Despite slumping 'hard' data, 'soft' survey data has been trending higher on a bed of soaring prices (well it must be demand), and supplier delivery delays (well it must be demand) providing any and all asset-gatherers and commission-rakers the ammo to confirm the recovery. But, perhaps, if today's PMI is right, that trend is beginning to end as Markit's final Manufacturing survey for May dropped from April and also ended below the preliminary print (but was still well into expansion at 62.1).

ISM also reported a small miss in its Manufacturing survey.

Source: Bloomberg

Stagflation threats loom large in the data as prices soar but production slows.

Input costs rose at the fastest pace since data collection for the series began in May 2007, as greater global demand for inputs put pressure on material shortages.

Output growth, however, was weighed down by ongoing and severe supply-chain disruptions, and reports of labour shortages. Although the rate of growth was among the sharpest since May 2007, firms noted difficulties processing new orders amid material delivery delays and challenges finding suitable candidates for current vacancies.

Suppliers' delivery times lengthened to the greatest extent on record in June, as component shortages and transportation issues exacerbated supply-chain woes.

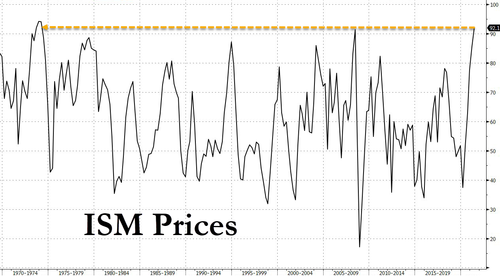

That is the highest prices paid index since the 70s' Oil Crisis...

Additionally, ISM's Employment Index dropped back below 50 (into contraction).

Chris Williamson, Chief Business Economist at IHS Markit said:

"June saw surging demand drive another sharp rise in manufacturing output, with both new orders and production growing at some of the fastest rates recorded since the survey began in 2007.

"The strength of the upturn continued to be impeded by capacity constraints and shortages of both materials and labor, however, meaning concerns over prices have continued to build.

"Supplier delivery times lengthened to the greatest extent yet recorded as suppliers struggled to keep pace with demand and transport delays hindered the availability of inputs. Factories were increasingly prepared, or forced, to pay more to secure sufficient supplies of key raw materials, resulting in the largest jump in costs yet recorded.

"Strong customer demand in turn meant producers were often able to pass these higher costs on to customers, pushing prices charged for goods up at a rate unbeaten in at least 14 years.

"Capacity needs to be boosted and supply chains need to improve to help alleviate some of the inflationary pressures. However, companies reported increasing difficulties filling vacancies in June, and raising COVID-19 infection waves in Asia threaten to add to supply chain issues."

Finally, hope is high as goods producers registered the strongest degree of optimism regarding the outlook for output for seven months. Confidence reportedly stemmed from hopes of a sustained period of strong client demand, and more consistent vendor performance going forward.

Conclusion: It's clear, It's Stagflation but man prefer to remain in denial.

Commenti

Posta un commento