But the adage is holding true in the bond market, according to Bloomberg, where quants are now striking it rich with the ability to code. The bond market is getting "wired up by systematic players" and firms are scrambling to scoop up the best talent.

Hedge funds are stealing each others' talent and trying to entice employees with robust compensation packages. For instance, credit-quant clients at Selby Jennings in London are offering annual compensation of $400,000 to a Ph.D. graduate with five years' experience as a desk strategist.

Ex-Citadel head of quantitative research for global credit Frederic Boyer had no issue finding work, either, after being recruited to Chicago-based Jump Trading, as the HFT firm seeks to move into the bond market. (Note: we highlighted Jump Trading's war over the best real estate for high frequency trading in Chicago in a past piece here).

And Hugh Willis, co-founder of BlueBay Asset Management, is now starting a systematic debt investment firm in London. More than 70% of the new firm's staff are able to code. A quant arm of the $113 billion hedge fund called Man Numeric started a corporate debt group last year.

Man Numeric's Robert Lam, who leads the quantitative credit group with Paul Kamenski, said:

"The pool of candidates is vanishingly small."

"Building a solid team is a very difficult task. It takes a lot of hard work to get the expertise on the systematic strategies side, as well as be an expert in credit markets," Kamenski added.

His team members are trained in machine learning, engineering, computer science and econometrics.

Andrew Das Sarma was recently hired by Jump from Citadel where he focused on convertible arbitrage and systematic credit strategies. He has a master's degree in Applied Mathematics and a bachelor's in Physics from Harvard University.

Recruiter Options Group reports that interviews for these types of credit quant positions are up by 25% from a year ago.

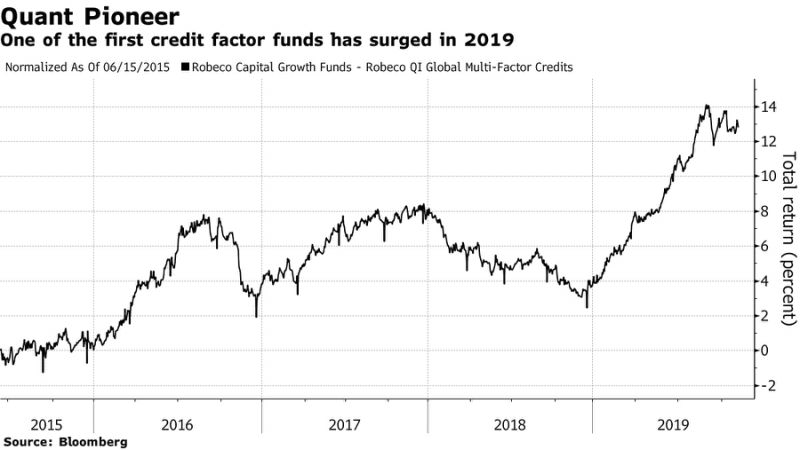

Robeco's offices in Rotterdam houses PhD graduates from nearby Erasmus University. Portfolio manager Patrick Houweling says:

"They're able to take empirical data, program a backtest and analyze the results and make sense of them."

At the firm, fundamental traders do things like watch Mario Draghi's press conferences. The quants are nowhere to be found.

"There's no Draghi on TV screens where the quant researchers sit," Houweling says. Instead, "a proprietary software program dubbed COBRA hums along each night, delivering an email to portfolio managers in the morning, recommending allocations."

"It's less straightforward than equity research. It requires much more attention to detail," he says. At the fund, humans only intervene in about 5% of the model's investment decisions. "You need the quant skills and you need the fixed-income

skills. If you're not a fixed-income expert, you may miss out on a lot of these bond-specific things which are simply not there in stocks."

About 70% of institutional and 78% of wholesale investors believe the strategy of factor-based investing can work in fixed income - especially with "factor investing" in equities misfiring of late.

Luke Williams, partner at London-based recruitment firm Lascaux Partners Ltd said: "There's been an intensification of interest and

willingness to put money on the table in the past 18 months. Credit has emerged as a stand-alone business in the systemic investing world."

Recall, it was just days ago that we wrote about JP Morgan giving its coders licenses to trade equities.

The bank got regulatory approvals this month for two of its coders in London and New York to trade cash equities. JP Morgan is targeting eight more licenses for coders, globally, by the end of the year.

Commenti

Posta un commento