Existing Home Sales Tumble YoY For 15th Month - Worst Run Since Housing Crisis

After April's disappointing drop in all segments of the home-sales data, existing home sales were expected to rebound (again) in May and surprised modestly to the upside.

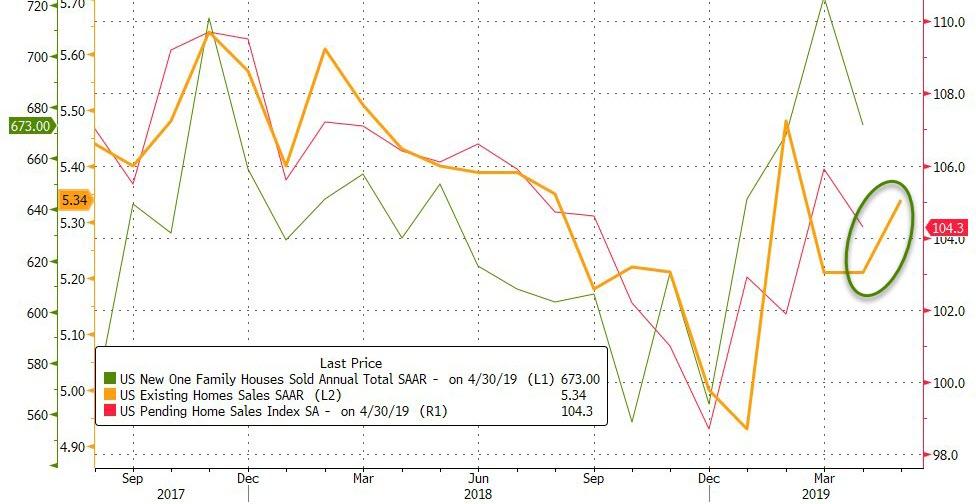

Existing home sales rose 2.5% MoM to 5.34mm in May (and saw a modest upward revision in April)

However, existing home sales have declined on a YoY basis for 15 straight months...

Home purchases advanced across all four regions, led by a 4.7% rise in the Northeast.

First time buyers accounted for 32% of sales nationally, unchanged from the prior month.

Finally, we note that the recent drop in existing home sales suggests a lagged response in mortgage purchase applications... even with rates collapsing...

As lower rates have apparently sparked a surge in prices as median home prices to a new record $277,700 - with a 4.8% YoY surge - the biggest spike since Aug 2018.

"The purchasing power to buy a home has been bolstered by falling mortgage rates, and buyers are responding," NAR Chief Economist Lawrence Yun said in a statement.

As Bloomberg notes, recent housing data have offered a mixed picture on the market, with housing starts falling from an April reading that was stronger than initially reported. Homebuilder sentiment deteriorated in June for the first time this year while permits gained, signaling a more robust pipeline of properties.

Inviato da iPad

Commenti

Posta un commento