U.S. Stock Futures Drop as Iran Retaliation Starts: Markets Wrap

Geopolitical tensions loom over markets on Wednesday

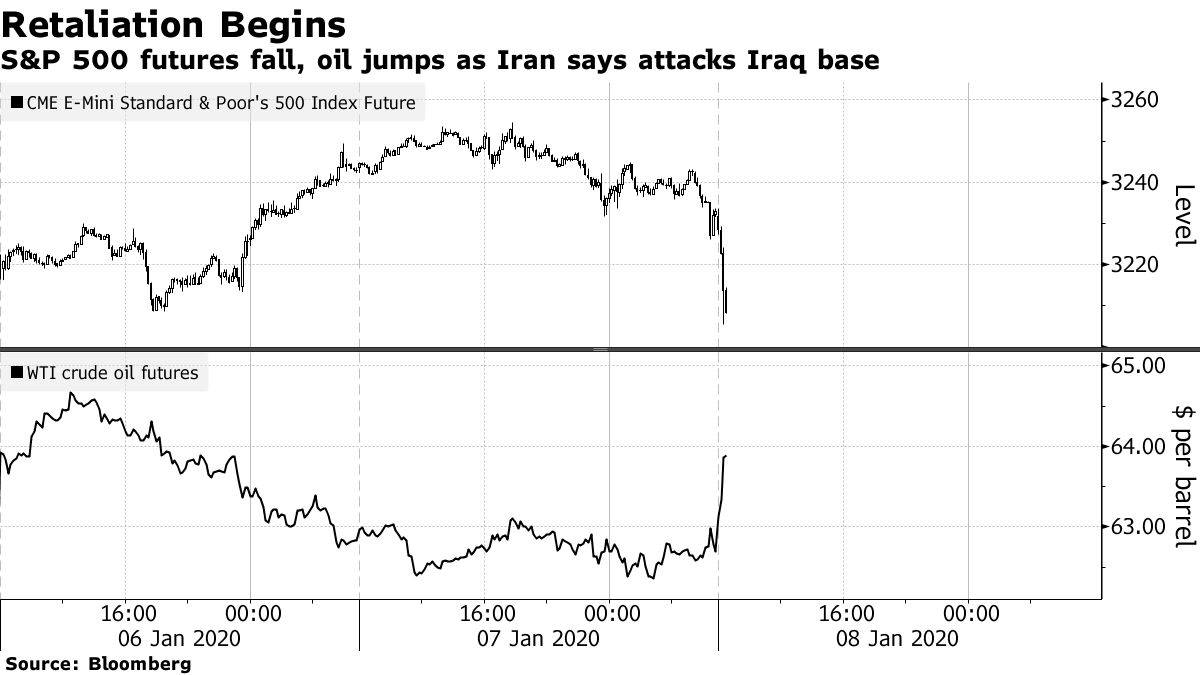

U.S. stock futures declined after Iran reportedly started an attack on a military base in Iraq hosting American troops, escalating tensions in the Middle East. Treasury futures and the yen rose.

Futures on the S&P 500 Index dropped more than 1%. Oil prices surged as Iran state TV said it started operation "Martyr Soleimani" at dawn with several rockets being fired at the Ayn al-Asad base. Australian shares fell, and Australian bond yields slid as the Asian trading session got going Wednesday. Gold advanced.

"It is frightening to think about the possible range of outcomes with this," Di Zhou, a fund manager at Thornburg Investment Management Inc., told Bloomberg TV. "We are closely monitoring this evolving."

Cautious is returning to markets amid signs hostilities are moving on to the next stage following the killing of a top Iranian military leader by the U.S. last week. Meantime, investors continue to weigh developments on the trade front with the first phase of the U.S.-China trade deal expected by many to be signed on Jan. 15.

Markets Weigh Patience and Panic in Wake of U.S.-Iran Tension

Bob Doll, chief equity strategist and senior portfolio manager at Nuveen, and Mithra Warrier, managing director at TD Securities, examine market reaction to the U.S. airstrike in Iraq that killed one of Iran's top generals.

Here are some events to watch for this week:

- Federal Reserve officials Richard Clarida, John Williams, James Bullard and Charles Evans speak on Thursday.

- The U.S. monthly employment report is due Friday.

These are moves in major markets:

Stocks

- Futures on the S&P 500 Index slid 1.2% as of 8:41 a.m. in Tokyo. The underlying gauge fell 0.3% on Tuesday.

- Futures on Japan's Nikkei 225 slid 0.5% earlier.

- Australia's S&P/ASX 200 Index was down 0.5%.

Currencies

- The yen rose 0.4% to 108.02 per dollar.

- The offshore yuan traded at 6.9465 per dollar.

- The Bloomberg Dollar Spot Index increased 0.3% Tuesday.

- The euro bought $1.1151.

Bonds

- The yield on 10-year Treasuries rose one basis point to 1.82% Tuesday. Futures climbed 0.4% in early trading.

- Australia's 10-year yield fell about seven basis points to 1.14%.

Commodities

- West Texas Intermediate crude jumped 2.9% to $64.57 a barrel.

- Gold rose 1.1% to $1,591.93 an ounce.

— With assistance by Cormac Mullen, and Haidi Lun

Commenti

Posta un commento