US equity futures and Treasury yields are trading higher this morning following yesterday's tech wreck and bond buyathon but relative strength signals are flashing warning signs that the risk of reversion looms large...

Treasury yields are 'most oversold' (bonds most overbought) in 21 years...

And stocks are most oversold since the December lows...

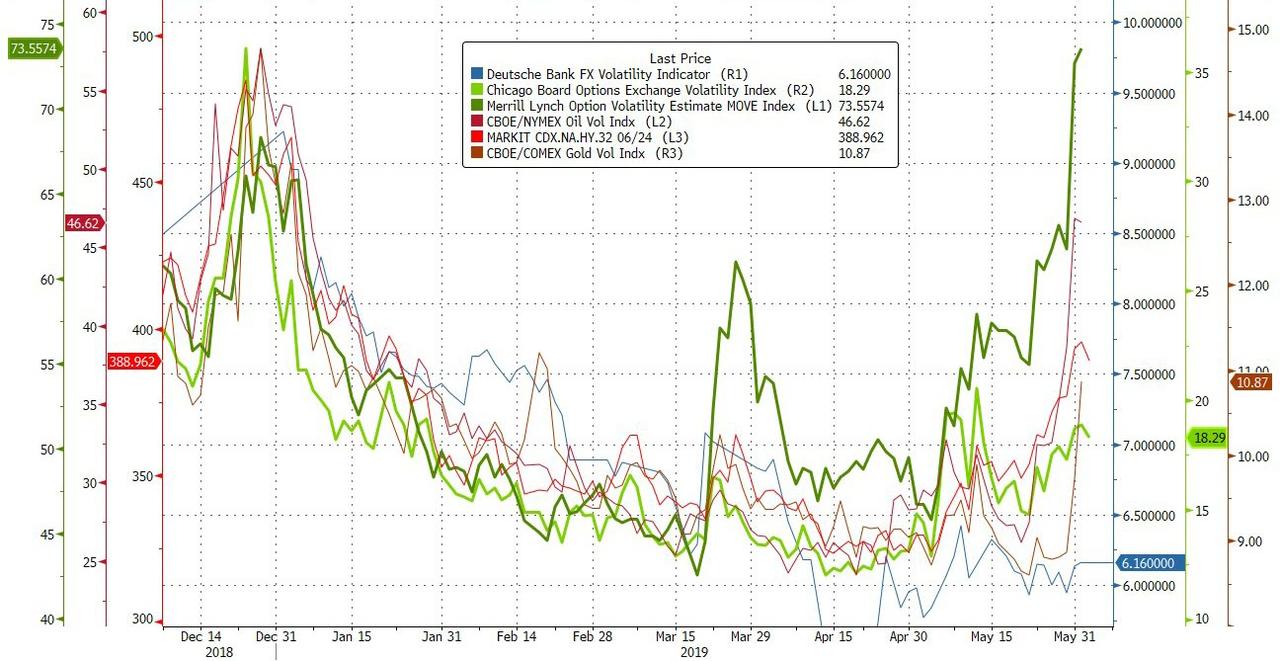

We also note that bond vol is exploding higher as equity vol remains calm (and FX vol is dead)...

We suspect the real canary in the coalmine for a bounce will be HY credit which has been the high-beta horror of this latest collapse...

And has the 'correction' run its course as liquidity is re-injected to save the world?

So which is it? Beware the bounce or buy the dip?

Commenti

Posta un commento