is the base effect more visible than in the 1-year spending on airlines, where we see a very clear "lift off" formation in progress.

Commenti

Posta un commento