The current boom is heavily built on credit. This is because in today's fiat money regime central banks, in close cooperation with commercial banks, increase the quantity of money by extending loans – loans that are not backed by 'real savings'. The artificial increase in the supply of credit pushes market interest rates downwards – that is, below the levels that would prevail had there been no artificial increase in bank credit supply.

As a result, savings decline, consumption increases and, investment takes off, and a "boom" gets going. However, such a boom can only last so long. Its continuation rests on more and more credit being fed into the system, provided at ever lower interest rates. The last ten years provide a good illustration: The Fed's lowering of interest rates and monetary expansion in the financial and economic crisis 2008/2009 has helped the banking industry to get back to its business of churning out more and more credit (see chart a).

As credit recovered, and stock and housing prices began to rise again (see chart b). The Fed succeeded in re-establishing the 'asset price inflation regime'. In December 2015, however, the monetary policy makers in Washington D. C. decided to take away the punch bowl by beginning to raise interest rates. Until December 2018, the Fed had brought back the Federal Funds Rate to a band of between 2.25 to 2.5 per cent. Where to go from here?

The Fed has signaled recently that it wants to take a break as far as any further interest rate decisions are concerned. Financial markets have their own view, though: They seem to expect that the Fed's hiking cycle is already over, and that the central bank will sooner or later lower interest rates again. The likelihood that this expectation will turn out to be correct is quite high: As the Fed wishes to keep the boom going, it has no choice but to return to the policy of suppressing interest rates.

Optimism Runs High

Financial markets are optimistic that the Fed will succeed in preventing the boom from turning into yet another bust. Indeed, if the central bank effectively keeps the lid on market interest rates, the boom may well go on for somewhat longer – for it typically takes a rise in market interest rates and/or a restriction of credit to turn the boom into bust. Against this backdrop it might not be too surprising that investors have become quite unconcerned that something could go terribly wrong.

To be sure: The current boom causes problems. If the market interest rate is artificially suppressed, people save less and consume more out of their incomes – compared to a situation in which the market interest rate had not been artificially lowered. In addition, firms invest in projects that had not been undertaken had the market interest rate not been manipulated downward. In other words: The artificially lowered market interest rate leads an unsustainable production and employment structure.

A boom can go on longer than people expect. If, for instance, firms come up with productivity gains, the overall economy's debt sustainability will be improved, and the boom will be prolonged. A necessary condition for the boom is, however, that the interest rate is pushed to ever lower levels, and credit and money keep flowing into the system. The logical end of such a monetary policy is a situation in which the market interest rate is basically pushed down to zero. However, what would happen then?

Toward Zero Interest Rates

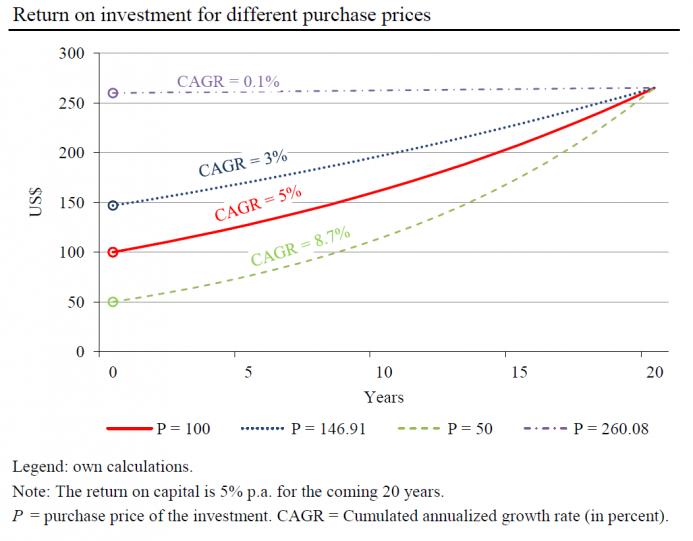

A simple example might help to answer the question. Assume there is a publicly traded firm. It has a return on capital of 5% per annum for the coming 20 years. If you buy the stock for 100 US$, your return on investment will be 5% p.a. If you buy the firm for, say, 50 US$ (just when there is panic in the market), your return on investment would be higher, in this case it 8.7% p.a. The message from these numbers should be pretty obvious: The lower the purchasing price is, the higher is the return on investment.

Let us assume that the market interest rate is 5% p.a., and your stock trades at 100 US$. Then, financial markets expect the market interest rate to decline to, say, around 3% p.a. In this case the firm's stock price would move up to 146.91 US$ (other things being equal). This price increase would give you with a gain of close to 47% – very nice to have! However, anyone purchasing the stock at the already elevated price would just earn 3% p.a. in the years to come.

What would happen if market agents expect the interest rate to drop further to, say, 0.10%? The stock price would move up even further, reaching 260.08 US$, thus giving you another one-off gain of 77.03% [(260.08 / 146.91 – 1) * 100]. Once the stock price has gone up to this level, however, any investor purchasing the stock at that price level will make just 0.10% p.a. for the remaining 20 years. Against this backdrop we may now understand where central banks' lowering of interest rates will lead to.

It exerts a tendency of dragging all returns in the economy down and towards the market interest rate as determined by the central bank – which is, of course, at an artificially suppressed level. In theory this process manifests itself as a bloating up of asset prices – not only affecting the prices of stocks, but also the prices of government and corporate bonds, real estate, land and commodities (which are priced according to their discounted marginal value product). However, this is not the end of the story.

A Ruinous Monetary Policy

If interest rates and returns hit rock bottom, people have little reason to save, and investors little incentive to invest. Consumption increases at the expense of savings, and capital consumption sets in. Existing capital will be used up and not replaced. It might take a while for people to find out that a central bank monetary policy that pushes the interest rate to ever lower levels does not bring prosperity but is very damaging, even ruinous, for the future prosperity of the commonweal.

Once investors realize that the economy is losing its strength, elevated asset prices, previously driven up by an ultra-low interest rate, will come crashing down. In the case of stocks, for instance, profit expectations are scaled back, and a downward adjustment of stock prices sets in. Falling asset prices in general would hit hard consumers' and corporates' balance sheets. Their equity positions and credit standing deteriorate. Malinvestment comes to the surface, and the boom is finally turning into bust.

The lesson to learn is this: The monetary policy of ever lower interest rate is not the solution to problems caused by a low interest rate policy in the first place. In the short-term it might look promising, but it is a way towards economic destruction. The longer the boom is kept going by central banks' ultra-low interest rate policy, the bigger will be the ensuing crisis – as the economists of the Austrian School of Economics have pointed out in great detail a long time ago. Murray N. Rothbard put it succinctly:

"It is only when bank credit expansion must finally stop or sharply slow down, either because the banks are getting shaky or because the public is getting restive at the continuing inflation, that retribution finally catches up with the boom. As soon as credit expansion stops, the piper must be paid, and the inevitable readjustments must liquidate the unsound over-investments of the boom and redirect the economy more toward consumer goods production. And, of course, the longer the boom is kept going, the greater the malinvestments that must be liquidated, and the more harrowing the readjustments that must be made."

There should be little doubt that the current boom will ultimately get what is coming for it.

Commenti

Posta un commento