Stock Volatility Isn't Dead. It's Just Got Freakish and Extreme

HSBC, Goldman Sachs warn on vol-of-vol risk amid illiquidity

Beneath the calm in global stocks lies a brittle market prone to violent spasms.

As central banks snuff out market fears for now and the brewing melt-up banishes memories of last year's meltdown, the threat of brief but extreme price swings looms over fast-money traders.

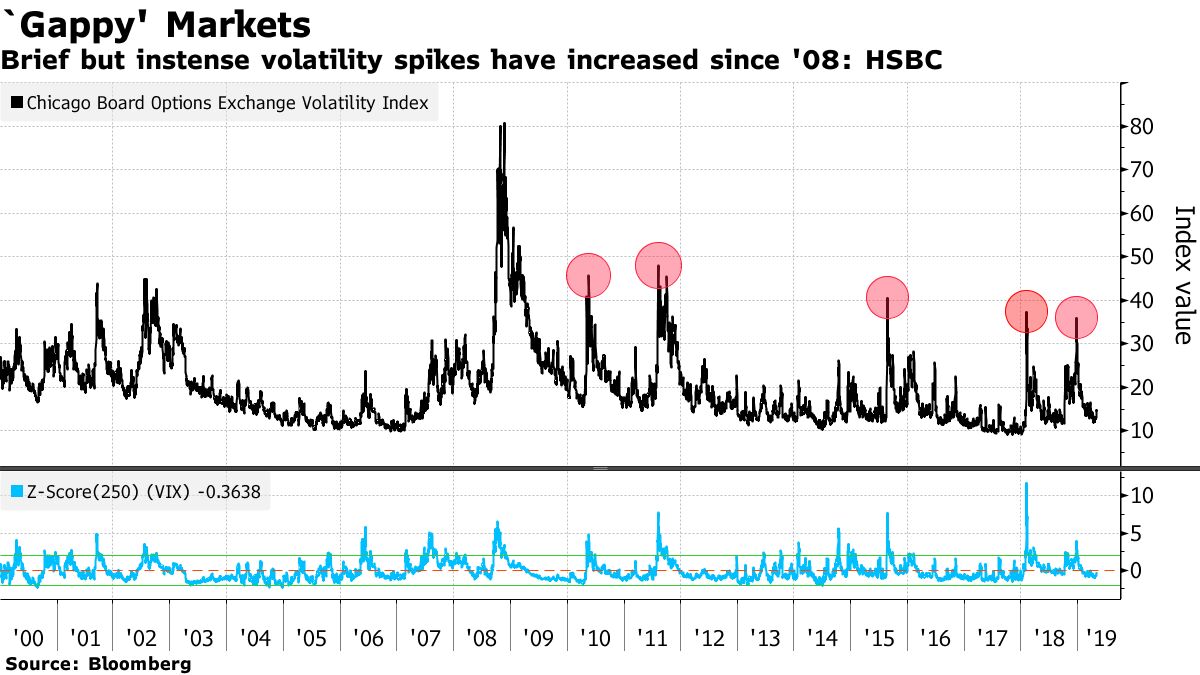

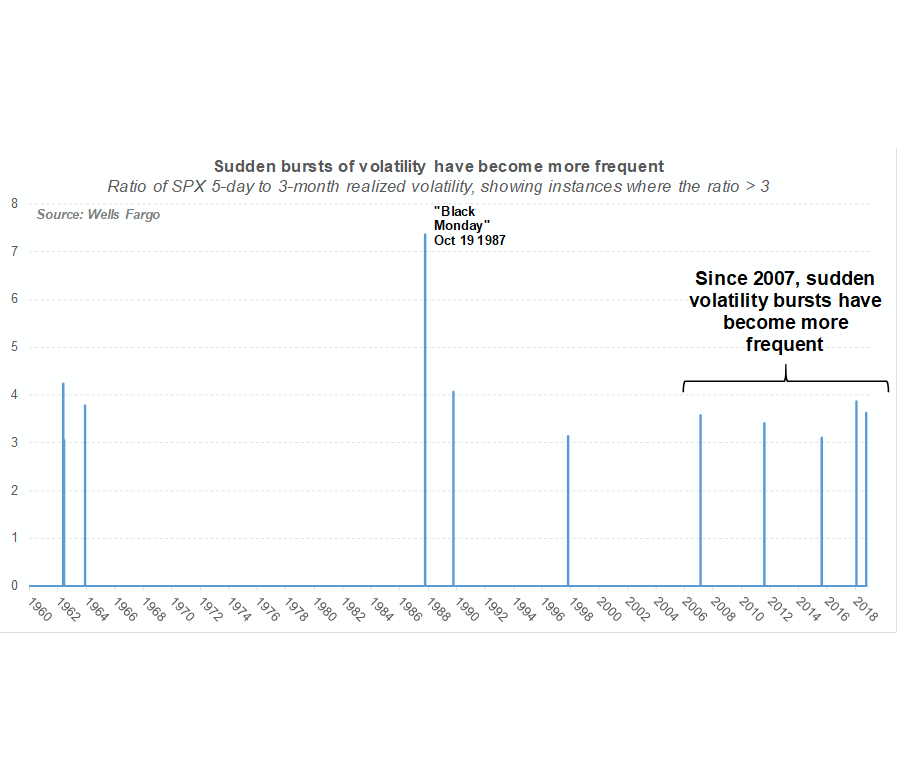

In financial parlance, gap risk -- sudden moves with little trading in between -- is growing, according to HSBC Holdings Plc.

Blame robots and electronic market-makers for creating an illusion of liquidity that can vanish on a dime. Post-crisis regulation, or the boom in volatility-sensitive investing.

Whatever the reason, the likes of Goldman Sachs Group Inc. warn hot-money flows from systematic traders may awaken volatility from its slumber, as hedge funds double down on bets the tranquility will endure.

"Volatility has become more volatile," Mark Spitznagel, founder of hedge fund Universa Investments LP, said in an interview in London. "It's incredible that after what happened in February 2018 and in the fourth quarter, so soon after that we're hitting new lows in implied volatility."

Limited macro threats thanks to dovish central banks and stable inflation expectations are capping lasting volatility for now. But it's an unstable peace, as convulsions like last February and December laid bare.

It's all feeding into fears that the hot money could beat a retreat in an unloved rally bereft of buy-and-hold flows. And it's a big risk for volatility sellers, in particular those with a propensity for levered bets with muted hedging.

As realized vol declines and equities trend higher, the stars are aligning for systematic traders to add more money to stocks -- potentially raising the risk of a volatility event if sentiment suddenly swings.

A Nomura Holdings Inc. model shows commodity-trading advisers and algos are scooping up equities, while volatility-targeting funds are risk-on.

Goldman Sachs, for one, gives reason for caution.

"Vol of vol is likely to remain high as procyclical investors such as CTAs, vol target and risk parity as well as option hedging have again been a key driver of demand for risky assets year-to-date," strategists led by Christian Mueller-Glissmann wrote in a note this week. "A trend reversal, e.g. due to a macro shock, could drive a material unwind of positioning."

Hot Money

Systematic selling tends to have an outsized impact these days given weaker liquidity.

JPMorgan quant strategist Marko Kolanovic has highlighted the relationship between trading in S&P 500 futures and the VIX. As the volatility gauge rises, the number of equity contracts that an investor can expect to trade without moving the market diminishes at an exponential rate.

Increased demand for calls from investors playing rally catch-up could also cause risks. Dealers that are "short gamma" from these trades would be forced to sell in a downturn, exacerbating losses, according to Goldman.

The good news: Exchange-traded products that contributed last year to ebbs and flows in implied volatility have gone bust. And institutional sellers of options -- who typically don't vanish in the grip of unrest -- are on the rise.

But in these complex markets, nothing can be taken for granted.

Just a modest two-day S&P 500 decline this week, for example, spurred "demand for 'tail risk' hedges to jump precipitously," Charlie McElligott, Nomura strategist, wrote in an email -- a sign of febrile sentiment in the market calm.

— With assistance by Joanna Ossing

Commenti

Posta un commento