Rarely has failure been celebrated so much. But it is of little wonder, after all as all asset classes rose in 2019 in spite of slowing growth and flat to declining earnings. In religious debates the question is often asked: Why is there something instead of nothing? In financial markets the corollary question may be easier to answer: Why are markets higher on nothing? The answer of course being primarily: Central bank liquidity.

We've discussed the unholy alliance and central bankers being trapped at length, but there is a much more sinister truth lurking beneath, one of system failure suggesting things are not anywhere near as rosy as they may appear.

Indeed, the evidence increasingly suggests the Fed, desperate to fix a leak in the hull, is lightening the whole ship on fire in the process by blowing a historic asset bubble setting markets up to fail and on course for a massive reversion.

Why system failure?

Because 2019 has revealed a fundamental truth: Central banks can't extract themselves from the monstrosity they have created and made markets dependent upon.

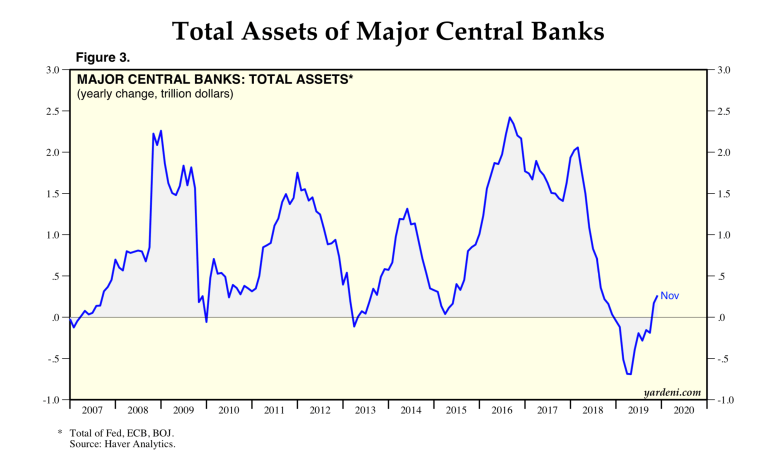

2018 was the only year since the financial crisis that central banks reduced liquidity on a net basis and it blew up in everybody's face:

All previous moves to neutral resulted in more intervention with the most aggressive move occurring on the heels of the 2015/2016 earnings recession.

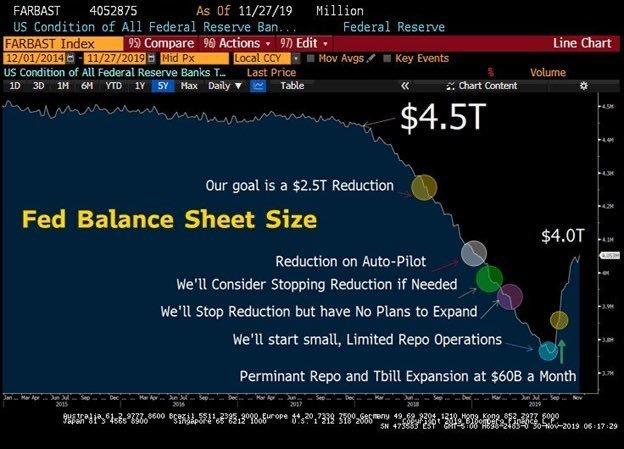

In 2018 the Fed moved to finally reduce the size of its balance sheet. It failed miserably. In fact the sequence of communications and actions by the Fed in the past year reveals another fundamental truth: Nothing the Fed says can be trusted, none of their communications have any predictive meaning whatsoever.:

I'll give you a basic timeline:

July 11, 2018, the St Louis Fed gives everyone a primer on Fed balance sheet reduction:"The Fed has always viewed the remaining increase as temporary, with an eye toward shrinking, or "unwinding," the balance sheet once economic recovery was complete. The Fed's long-term plan was to gradually end both policies: aka, normalizing monetary policy."

Oh yea, normalization, unwinding. Fighting words. But that's what they promised all along.

The fighting words lasted until mid December 2018.

December 19, 2018: "The Fed currently is allowing $50 billion a month to run off the balance sheet, which is largely a portfolio of bonds the central bank purchased to stimulate the economy during and after the financial crisis. Powell said the process is going well. "I think that the runoff of the balance sheet has been smooth and has served its purpose," he said during a news conference. "I don't see us changing that."

Ha ha. Markets were collapsing and only a few days later Powell switched course:

January 4, 2019: "We don't believe that our issuance is an important part of the story of the market turbulence that began in the fourth quarter of last year. But, I'll say again, if we reached a different conclusion, we wouldn't hesitate to make a change," he said. "If we came to the view that the balance sheet normalization plan — or any other aspect of normalization — was part of the problem, we wouldn't hesitate to make a change."

Suddenly he's flexible. This is what markets wanted to hear, an admittance that the Fed's normalization was causing "market turbulence" and stocks soared over 3.5% in just one day on that statement and it marked the beginning of Jay Powell being the market bottom trigger throughout all of 2019.

In March a further rally was prompted when the Fed announced it would end the balance sheet run-off.

March 8, 2019: "The Committee is now well along in our discussions of a plan to conclude balance sheet runoff later this year. Once balance sheet runoff ends, we may, if appropriate, hold the size of the balance sheet constant for a time to allow reserves to very gradually decline to the desired level as other liabilities, such as currency, increase."

We'll end QT and then keep the balance sheet constant for a time. Sure. But that's what markets wanted to hear, and this is what markets got.

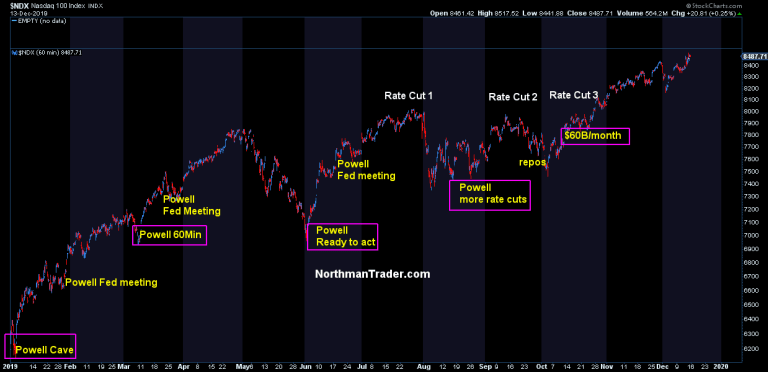

Then it was the rate cut carrots that kept markets propelling higher, and this carrot was brought forth every single time markets got in trouble, in May and in August, but then something odd happened. The actual rate cuts announcements were sold. Both the July and September rate cuts were sold prompting the need for ever more aggressive actions and successively more so.

The trigger? The September 16 overnight funding crisis which prompted overnight rates to spike dramatically forcing the Fed to intervene. The leak in the hull.

And now watch the communications and actions, first it was "temporary", then morphing into ever more aggressive course of actions:

September 20, 2019: 'The Federal Reserve will keep pumping cash into a vital but obscure corner of U.S. financial markets in coming weeks.

The New York Federal Reserve Bank, which handles the central bank's interactions with financial markets, said Friday that it will offer daily repurchase, or "repo," operations of at least $75 billion through Oct. 10. The aim is to maintain the Fed's key policy rate within its target range. Officials say this week's spike in rates is not a precursor of the type of underlying troubles that preceded the 2008 market meltdown. The Fed began conducting these operations to calm money markets. Rates on short-term repo agreements had briefly spiked to nearly 10% earlier this week as financial firms scrambled to find short-term funding."

To calm markets. It didn't last long. More action was required and in October the Fed went wild:

October 8, 2019: "Powell says the Fed will start expanding its balance sheet 'soon' in response to funding issues. "This is not QE. In no sense is this QE".

Sure.

October 11, 2019: "The Federal Reserve is poised to begin at least a six-month operation to buy about $60bn of Treasury bills per month, as the US central bank seeks to ease cash shortages that caused a recent spike in the overnight cost of borrowing.

The announcement on Friday sent three-month bill yields sharply lower, dropping from a high of 1.7 per cent to a low of 1.62 per cent. The size of the operation shocked Wall Street analysts who had expected the central bank to be more conservative."

October 23, 2019: The Fed is sharply increasing the amount of help it is providing to the financial system. The New York Fed announced it is increasing its temporary overnight repo operations to $120 billion a day from the current $75 billion.

Temporary. Right. It's so temporary we'll increase repo by 60%. But why stop there? Even this is not enough apparently. The unholy alliance strikes again. The same week the Trump administration announces a phase one trade deal the Fed announces even more liquidity to come.

December 13, 2019: Fed boosts plan to inject billions into the US economy. The central bank lifted its limit for operations scheduled between December 31 and January 2 to $150 billion from $120 billion, according to a release.

Let's be crystal here: These actions announced in October changed market dynamics entirely. Volatility was crushed and markets went on a one way street to new highs. The banking sector, having failed to break out of its trading range all year suddenly managed to explode to the upside and disconnecting from the previous yield relationship in the process:

This rally in 2019 and in Q4 in particular is entirely the product of liquidity injections in the forms of rate cuts and balance sheet expansions.

It's not the economy stupid. It's the central bank balance sheets...

It's not based on economic reality, it's not based on earnings growth, it's not even based on a trade deal that is opaque and ill-defined without details.

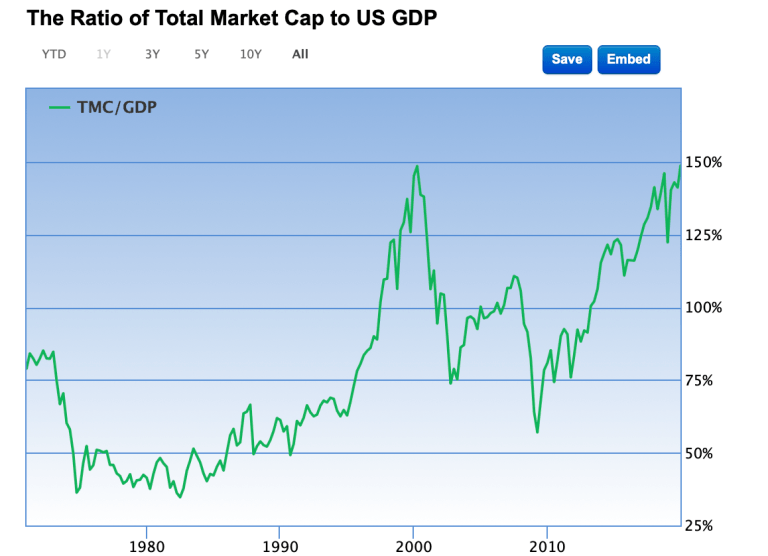

And because of it markets keep disconnecting ever farther from an economic basis. In fact on an economic basis markets have reached record levels not seen since the year 2000. Party like it's 1999:

The aggregate US market closed at $32 trillion market cap for the first time ever or approximately 149% market cap/GDP.

Most notable this valuation milestone was reached amid flat to declining earnings growth and slowing economic growth.

Market cap to GDP is now overtly flirting with the 150% level last seen in 1999:

Some will say that's fine because there are now more international sales reflected in S&P companies. Fine if you want to make that argument, but you have to account for several factors: One is that growth in international is a flat as a pancake and keeps slowing. This week the Bundesbank reduced German GDP growth outlook to 0.6% for 2020 and 1.6% for 2021. The OECD has Japan's GDP growth outlook pegged at 0.6% for 2020 and 0.7% for 2020.

And the ECB has Europe on a forever 1.x% for years to come:

So if you want to justify markets trading at a 150% market cap to GDP based on international sales go right ahead, but don't justify it based on solid expanding growth. It's not there and hence that justification would be a fantasy.

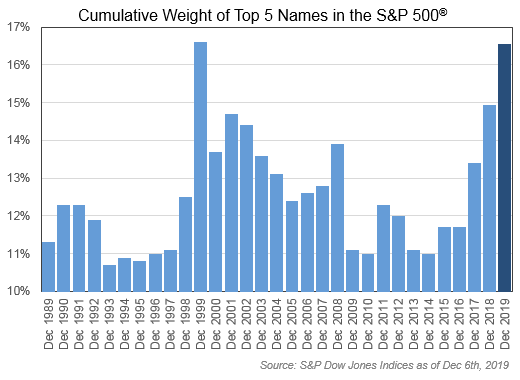

In keeping with the year 2000 theme note we are seeing some of the same internal distortions we saw during the tech bubble as 5 tech components now represent 16.5% of the S&P 500 relative to the rest of the market, same as in 1999:

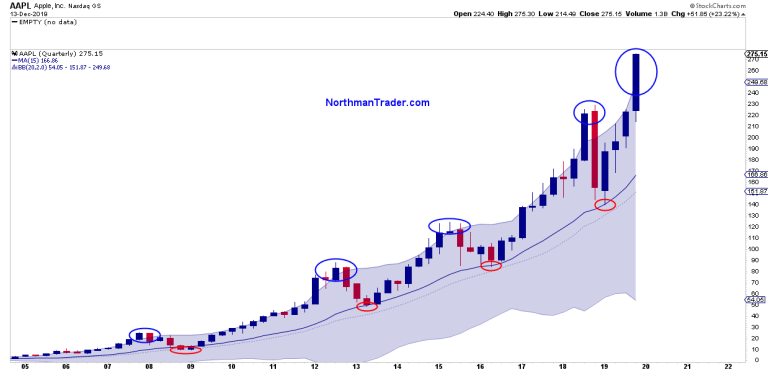

We're ending 2019 with key market cap components such as $MSFT and $AAPL massively overbought, technically disconnected, extended and over-owned. These types of extremes have lead to coming pain and reconnects. Take $AAPL as an example seemingly repeating a previous pattern extending far above its quarterly Bollinger band far above its quarterly 15MA

To the extent these moves are driven by global liquidity the Fed may well then have set up the entire market for a massive failure.

In Q4 the Fed has been forced to set on a path of ever increasing liquidity injections with its balance sheet now destined to reach record highs as early as perhaps as the first quarter of 2020.

Be clear: The Fed went from autopilot normalization, to pausing, to increasing temporarily, to increase more and increase ever more. In process they unleashed a massive melt-up in markets stretching everything to extremes. Again.

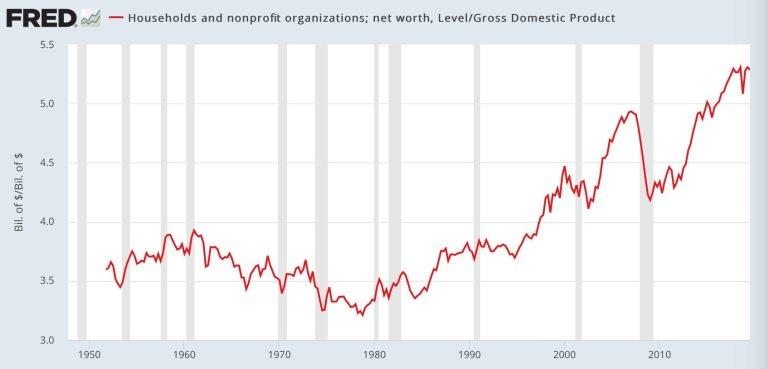

No, 2019 was a giant system failure. Central banks can't reduce liquidity or markets fall apart and the process of never letting markets correct is producing valuations across the entire economic spectrum worse than even 2000 as household wealth (concentrated among the top 10%) relative to GDP has reached never before seen levels:

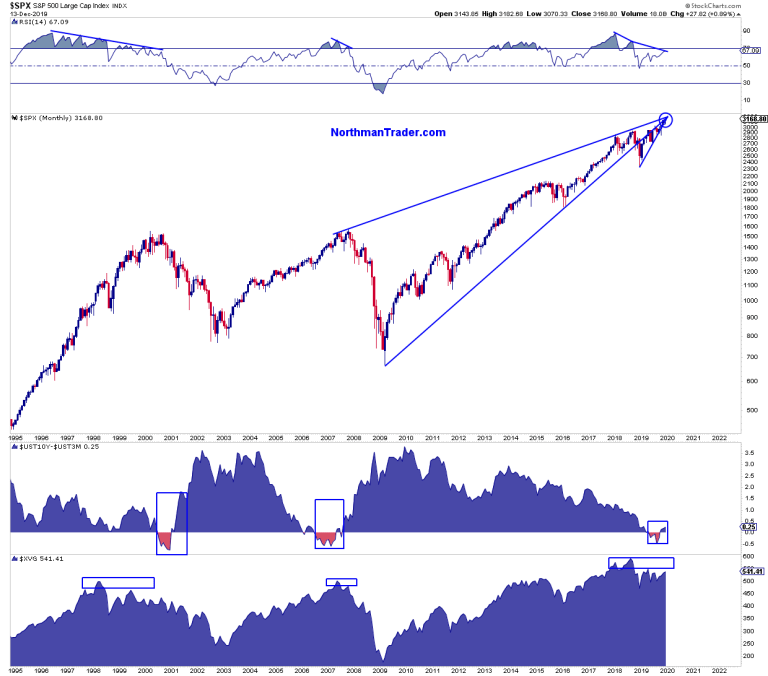

And yet all new market highs are following a familiar historic script:

All new highs are coming on negative divergences. $SPX has reached its trend line apex. The yield curve went from inversion to steepening a process that has preceded recessions every time in the past 50 years. And when these conditions take place we can see that the geometric value line index ($XVG) shows significantly lower readings compared with previous highs as we do now as $XVG, despite new market highs, remains far below the readings of 2018.

All of these conditions suggest markets remain at sizable reversion risk. At the end of December 2018 I talked about bullish technical reconnects to take place in 2019 as a result of deeply oversold conditions. Now a year later we're seeing some of the same conditions, but to the upside suggesting that we will witness corrective reconnect activity into 2020.

As markets are now dependent on ever expanding liquidity any pausing or reduction in liquidity will have the practical effect of tightening. Without a substantive growth basis to support these historic economic disconnects market reversion risk is increasing by the week.

But be clear: The liquidity avalanche will continue into year end, and, until something breaks, the upside train can continue despite overbought conditions.What's it mean for investors? I suppose if long stay long until wrong, from our perch it's sell the rips and buy the dips until the dynamic changes, although the Sell case has not been disproven as of yet as price has not breached the sell zone indicated.

The Fed has now indicated it will not cut rates further in 2020. Based on their track record in the past year such a proclamation has no meaning. Indeed both Powell and new ECB president Lagarde cemented the system failure of 2019 this month: Powell indicated no rate hikes ever unless inflation exceeds either the Fed's inflation target (which they've failed to reach in over 10 years). According to how both the Fed and the ECB measure inflation this seems to imply no rate hikes ever as Lagarde implied no end of QE until just before the ECB will raise rates. So QE forever?

To summarize: We went from "normalization" in the summer for 2018, to the Fed becoming the most interventionist central bank in the world in net liquidity additions with its balance sheet looking to reach record highs in 2020. Temporary repo has become permanent and so have balance sheet expansions and low to negative rates across the globe.

On the heels of the financial crisis we entered the decade with trillion dollar deficits, dropping rates and expanding central bank balance sheets and now we exit the decade the same way with absolutely no conceivable path or plan to ever raise rates again or reduce artificial central bank liquidity. There is no path or plan.

And that is the system failure in a nutshell and it has produced historic distortions in markets. For now investors can party like it's 1999, but have a plan for when the music stops for, as historic suggests, it can stop suddenly. In 2000 it stopped in March.

* * *

Commenti

Posta un commento