Today we gasp, stagger, reel.

The enormity of it all has finally overmatched our capacities. Consider…

Total global debt presently piles up to 322% of GDP — a record.

Total "developed world" debt piles higher yet — 383% of GDP — another record.

The world's stock markets combine to $88 trillion, or 100% of global GDP. That is another record yet.

Record upon record upon record has come down… as debt has gone relentlessly up.

And what does the world have to show for the deluge?

Little Bang for the Buck

Real United States GDP growth gutters along under 2%. Fair estimates place European and Japanese 2020 growth under 1%.

Interest rates, meantime, are coming down. And so the supply of "dry powder" available to the central banks is coming down. They will require heaps of it come the next crisis.

Project Syndicate, in summary:

The major developed economies are not only flirting with overvalued financial markets and still relying on a failed monetary-policy strategy, but they are also lacking a growth cushion just when they may need it most.

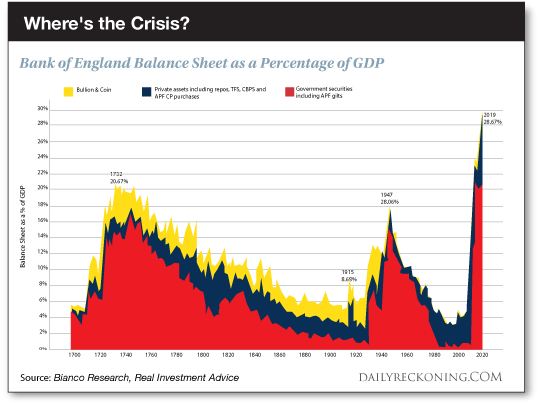

Direct your attention now to the Bank of England. Specifically, to its balance sheet…

Where's the Crisis?

As a percentage of GDP…

Not once in three centuries has this balance sheet swollen to today's preposterous extreme…

Not when England was life and death with Napoleon, not when England was life and death with the kaiser, not when England was life and death with Hitler:

The Bank of England's balance sheet — again, as a percentage of GDP — presently nears 30%.

It never cleared 20% even when England was absorbing obscene debts to put down Herr Hitler.

Where is today's Napoleon? Where is today's kaiser? Indeed… where is today's Hitler?

Yet the balance sheet indicates England is battling the three at once. And on 1,000 fronts the world across.

We razz English people only because the Bank of England is nearly the oldest central bank going (est.1694) and keeps exquisite records.

It therefore offers a detailed, three-century sketch of central banking's shifting moods.

Our own Federal Reserve's history stretches only to 1913. But its compressed history offers a parallel example…

Crisis-Level Balance Sheet

Its balance sheet expanded to perhaps 20% of GDP against the twin calamities of the Great Depression and Second World War.

It then came steadily, inexorably and appropriately down, decade after decade. Pre-financial crisis… that percentage dropped to a stunning 6%.

But then the great quake of '08 rumbled on through… and shook the walls of Jericho to their very foundations.

The Federal Reserve got out its mason kits and set to patching the damage.

Patching the damage? It built the walls up higher than ever…

By 2014 quantitative easing and the rest of it swelled the balance sheet to 25% of GDP. That, recall, is five full percentage points above its 20th-century crisis peaks.

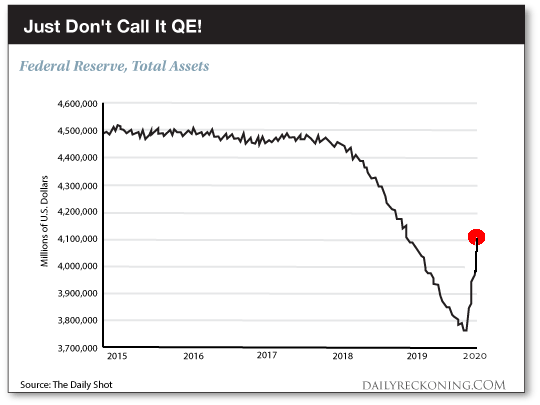

Mr. Powell's subsequent quantitative tightening knocked down some of the recent construction.

The balance sheet — as a percentage of GDP — slipped beneath 20% by 2018.

But last year he pulled back the sledgehammers. Then, in September, the short-term money markets began giving out… and Powell rushed in with the supports.

The Fastest Expansion Ever

He has since expanded the balance sheet some $400 billion in a four-month span — over 10%. Not even the financial crisis saw such a violent expansion.

As we have presented before, the visual evidence:

The balance sheet presently nears $4.2 trillion, only slightly beneath its 2015 maximum.

Here then is irony…

"A Magnet for Trouble"

Observe the 2012–14 comments of Carlyle Group partner Jerome Powell — before he was Federal Reserve chairman Jerome Powell:

I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons.

First, the question, why stop at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated…. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?…

[W]hen it is time for us to sell, or even to stop buying, the response could be quite strong;there is every reason to expect a strong response…

Continues the present chairman:

My [next] concern… is the problem of exiting from a near $4 trillion balance sheet… It just seems to me that we seem to be way too confident that exit can be managed smoothly. Markets can be much more dynamic than we appear to think…

I think we are actually at a point of encouraging risk-taking, and that should give us pause…

I kind of think that a large balance sheet might prove to be a magnet for trouble over time… So I tentatively land on a floor system with the smallest possible balance sheet…

"Why stop at $4 trillion?"… "It will never be enough for the market"… "faster economic growth, which it is probably not in our power to produce"… "a large balance sheet might prove to be a magnet for trouble over time"… "I tentatively land on a floor system with the smallest possible balance sheet"…

Again — here is irony.

What Happened to Powell?

Where a fellow stands often depends upon where he sits. And this particular fellow sits in the chairman's seat at the Federal Reserve.

The Federal Reserve has a certain institutional… perspective.

And so he leans whichever way it slants.

Our co-founder Bill Bonner puts it this way:

"People come to believe whatever they must believe when they must believe it."

What does Mr. Powell's 2012–14 self, the conscience tapping naggingly on his shoulder, tell him?

That no enormity is ever enough for the market? Something about a magnet for trouble? A preference for the smallest possible balance sheet perhaps?

But Jerome Powell has come to believe what he must… when he needed to believe it.

We shudder at what he will come to believe come the crisis — or whatever his successor will come to believe.

Meantime, the world runs to record debt, its stock markets run to record highs…

And we are about ready to run for the Hills…

Commenti

Posta un commento