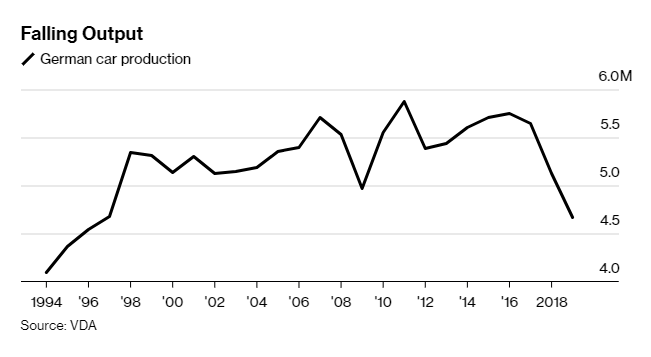

It's official: the worldwide automotive industry recession is in full swing.

Car production in Germany has tumbled to its lowest levels in 23 years, according to Bloomberg. Names like Volkswagen, BMW and Daimler produced 4.66 million cars in German factories last year, which is the weakest number since 1996.

The 9% decrease was blamed on waning demand from international markets and estimates are for deliveries to drop to 78.9 million vehicles this year, from 80.1 million in 2019.

Pollution concerns led by Volkswagen's 2015 diesel-cheating scandal have threatened to dethrone Germany as a global manufacturing powerhouse. Combined with the global auto recession, trade conflicts and slowing economies, it's a recipe for falling output.

Germany has been more susceptible to emission regulations due to the country's propensity for making high performance vehicles. Brands like BMW, Porsche and Audi have made their names focusing on power and performance.

Meanwhile the industry is focused on investing in cleaner vehicles and self-driving features. The market has been rewarding these companies, with ride-sharing company Uber posting a market value nearly equivalent to Daimler.

This has been leading the industry to "explore unusual projects", according to Bloomberg:

The country's domestic autos market grew 5% last year after buyers registered 3.6 million new cars, the most since 2009. But the industry expects the market to contract this year and there is anticipation of job cuts amid the transition to electric vehicles. Germany maintained its lead over Norway as Europe's biggest EV market, after selling 63,281 EVs last year.

Commenti

Posta un commento