There are no two ways about it: the first full year of the year was a lousy one for stocks, with the S&P falling by 1.9% and the Nasdaq tumbling 3.5%, its biggest drop since the year 2000 - the year the dot com bubble popped.

The culprit for the plunge, of course, was the Fed, with the mid-week pivot coinciding with the release of the hawkish December FOMC minutes that hinted at not just a faster liftoff, but an even faster balance sheet drawdown. As a result, banks expect the Fed to hike either three or four times, with some expecting the Fed to announce QT in early H2, and Friday's dismal jobs report which showed just 199K gains (vs. consensus of 450K) did not deter hawkish expectations as the unemployment rate - just a few years ago viewed as a completely meaningless statistic - fell to 3.9%, down 0.3% from 4.2% in November.

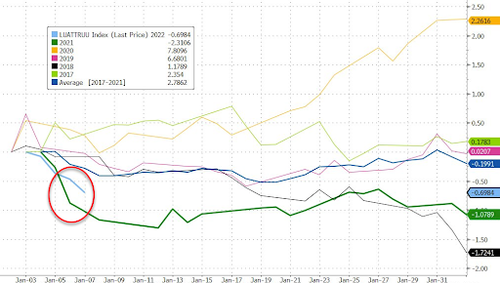

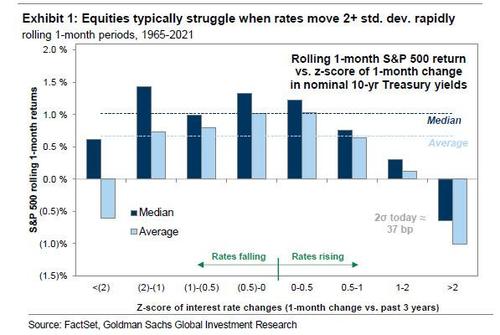

Looking at the price action, Goldman's David Kostin - who is of course, head of research and not an actual trader - points to the rapid move higher in yields catalyzed by the Fed statement, and which surged as high as 1.80% last week before settling around 1.76% after ending 2021 at 1.52%, a 24 bps rise over just 5 days. This is material because as Kostin notes in his latest Weekly Kickstart note, the speed of rate moves matters (perhaps more than the actual move) for equity returns. To wit, "equities typically struggle when the 5-day or 1-month change in nominal or real rates is greater than 2 standard deviations. The magnitude of the recent yield backup qualifies as a 2+ standard deviation event in both cases."

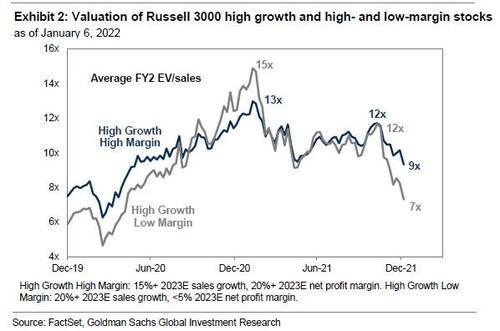

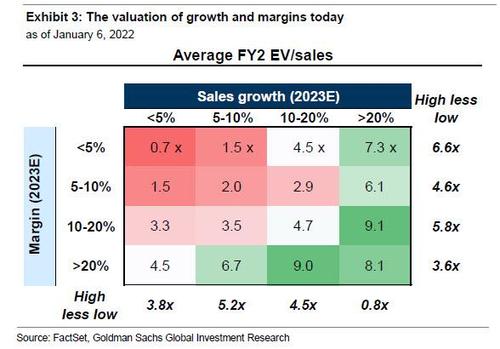

Kostin then notes that the sharp spike in rates was an obvious risk to the premium valuation accorded to the longest duration equities (high growth but low margins), something discussed here extensively. And sure enough, these stocks have been violently re-priced during the past few days, but also past few months

It may not feel like it, but the EV/sales multiple for these stocks has compressed from a peak of 15x in February, to 12x at the start of November, to 7x today. But if the Russell 3000 constituents traded in a well-ordered progression, the relative valuation of these stocks would be wider than the current spread.

With all that in mind, and with one eye trained on macro developments, investors now await the start of 4Q 2021 earnings season that begins next week, when BLK, C, FRC, JPM, and WFC all release their 4Q 2021 results on Friday, January 14.

As Kostin calculates, between January 10 and February 11, companies representing 79% of S&P 500 market cap will report year-end results, and a list of next week's reporters is shown below.

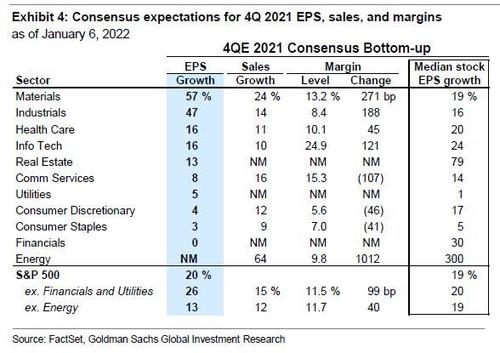

Looking ahead, consensus expects 4Q 2021 S&P 500 EPS will grow by 20% year/year. The growth rate will represent a sharp deceleration from previous quarters that benefited from comparison with the worst quarters of Covid-plagued 2020. In 2021, the sequence of year/year EPS growth was 48% (1Q), 88% (2Q), and 39% (3Q). If the consensus expectation for 4Q is realized, it would represent a step in the direction of normalization towards trend growth. Among the sectors, energy is expected to swing from negative to positive EPS. Materials (+57%), Industrials (+47%), and Health Care (+16%) are forecast to report the highest EPS growth while Financials (0%) and Consumer Staples (+3%) are expected to barely grow earnings vs. 4Q 2020

On the revenue side, consensus expects sales will grow by 15% year/year vs. 17% for the prior quarter. Energy (+64%), Materials (+24%), and Communication Services (+16%) will generate the largest revenue gains. Consumer Staples will lag (+9%).

Net margins are forecast to expand year/year by nearly 100 bps to 11.5% despite soaring inflation, suggesting that all of the input price increases and then some, have been passed on to consumers. On a rolling four-quarter basis margins will equal 12.1%. Note that in 3Q, actual results were 70 bps above analyst forecasts at the start of earnings season. Energy and Materials are anticipated to have the largest margin expansions.

In any case, as companies close their books on 2021, investors and managements are already focused on 2022. Goldman forecasts the S&P 500 will generate 8% EPS growth to $226, slightly below the median top-down forecast but above the consensus bottom-up forecast of $223. At the index level, Kostin and Co. expect sales growth of 9%, and also project a net profit margin of 12.6% which implies 41 bps of expansion and explains the bank's above-consensus EPS forecasts. As Kostin explains, his above-consensus forecast "is driven by a combination of operating leverage, pricing power, and cost management." He also notes that Goldman's expectations differ most from consensus for the Industrials and Utilities sectors, where it projects slower year/year EPS growth, and for the Communication Services, Materials, and Info Tech sectors, where the bank expects more EPS growth than bottom-up estimates.

Putting it all together, investors will focus on three items during 4Q reporting season and into 2022.

1.Threats to growth, especially those posed by Covid variants. The Omicronvariant has introduced new risks to economic activity given its heightenedtransmissibility and drag on reopening. Our economists recently slashed their USgrowth forecasts to 3.5% (from 4.2%), in part due to the effects of Omicron. Each 1pp change in GDP growth translates into roughly $7 of S&P 500 EPS.

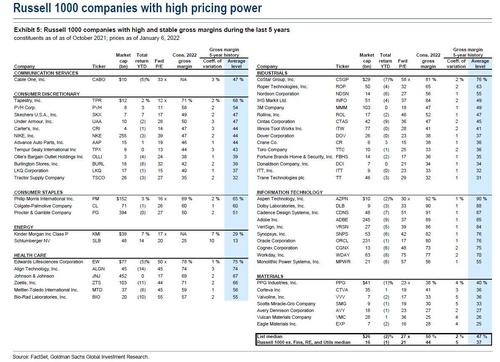

2. Expanding margins will be an uphill battle for companies in 2022, due in part to persistent labor market tightness. In earnings calls as recent as 3Q, managements bemoaned historic worker shortages, particularly for low-wage jobs in the services sector. Goldman economists expect the rapid pace of wage inflation to subside to around 4%, but this could take several quarters to achieve. Today's jobs report showed average hourly earnings rose 4.7% year/year. Firms with high labor costs or exposure to wage inflation will face the most difficulty in preserving margins. Since the beginning of 4Q, companies with high and stable gross marginshad outperformed those with weak and variable margins by 12 pp(+4% vs. -9%), but the trade has slightly reversed in recent weeks. The next chart shows a list of stocks with high and stable gross margins.

One headwind to margin expansion that may soon improve is the resolution of supply chain bottlenecks that plagued firms in 2021 (assuming it doesn't get even worse should China's suffer an Omicron-linked lockdown of its key ports). Managements employed a mixture of price increases and cost controls to offset surging raw materials and shipping prices. Looking ahead, Goldman notes that market measures of supply chain tightness appear to be slowly easing, and shipping costs have begun to decline in recent weeks. We disagree.

3. Finally, the revival and ultimate passage of President Biden's Build Back Better bill would have mixed implications for US equities. Senator Joe Manchin's late-December rejection of the draft legislation ruled out its passage last year. In the event that the legislation is adopted this year, Goldman estimates this tax reform would reduce S&P 500 EPS by 2-3% relative to current tax policy but only go into effect in 2023 at the earliest. By then, however, Dems will no longer have a supermajority in Congress so everything will be in flux.

Commenti

Posta un commento