Because Orcs

"And as if in answer there came from far away another note. Horns, horns, horns, in dark Mindolluin's sides they dimly echoed. Great horns of the north wildly blowing. Rohan had come at last."

Today is going to be dominated by the market pricing in US fiscal stimulus for the nth time, unless we buy the rumor and sell the fact: and it's rumors and facts I want to address. US CPI yesterday saw headline inflation in line with consensus at 0.4% m/m and rising from 1.3% to 1.7% y/y, but core inflation a tick lower at 0.1% m/m and so dipping to 1.3% y/y. On the back of that, and a moderate US 10-year auction, US equities rose (the S&P up 0.6%); US bond yields dipped, (10s down 6bp from their intraday peak to close at 1.52%); and USD wobbled.

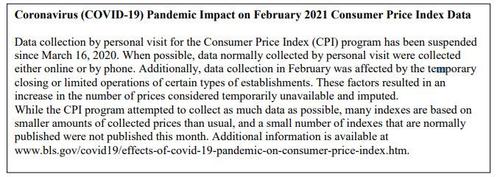

The CPI release included a footnote stating:

"…data collection in February was affected by the temporary closing or limited operations of certain types of establishments. These factors resulted in an increase in the number of prices considered temporarily unavailable and imputed. While the CPI program attempted to collect as much data as possible, many indexes are based on smaller amounts of collected prices than usual, and a small number of indexes that are normally published were not published this month."

Or, to put it differently, 'We did our best, but made some of it up'.

This rightly worried some people: is inflation being 'hidden'? If so, let's not forget US CPI has long had 'hedonic adjustments' that presume goods such as clothing and books get "cheaper" as their price goes up because they are "better"; and since 1999 it has used a geometric not arithmetic mean to assume when beef goes up, consumers buy chicken, so inflation stays lower overall. Would they want to actively hide inflation though?

Being cynical, there are only four logical options for the authorities if things go badly wrong in our fragile, asset-based, financialized economies (for example, if inflation rips higher):

- Do nothing, or try to normalise rates, and watch a crash happen;

- Target bond yields - effectively making bond prices up;

- Target equities - effectively making stock prices up; or

- Target data - so market outcomes mean nothing blows up.

I am not saying this happened with US February CPI! Yet I am saying that despite the BOJ apparently backing away from YCC a little, the *systemic* global glide path we are on is logically (and historically) going to be towards one, or more, of the above. But on a deeper level, even if inflation were 'made up' (by a whole tick!), aren't we making most things all up anyway?

Think of GDP. There is always the issue of unreported transactions. More fundamentally, classical economics categorised it into labour, capital, and rent – the tax aristocrats imposed on workers and businesses due to the monopoly they held on land ownership. Neoclassical economics folded 'rent' into capital so this de facto tax, be it from land and other monopolies, is now 'profits' under capital. At a time when inequities in society are rightly being challenged, some of those doing so conveniently fail to recognise where their income sits within that particular paradigm.

Still on GDP, I have regularly repeated the 50-year old neoclassical critique of Sonnenschein-Mantel-Debreu that proves there are no aggregate demand curves ("The importance of the above results is clear: strong restrictions are needed in order to justify the hypothesis that a market demand function has the characteristics of a consumer demand function. Only in special cases can an economy be expected to act as an 'idealized consumer.' The utility hypothesis tells us nothing about market demand unless it is augmented by additional requirements.") Hence economic analysis based on them is just making things up.

Think of productivity: as argued, isn't this just measuring total incomes in the economy? So isn't the growing gap between aggregate gains in productivity and average earnings underlining that some people's incomes have soared relative to others? (Which sits with the point above.)

Think of accounting standards: there have been debates around the accuracy of these for years; and think of ratings agencies - like vestigial organs, these are still with us, but does anyone in markets think they have any meaning post-GFC? (Recall the days when it was all Moody's this and S&P that?)

Think of the sudden market excitement that just because senior US officials are going to meet senior Chinese officials that somehow US-China relations are going to go back to where they were 10 years ago (remember "Chimerica"?) and the Cold War and Great Power stuff is all over.

Of course, philosophically, everything is made up. The point is, if you want people to go along with a particular version of reality it needs to be internally consistent, otherwise the whole thing rapidly collapses under its own contradictions.

Even in movies this is true. A perfect example is the contrast between 'The Lord of The Rings' and 'The Hobbit' trilogies. The former, while having its share of tooth-grinding bathos for a Tolkien fan ("Nobody tosses a dwarf!") works because its fantasy world feels real: a single arrow can kill a hero. The Hobbit films look like the world's most expensive school play due to the 48FPS format, and are so filled with computer-game action sequences that we immediately disengage: the most egregious examples are Legolas running up a collapsing stone bridge faster than gravity ("because Elves"); and the pointless baddie floating on his back underwater below inches-thick ice, then leaping vertically out of the water through the ice like a geyser ("because Orcs").

The point here is that our authorities have the power to make things up: they can target bond yields if they want; they can target equities; they can tweak inflation data – and what are you going to do about it? However, they also have to maintain the appearance of consistent internal rules to suspend our collective disbelief – and they can't do both for long. Nobody wants to watch "The Hid-it" (Inflation, that is).

We can already see that belief in our whole fantasy system is collapsing for the young, who don't want to be told things must be the way they are "because markets". Anyway, back to pricing in US fiscal stimulus for the nth time, I suppose; and to listen to the ECB spin their own fantasies.

Commenti

Posta un commento