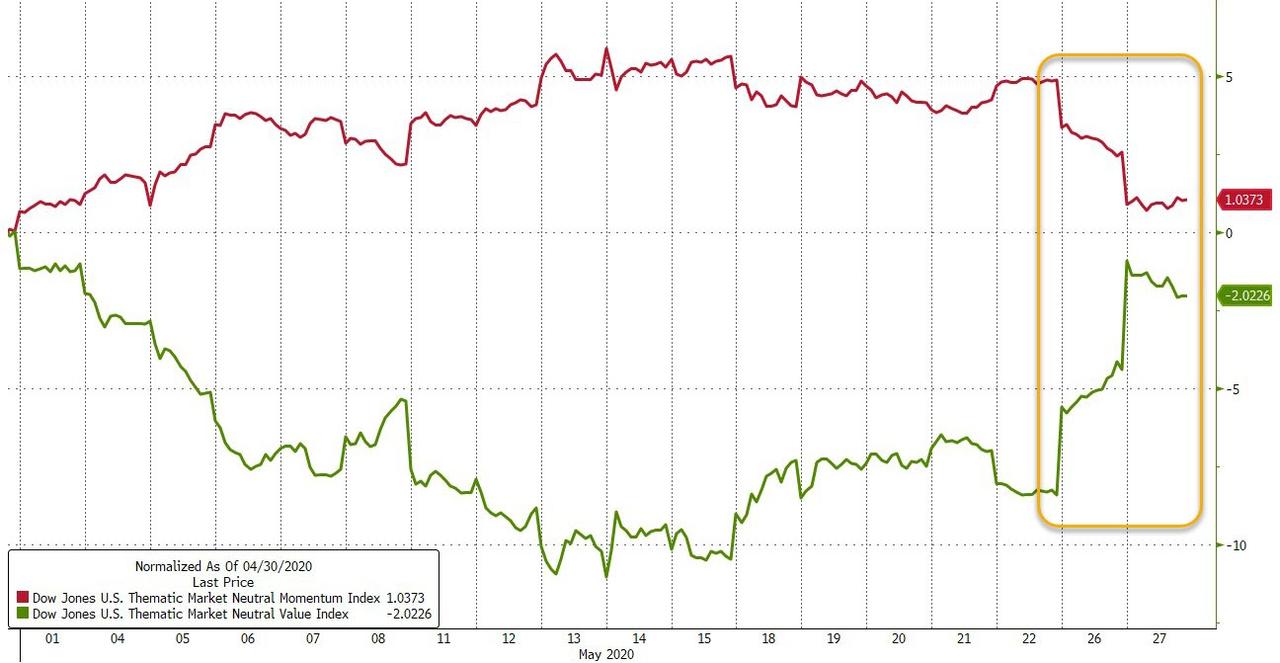

As we have discussed here over the past few days, there has been a tremendous rotation below the market surface in recent days, one on par with the great quant crash in early September 2019, with value stocks soaring - arguably on reopening optimism and expectations for a rebound in inflation on the back of the fiscal firehose we noted yesterday - as outperforming momentum names have been trampled...

... resulting in the latest shock to hedge funds, which were positioned for a continuation of the legacy momentum-over-value theme.

As touched upon previously, there are 3 key factors behind this pro-cyclical "risk-on" narrative shift:

- fiscal stimulus acceleration (Europe / Germany HUGELY symbolic for a capitulation away from austerity)

- accelerating Yield Curve Control talk from Fed (as a curve steepener / reversal of trend catalyst)

- The ongoing "rush to reopen" the global economy, while high-frequency mobility -and credit card spending - data seemingly shows fledgling indications of "return to normalcy" type behavior from American consumers.

This 3-peat shock to legacy deflationary positioning, has fallen into what Charlie calls "remarkably short/underweight positioning dynamics" where Asset managers remain net short (1st %ile leveraged fund net "short" position) and CTA's having been "short" across 12 of 13 of global equities futures in the portfolio over much of the prior 2m.

But as a result of this narrative shift and corresponding realized vol compression, there has been a "spectacular systematic covering bid off lows—with the SPX futures model actually again flipping outright long yesterday, while both RTY and Estoxx legacy short signals were cut in half yesterday as well—and showing an aggregate ~$330B of gross "buying (almost predominately to cover) off the "max short" extreme of early March."

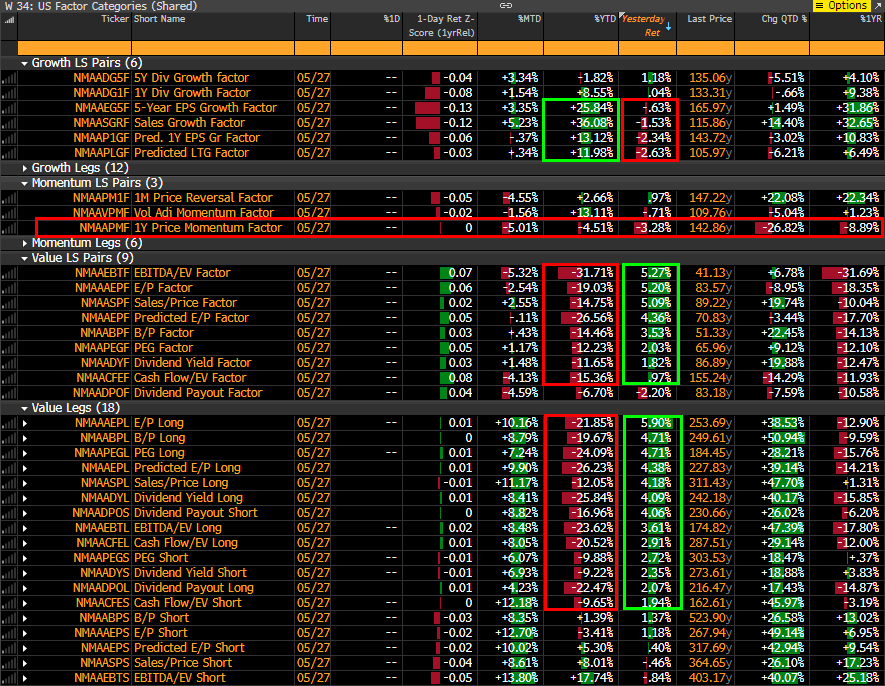

Not surprisingly then, McElligott notes, the "Everything Duration" consensus trade in Equities—which became de facto Equities consensus "hiding place" positioning—has been hit hard, with US Equities "1Y Price Momentum" -9.8% in 2 days alone (which as the Nomura quant admits has filled "all the positive returns for my "Long Momentum" tactical call for May which mercifully ends imminently"), which has also corresponded with Nomura's Equities Long-Short model portfolio experiencing its fifth-worst 2d drawdown of the past 1Y window.

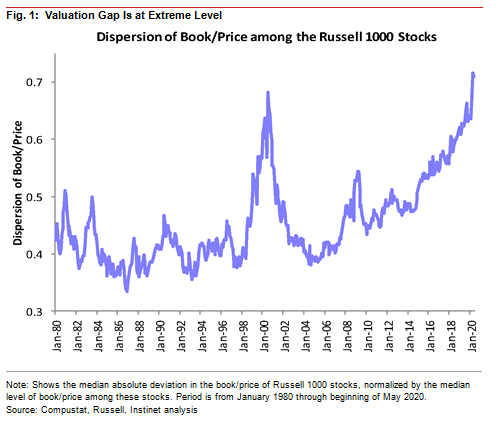

So does this mean that after the biggest rout in history, investors can finally chase value shares again?

According to the Nomura quant, it is counter-intuitively the "Recession" which marks the "turn" for Value factor market-neutral per the back-test "as expensive stocks begin to break down ("Value Shorts" i.e. Secular Growth) as the market prices-in a growthier forward-state thereafter thanks to monetary and fiscal stimulus actions which contributes to a bear-steepening", a point which is in keeping with what Goldman said a month ago when the firm said a handoff from growth to value would lead to a violent market repricing. Conversely, this would also benefit economically sensitive stocks which make up much of the "Value Long" universe, "and this is obviously what the market is debating right now in real time as per the above thematic behavior."

And speaking of debating, the bears - at least in the systematic community are losing the argument - as a result of what appears to be a wholesale capitulation by shorts. But before we look at the quants, let's not forget the carbon-based bearish discretionary traders who as we noted over the weekend, were steamrolled by euphoric retail, and have started to chase. As Nomura note, "last week's trimming of longs in global risk proxy S&P 500 futures from Asset Managers (who sold -$5.4B of Spoos last week) and pressing of shorts from Leveraged Funds (an additional -$2.3B of Spooz sold last weekly period and now -$14.3B over the past month—making the overall net notional position just 1.1%ile in SPX at -$53.5B)" now serve as short fodder which is acting as "kindling for this acceleration higher in U.S. Equities futures."

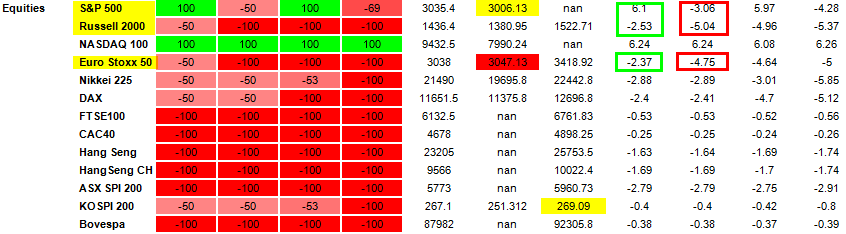

Meanwhile, the systematics - which until recently were max short, are puking, and according to Nomura, CTA Trend buying has been a mammoth source of "buy to cover" flows in Global Equities on the realized volatility reset:

Since the max of the "gross notional short" exposure in the CTA model across Global Equities futures (set March 9th), we have since seen an aggregate ~$380B of gross "buy (to cover)" flows (incl implied leverage) across the 13 Global Equities futures in the portfolio thereafter

There is more to come, because whereas S&P CTA are now 100% long, "there is still more fuel for the fire, as 11 of said 13 signals across Global Equities futures remain "short" in the model CTA Trend portfolio" representing a -$5.5B aggregate gross "short", as both the Russell- and Estoxx- went from recent "-100% Short" to now "-50% Short" signal yesterday, while the S&P 500 futures signal again outright flipped yesterday from the prior "-50% Short" back to "+100% Long" resulting in $17B to BUY in ES alone and a total $49.3B to buy across S&P, Russell and Eurostoxx futs yesterday.

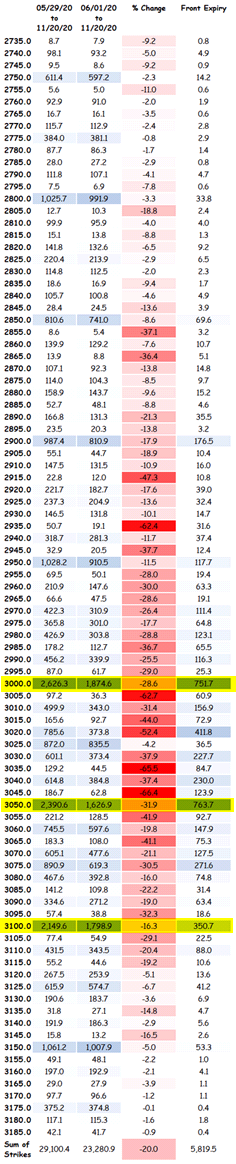

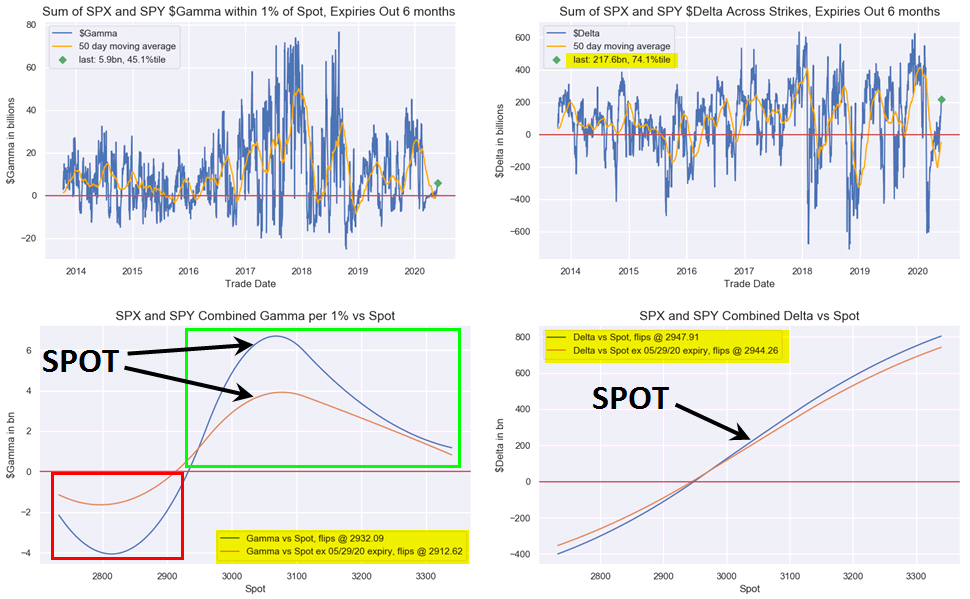

And while overall gamma levels have declined substantially after the recent op-ex, looking at SPX / SPY consolidated options positioning on the move, Nomura sees substantial Gamma building across the 3,000 ($2.63B), 3,050 ($2.39B) and 3,100 ($1.80B) levels...

... and thanks to the rally, seeing the Delta rank has spiked, and is suddenly long at 74th percentile.

Commenti

Posta un commento