The only problem today that market watchers like ourselves have noticed – is that traditional monetary policy has had a challenging time stimulating growth in developed and emerging economies.

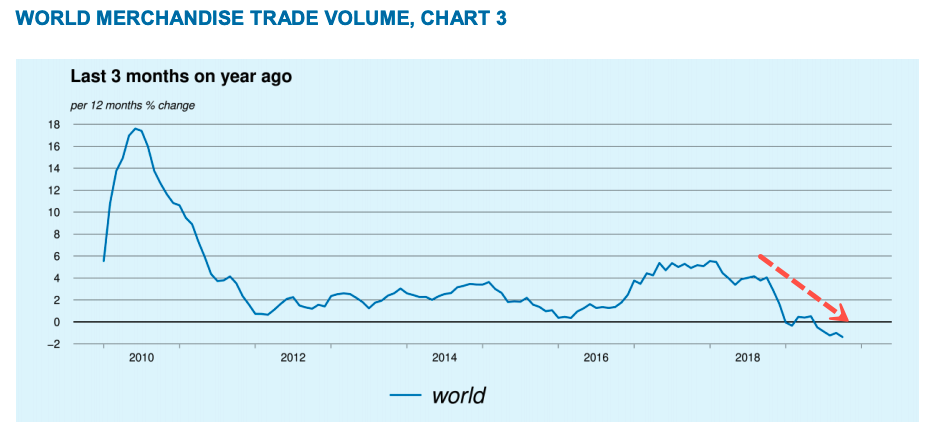

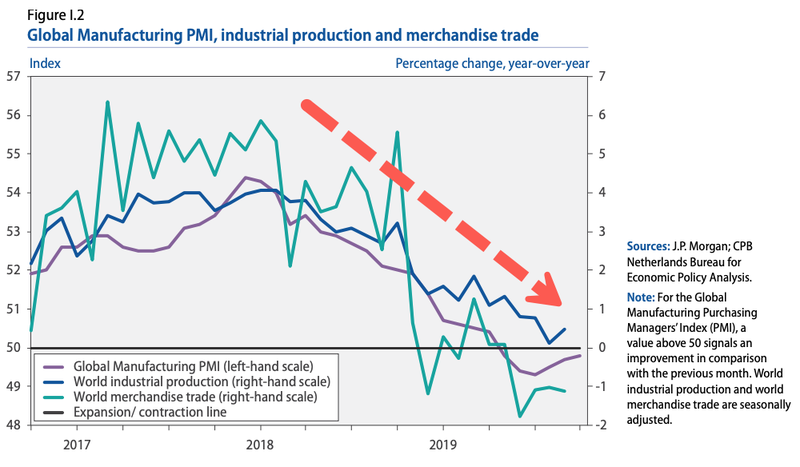

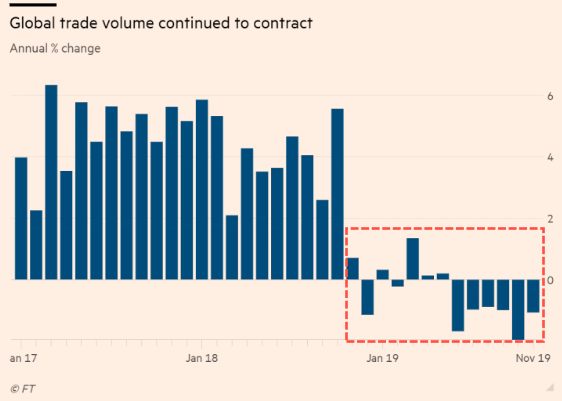

Data from Netherlands Bureau for Economic Policy Analysis (CPB) showed Friday that global trade volume continued to contract in November, marking one of the most extended stretches of negative growth since the end of the financial crisis.

According to CPB, world trade slipped 0.60% in November over the prior quarter and was down 1.1% compared to the same month a year ago.

November was the sixth month of straight of declines on a Y/Y basis, the longest stretch since right after the 2008 financial crisis.

World trade has dropped sharply from 3.4% in November 2018.

However, there was some good news; the rate of contraction has slowed from a -2% pace seen in October, which was the quickest rate of decline since a decade ago.

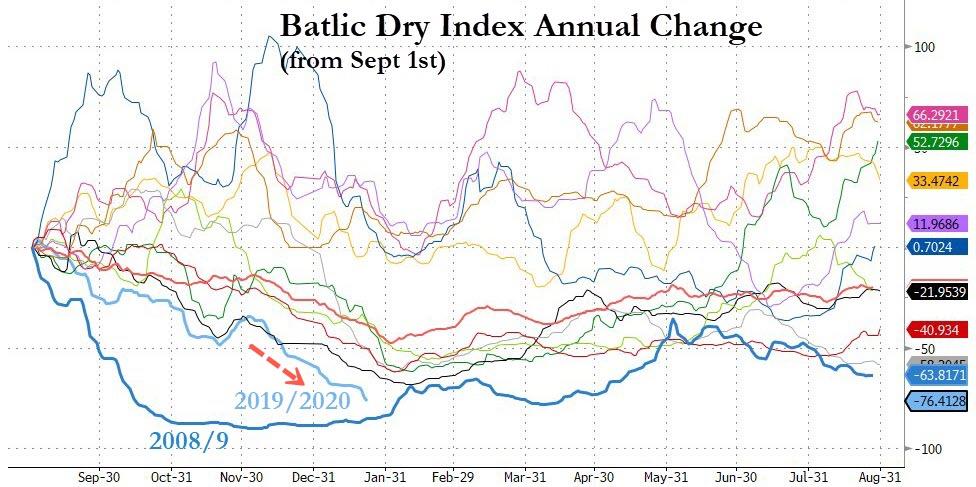

And while hope is high that the so-called 'trade deal' will lift all boats, data shows that the global economy has continued slowing into 2020 as the Baltic Exchange's main sea freight index has crashed 70% in the last four months, the biggest down moves since 2008.

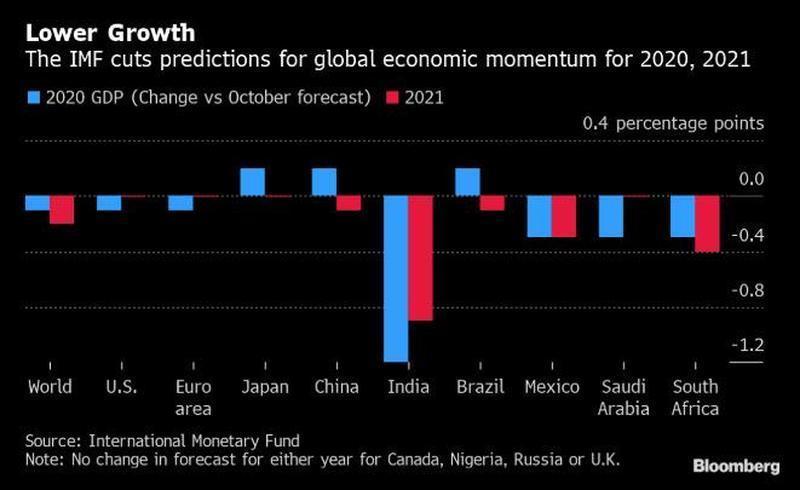

Additionally, earlier this week, the IMF downgraded its forecast for global GDP for 2020 and 2021, its sixth straight reduction, although in a sliver of optimism, global GDP in 2020 is now expected to post a modest rebound from 2.9% to 3.3%, (down from 3.4% in October) and to 3.4% in 2021 (down from 3.6%) as the IMF said, "there are now tentative signs that global growth may be stabilizing, though at subdued levels."

Before Davos this week, the World Economic Forum (WEF) President Borge Brende warned the world is "faced with a synchronized slowdown in the global economy. And we're also faced with a situation where the ammunition that we have to fight a potential global recession is more limited."

Last week, the UN published its annual report that warned the global economy recorded its lowest growth in a decade in 2019, falling to 2.3% as a result of the U.S. and China trade war and sharp pullbacks in investment.

The report warns of slowbalisation will define the global economy in the early 2020s. Growth is expected to pick up slightly across the world from 2.3% last year to 2.5% in 2020, but that depends on the effectiveness of monetary policy and if all trade disputes can be resolved.

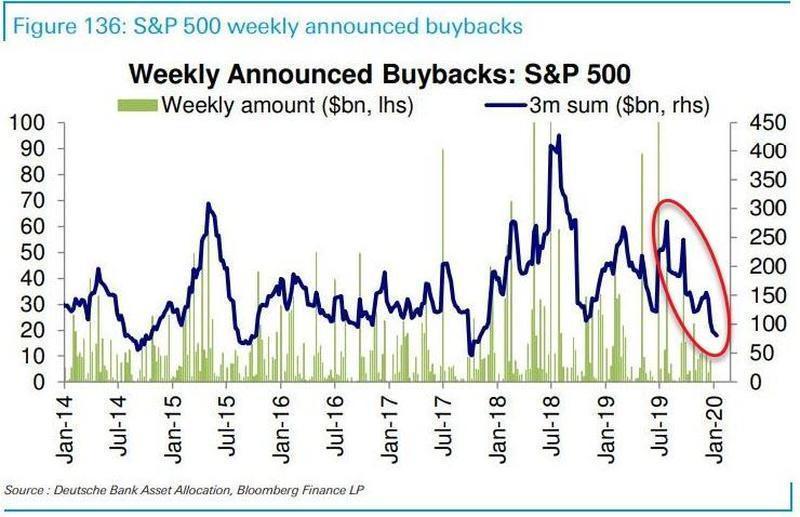

And on top of everyone warning about a decelerating global economy in 2020, the market's most important pillars of support - buybacks – are declining.

If the global economy fails to rebound in a V-shape fashion in early 2020, asset manages and leverage funds, who've already priced in a massive recovery by bidding stocks to record highs, could soon see a repricing of growth that would ultimately lead to a blowoff top in stocks.

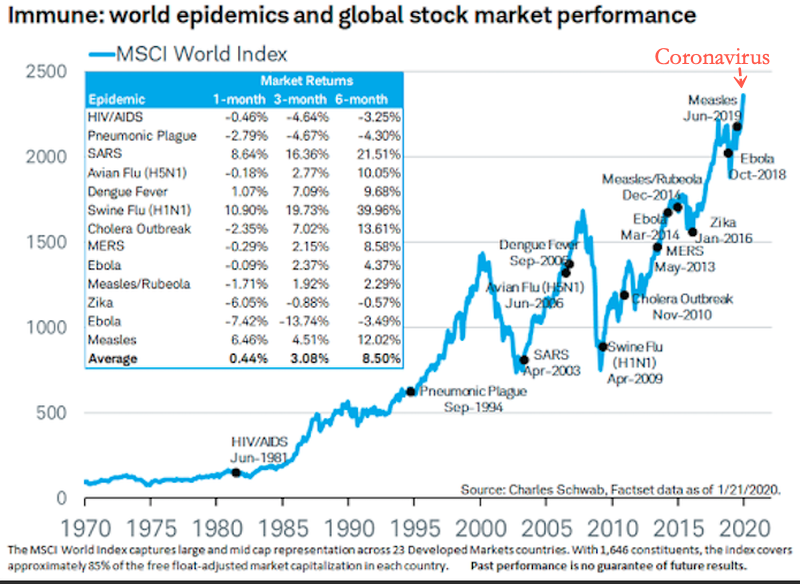

Along with a continued global slowdown, a deadly virus outbreak could derail consumer spending habits across Asia that would ultimately weigh on global trade.

Most epidemics were a buying opportunity for bulls...

But given the level of excess-liquidity and extreme over-valuation today, this time could indeed be different.

Commenti

Posta un commento