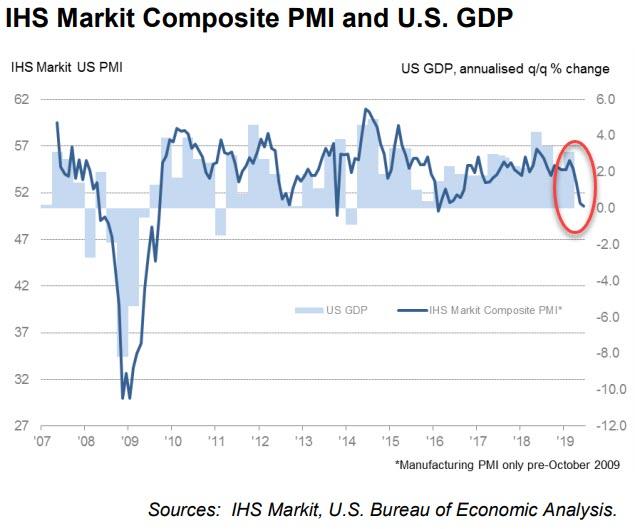

US Manufacturing PMI Plunges To 10-Year Lows, Services 'Hope' Lowest On Record

Following (slightly) better-than-expected European PMIs, expectations for US PMIs was for some stabilization after May's collapse but they did not.

Both preliminary Manufacturing and Services PMIs for June dropped further, edging closer to contraction:

Flash U.S. Composite Output Index at 50.6 (50.9 in May). 40-month low.

-

Flash U.S. Services Business Activity Index at 50.7 (50.9 in May). 40-month low.

-

Flash U.S. Services PMI Business expectations fall to 57.8 - the lowest reading on record

-

Flash U.S. Manufacturing PMI at 50.1 (50.5 in May). 117-month low.

-

Flash U.S. Manufacturing Output Index at 50.2 (50.7 in May). 37-month low.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

"Recent months have seen a manufacturing-led downturn increasingly infect the service sector. The strong services economy seen earlier in the year has buckled to show barely any expansion in June, recording the second-weakest monthly growth since the global financial crisis.

"Business optimism has also become more subdued, with sentiment about the year ahead down to a new series low amid intensifying worries about tariffs, geopolitical risk and slower economic growth in the months ahead.

"The labor market is also showing signs of weakening. The survey data for June indicate nonfarm payroll growth of 140k,averageing 150k in the second quarter after a 200k signal for the first three months of the year .

"Prices for goods and services meanwhile rose at a slightly increased rate in June, mainly due to tariffs. To illustrate, some two-thirds of all manufacturers attributed some or all of their raw material cost increases to tariffs during the month. However, the inflationary impact of tariffs was offset by a broader softening of demand, which reduced suppliers' pricing power. The overall rate of input cost inflation in manufacturing eased to a two-year low, while average selling prices for goods and services showed one of the smallest rises seen since late2016."

Finally, Williamson notes:

"Business activity edged closer to stagnation in June, expanding at the slowest rate since February 2016 and rounding off a second quarter in which the survey data point to the pace of economic expansion slipping to 1.4%.

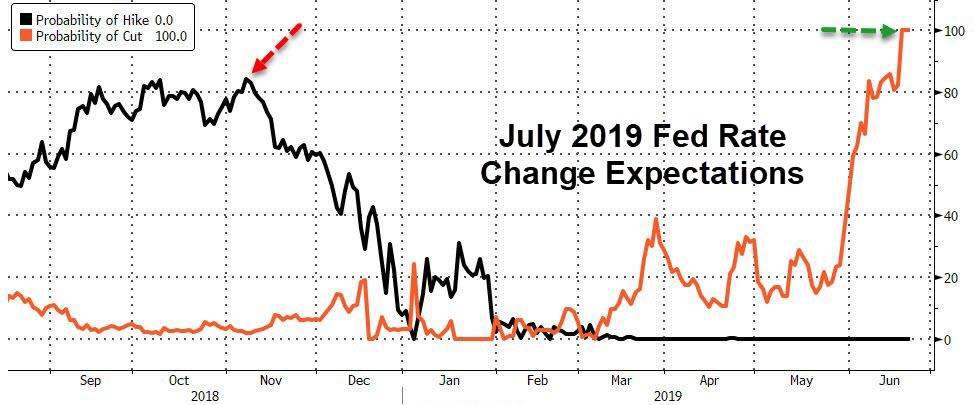

So, 50bps rate cut in July?

Commenti

Posta un commento