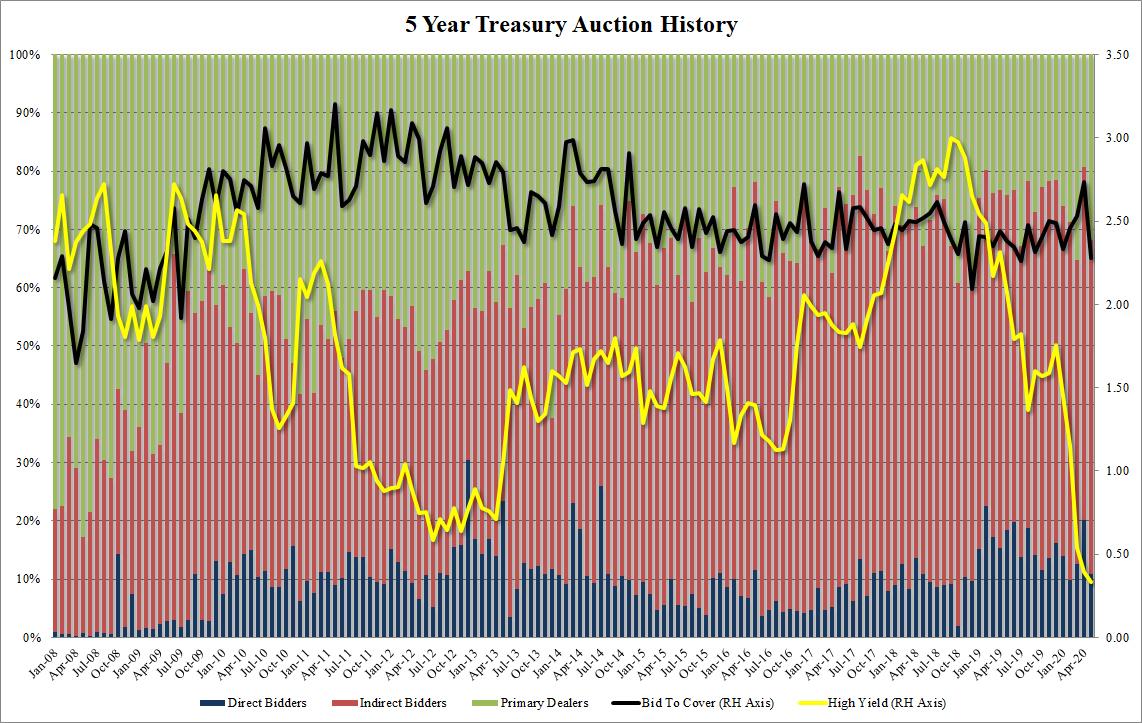

At 1pm the Treasury sold $45 billion in 5Y Treasuries, which in keeping with recent issuance, was also a record large notional for the tenor.

However, whether due to the record size, or due to the lack of concession in today's market which has seen yields slump sharply on renewed fears about US-China relations, the auction was an outright disappointment. Pricing at a high yield of 0.334, which incidentally was another record low yield for this tenor and below April's 0.394%, it tailed the When Issued 0.321% by 1.3bps, the biggest tail since December 2018.

Just like yesterday's 2Y auction, the Bid to Cover today also plunged, tumbling from 2.74 to 2.28, the lowest since July 2019, and far below the six auction average of 2.51.

The internals were also subpar, with Indirects taking down 57.3%, below the recent average of 50.1%, Directs accepting just $4.873BN or a 10.8% takedown, leaving Dealers with 31.8%.

Overall, this was a very poor auction and does not bode well for tomorrow's closely watched "belly-buster" record 7Y auction. And while dealers were quick to explain away the poor performance due to today's rally across the curve, we may have just gotten the first sign of buyside indigestion ahead of the upcoming tsunami of supply which may soon prompt higher yields especially if potential buyers start asking when the Fed will ramp up its own QE to ensure there is enough space to monetize all the upcoming Treasury issuance.

Commenti

Posta un commento