"Absolute Shocker": China's Service Economy Unexpectedly Implodes With 2nd Worst Non-Mfg PMI Print On Record

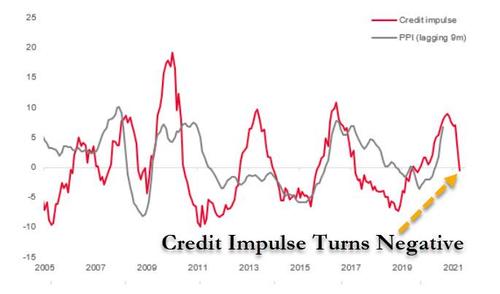

Three months ago when observing the reversal of China's all-important credit impulse to negative, its first red print in over a year, we warned that China was set to unleash a deflationary wave across the world...

... but first it would be China's own economy that is impacted.

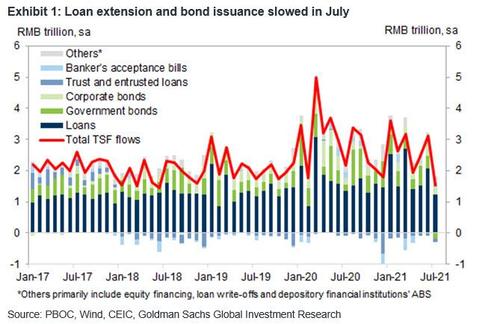

And sure enough, the country which first emerged from the covid pandemic it created courtesy of a tidal wave of new debt creation which however collapsed right on schedule in July, when China's Total Social Financing aggregate printed at the lowest level since February 2020...

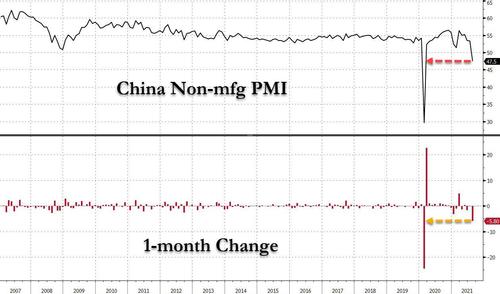

... has just seen its service sector contract sharply, because moments ago China's official Services (non-manucaturing) PMI Index unexpectedly collapsed from a healthy 53.3 to a contractionary 47.5 - the second lowest print on record with just the Feb 2020 peak covid print lower, badly missing the 52.0 Bloomberg consensus, and the largest one-month drop (-5.8)outside of the covid recessionary plunge in February 2020.

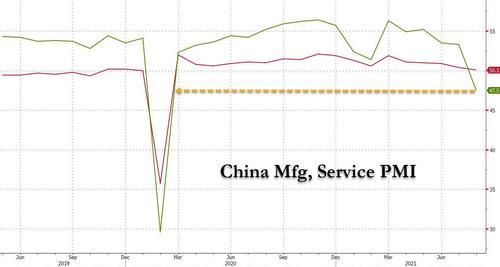

While China's service economy is clearly disintegrating, the silver lining was that the Mfg PMI printed just barely in expansion territory, although at 50.1, not only did it miss expectations of a 50.2 number, but dropped from 50.4 in July, and was the lowest print in this data series since Covid. At this rate, China's manufacturing sector will also be in recession next month.

The PMIs - and especially the Non-mfg print - were bad. So bad that Bloomberg's Simon Flint wrote after the number was released that it may "increase concern about the health of the global economic recovery, and slightly dampen risk sentiment" (no worry there, Eminis are actually higher on the news because in this idiot market, the worse things get, the better for the 1%).

Although the data bode ill for the yuan, the historical read-across has been very mild. Non-manufacturing was an absolute shocker at 47.5. This is more than 5 standard deviations below Bloomberg consensus, outside the entire forecast range, and the first sub-50 reading since the first Covid wave. Factory PMI came in at 50.1, just a fraction below forecast. This amplifies a run of generally worse-than-expected data from the PMIs.

Over April-July, the average shortfall was 0.3 points for the manufacturing index, and 0.7 for non-manufacturing. That said, PMIs tend to be taken less seriously than the hard data. It's also possible that the market will look through them given that the slowdown is most likely related to the Covid-19 shock, and the market has a fair degree of confidence in China's ability to manage the virus.

Here will just add that the "market" will not give a rat's ass about the China PMI because the only thing that matters for stonks is how many billions in liquidity will Uncle Jerome inject today.

As for China, many are scratching their heads why Beijing is taking so long to address the sharp slowdown in its economy. But while the latest China credit - and now PMI - data is flashing a bright red alarm light that the global reflationary wave is not only over but is going into reverse, the good news is that anyone harboring any expectation that the PBOC may tighten to frontrun the Fed's tapering or hiking, is now crushed.

Commenti

Posta un commento