The monetary policy guide has fundamentally changed and so to has the business cycle. Changes in monetary policies and practices nowadays stimulate finance over spending. The power and risks of equity markets should not be overlooked as important metrics show equity valuations to be 2X times their historical norm.

Monetary policy can stimulate too much finance (equities) as it did with spending (inflation). As such, the risks of business cycles have shifted toward finance and away from inflation.

Here are 5 examples of how monetary policies, new tools and practices stimulate finance over spending.

1. Policy Rates: The primary tool of monetary policy is the target on the federal funds rate. Policymakers have often struggled to find a good balance, or find a rate that was equally good for the economy and finance.

Policymaker's promise to keep official rates exceptionally low in recent years, and now for the foreseeable future, clearly favor finance over spending. To be sure, interest rates are the most important item in determining the value of equities so the promise on official rates creates the "perfect knowledge" market theory for investors since it eliminates one of the key risks and unknowns---the current and future level of official rates.

2. Policy Bias: Policymakers have consistently shown a bias to ease policy during sharp sell-offs in the financial markets and no bias to withdraw liquidity when finance races far ahead of the economy. This uneven policy ---often call the "Fed put"---creates the impression in the minds of investors that policymakers will always ride to their rescue during sell-offs and not stand in the way when markets boom.

Policy actions of 2018 and 2019 clearly demonstrate that the policy bias is alive and well. Policymakers canceled their plans to raise official rates in 2019, following the abrupt and sharp equity market sell-off in Q4 2018, and yet show no inclination to take back any or all of the three rates cuts of late 2019 despite the resurgence in equity markets to new record highs.

3. Asset Purchases: The Federal Reserve has become a big investor in financial assets, expanding the Feds balance sheet to $4.5 trillion at its peak, up from less than $900 billion before the financial crisis. The new Fed tool works through the portfolio channel, injecting more liquidity into the financial markets, thereby lifting the price of financial assets, while also signaling to investors an easier stance on monetary policy.

The recent selloff and rebound in the equity markets have been highly correlated with the shrinkage and the renewed expansion of the balance sheet in 2018 and late 2019. Rightly or wrongly investors view increases and decreases in the Fed's balance sheet as a signal of easy or tight money and a risk-on or risk-off strategy.

4. Transparency and Forward Guidance: Policymakers now telegraph their decisions on policy rates, well ahead of any actual decision and also offer forward guidance on policy rates along with their economic forecasts. Who benefits from greater transparency and forward guidance?

Investors appear to be the big winner. Never before did policymakers offer so much transparency on official rates---telling investors what they plan to do, when and by how much. That's not to say policy transparency has taken all of the risk out of investing, but it removed one of the biggest risks, enabling investors to devise a series of investment strategies based on "inside" knowledge on official rates.

5. Price Targeting: The Fed elevated inflation from an objective of monetary policy to an actual target. That might not sound like a big deal, but it is.

The curious thing about price targeting is the gauge policymakers chose to target. The Fed picked the personal consumption expenditure deflator (PCE) over the more widely used consumer price index (CPI). PCE consistently runs below the CPI, so by selecting the PCE there is a clear bias towards lower rates.

In 2019, the choice of the price index proved to be the difference between easing and tightening policy. To be sure, the core PCE reading of 1.7% tilted policy towards an easier stance, while the CPI of 2.3% favored rates inching up a bit more.

The Results

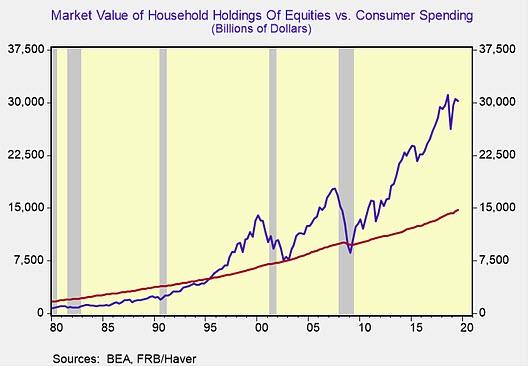

The numbers on finance (equity valuations) are impossible to ignore. Household holdings of equities stand nearly 2X times the level of consumer spending as does the market valuation of domestic companies to nominal GDP. Historic norms are closer to 1X.

Commenti

Posta un commento