The American Farm Bureau (AFB) warned Wednesday that farm bankruptcies are entering a parabolic move.

The farm crisis, as we've pointed out, is only accelerating and will likely be on par with the farm disaster that was seen in the early 1980s.

President Trump's farm bailouts, given to farmers earlier this year, appears to be failing at this moment in time, as a tsunami in farm bankruptcies is sweeping across the country.

With record-high debt, collapsing farm income, and depressed commodity prices, US farmers are dropping like flies as there's no end in sight in the 15-month long trade war.

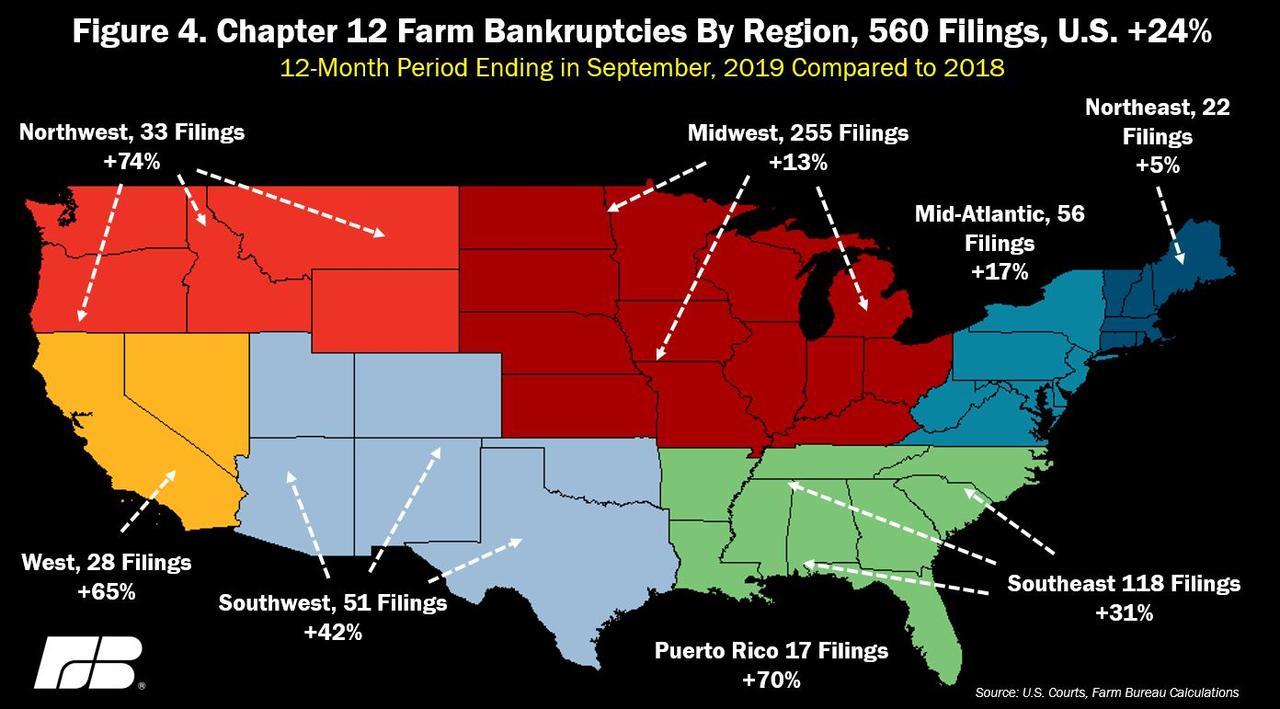

AFB said farm bankruptcies for the 12 months ending in September, totaled an astonishing 580 filings, up 24% YoY.

The number of Chapter 12 farm bankruptcies [580 filings] for the period was the highest since 676 filings were recorded in 2011. For 3Q19, farm bankruptcies were slightly lower, down 2% YoY.

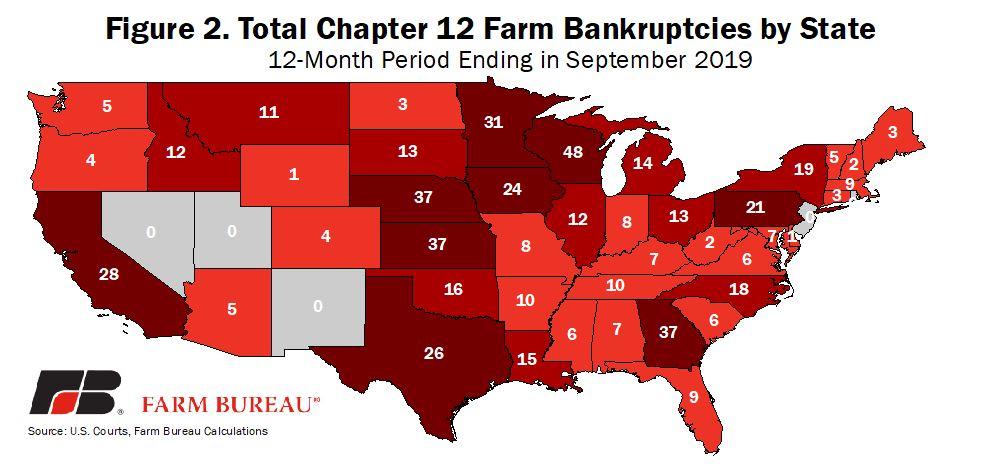

"Total bankruptcies filed by state vary significantly, from no bankruptcies in some states to more than 20 filings in others. Bankruptcy filings were the highest in Wisconsin at 48 filings, followed by 37 filings in Georgia, Nebraska, and Kansas. Iowa, Kansas, Maryland, Minnesota, Nebraska, New Hampshire, South Dakota, Wisconsin, and West Virginia all experienced Chapter 12 bankruptcy filings at or above 10-year highs," AFB wrote.

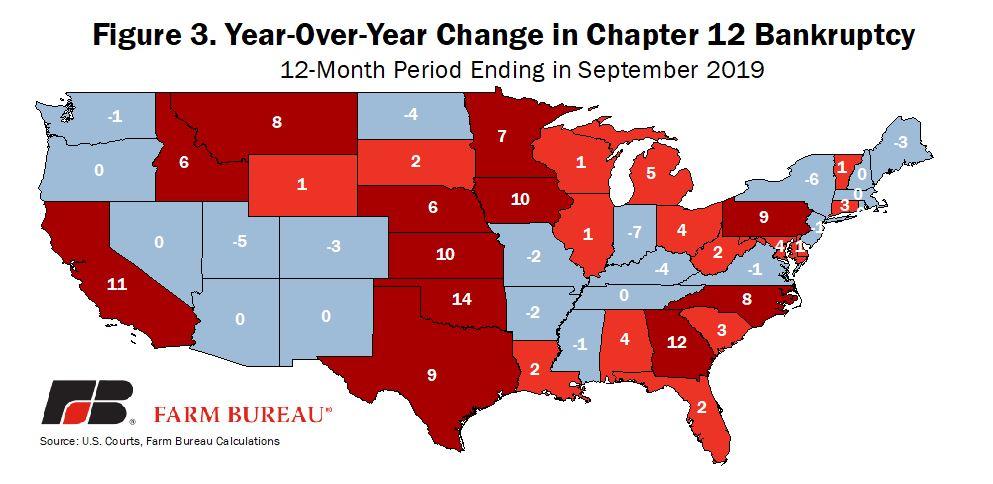

AFB's next chart is YoY change in farm bankruptcies over the 12 months, which shows bankruptcies accelerated the greatest in Oklahoma, Georgia, California, Iowa, and Kansas.

The next chart from AFB outlines how bankruptcy filings over the previous 12 months ending in September, jumped in every major region across the country. Some of the most significant increases were seen in the Midwest, up 40% over the period.

Chapter 12 farm bankruptcies are expected to increase through the next several quarters. This could be problematic to President Trump as the 2020 election year begins. Many of the bankruptcies are occurring in election battleground states like Wisconsin.

Commenti

Posta un commento