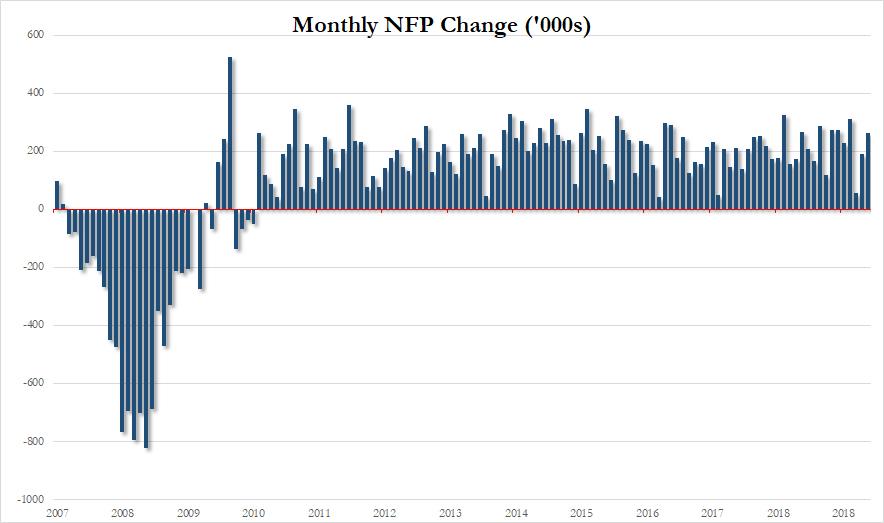

While overall expectations for the April payrolls number were generally in line, the "whisper" was for some weakness below the 190K consensus as a result of delayed census hiring. However, it was just not meant to be as the US job market juggernaut continues to accelerate, and moments ago the BLS reported that in April the US economy added another 263K, smashing expectations of a 190K print, and well above both the March (189K) and February (56K) prints. The April print was well above the average monthly gain of 213,000 over the prior 12 months.

Payrolls were highlighted by strength in construction (+33,000), professional and business services (+76,000), education and health services (+62,000); weak spots include manufacturing (+4,000) and retail (-12,000), the third straight decline.

The change in total nonfarm payroll employment for February was revised up from +33,000 to +56,000, and the change for March was revised down from +196,000 to +189,000. With these revisions, employment gains in February and March combined were 16,000 more than previously reported. After revisions, job gains have averaged 169,000 per month over the last 3 months.

While overall payrolls were scorching, the goldilocks picture continued, as Average hourly earnings rose "only" 0.2% from the prior month, and 3.2% from a year earlier - once again these figures were below forecasts and the same as March's readings, however it is worth noting that wages for production and nonsupervisory workers accelerated to a 3.4% gain from 3.3%, signaling gains for lower-paid employees.

As Bloomberg notes, wage growth was led by lower-paid employees - those in production and non-supervisory roles. What is more concerning, and suggests that the real hourly earnings number would be even worse, is that the average workweek actually declined from 34.5 to 34.4, indicating that average comp would be even lower if hours worked was unchanged.

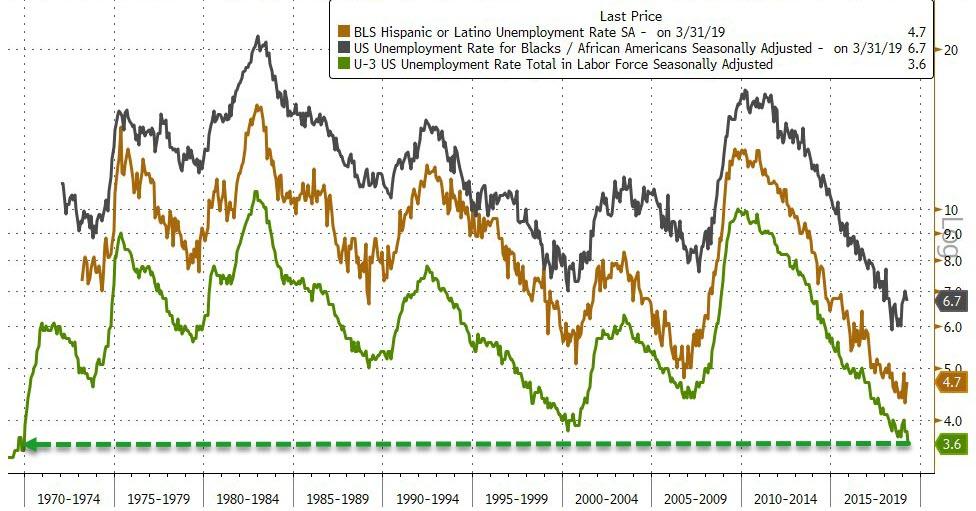

While of secondary importance, the jobless rate fell to a new 49-year low of 3.6% (or 3.585% to be precise), down from 3.811% last month, though that was partly due to another drop in the size of the labor force; the household survey showed the employed fell by 103,000, the unemployed fell by 387,000, and the overall labor force shrank by 490K to 162.47 million.

Also of note, and a key point that Trump will be making shortly is that Hispanic unemployment dropped to a record low.

As noted above, with the labor force tumbling, the labor force participation rate unexpectedly dropped back to the lowest level since the 1960s, sliding from 63.0% to 62.8%.

Some more details:

Professional and business services added 76,000 jobs in April. Within the industry, employment gains occurred in administrative and support services (+53,000) and in computer systems design and related services (+14,000). Over the past 12 months, professional and business services has added 535,000 jobs.

- In April, construction employment rose by 33,000, with gains in nonresidential specialty trade contractors (+22,000) and in heavy and civil engineering construction (+10,000). Construction has added 256,000 jobs over the past 12 months.

- Employment in health care grew by 27,000 in April and 404,000 over the past 12 months. In April, job growth occurred in ambulatory health care services (+17,000), hospitals (+8,000), and community care facilities for the elderly (+7,000).

- Social assistance added 26,000 jobs over the month, with all of the gain in individual and family services.

- Financial activities employment continued to trend up in April (+12,000). The industry has added 110,000 jobs over the past 12 months, with almost three- fourths of the growth in real estate and rental and leasing.

- Manufacturing employment changed little for the third month in a row (+4,000 in April). In the 12 months prior to February, the industry had added an average of 22,000 jobs per month.

- Employment in retail trade changed little in April (-12,000). Job losses occurred in general merchandise stores (-9,000), while motor vehicle and parts dealers added 8,000 jobs.

- Employment in other major industries, including mining, wholesale trade, transportation and warehousing, information, leisure and hospitality, and government, showed little change over the month.

In summary, it looks like another "meh (or bad) news is good news" report, because while jobs came in stronger than expected, the "goldilocks" aspect of today's report was the weaker than expected hourly earnings, which would have been even lower if average workweek had not dipped. Predictably, stocks found whatever narrative suits them best, and rose while both the dollar and 10Y yields kneejerked higher initially before sliding lower.

Commenti

Posta un commento