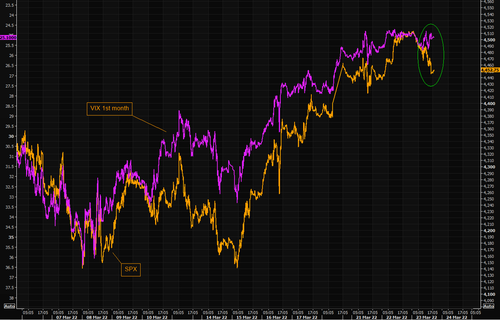

SPX - time to chill?

SPX has squeezed from the low of the range straight up to the high of the range. People still try to push the break out momentum, but there is no trend in SPX to be pushed. Let's see where we go from here, but we are rather overbought; 4500/4520 is a big "congestion" area and short gamma is gone (dealers are sellers of deltas on upticks). Time for SPX to chill for a few days?

Source: Refinitiv

Who is buying this tape right now?

Answer: CTAs ($20b S&P this week), Retail (High Retail Sentiment Basket +578bps...GME +30% and TSLA + 8%), HFs Covers (GS Most Short Basket +376bps) and L/Os back nibbling in China ADRs on heels of BABA $25b buyback (China ADR Basket +823bps) (GS trading desk)

~7% stocks account for over 90% of all gains

Even in the public markets power law dynamics play out. In between 1980 to 2014….~40% of stocks lost money, 64% of stocks underperformed benchmark and ~7% stocks account for over 90% of all gains (Bobby Molavi)

Time to hedge (soon)

GS notes the latest volatility implosion and they suggest one should get involved in hedging. We agree on the vol logic, but we actually think the "new boring" could drag on slightly longer. They write:

"...the past few days' rally, implied volatility has fallen so quickly that by many metrics it is below recent realized volatility. Falling short-dated skew and a lower VVIX also leave hedges more viable. This sets up an attractive entry point for short-dated hedges, especially if the alternative to hedging is reducing the size of long positions."

Short term options are relatively cheap while longer dated options remains rather rich.

Source: GS

VIX isn't getting excited

The short term gap between SPX and VIX is once again widening. VIX seems to think this market needs some "boring time" going forward. Spoos vs VIX 1st mth inverted.

Source: Refinitiv

TLT - THE reversal?

Earlier today we sent our thematic email on the possible reversal in yields (premium subs only). TLT managed putting in a huge hammer candle (weekly) right on some major support levels. RSI is very oversold and TLT "VIX", VXTLT, is rather elevated. For the ones looking for rates to take a pause/move lower, using elevated VXTLT with directional bias offers interesting set ups. Do you dare selling some downside puts in TLT, or buying deltas and overwriting later using elevated vols?

Source: Refinitiv

Source: Refinitiv

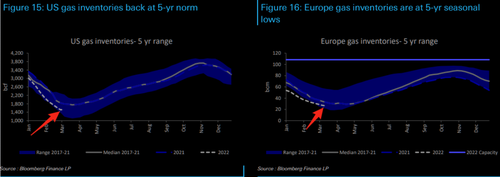

Gas inventories - what is normal?

Europe remains the biggest sucker, but as DB writes:"The answer is simply that gas spot and forward price are far too volatile to sensibly use the latest peak prices - for all we know the Ukraine situation could de-risk next week and curves could fall swiftly back to pre-invasion levels( and still be 3.5x higher than 'normal')"

Source: DB

Gold - did you miss it the first time?

Gold has consolidated over the past weeks, but note it is trying to build some sort of a base around the break out level. Gold volatility, GVZ, has fallen a lot since recent highs. On March 10 we outlined our most recent logic on gold (premium email subs) and we wrote; "Gold needs to consolidate before anything meaningful can occur again according to us. If you are running "must be longs" here but think we are due for a consolidation, we see overwriting as interesting set ups. Gold volatility has exploded higher and offers great yield enhancement plays." Let's see if gold catches some bids going forward, but GVZ remains elevated and has so far offered great yield enhancement. If you missed the violent move higher, maybe there is a second chance, but the set up is far from clear this time around...

Source: Refinitiv

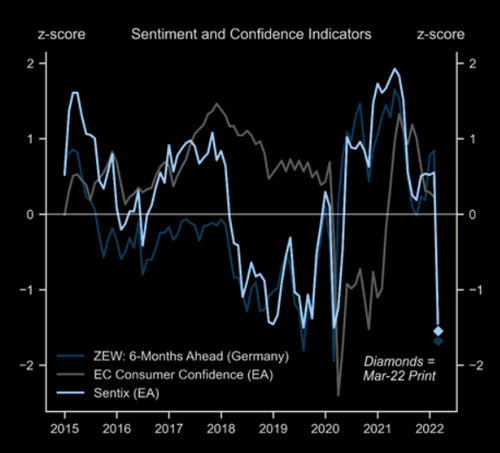

European worries

Goldman: "we look for a substantial hit from the war in Ukraine from tighter financial conditions, weaker confidence and higher energy prices. While some of the initial tightening in financial conditions has eased more recently, the early-March surveys point to a substantial weakening in sentiment. Looking ahead, we will closely monitor the incoming business and consumer confidence surveys"

Source: Goldman

Brazil's commodities connection

It wasn't long ago Brazil was under performing the "commodities" logic, but lately things have gone the inverse way. Brazil remains a huge commodities/oil play, but is the samba getting a little ahead of itself?

Commenti

Posta un commento