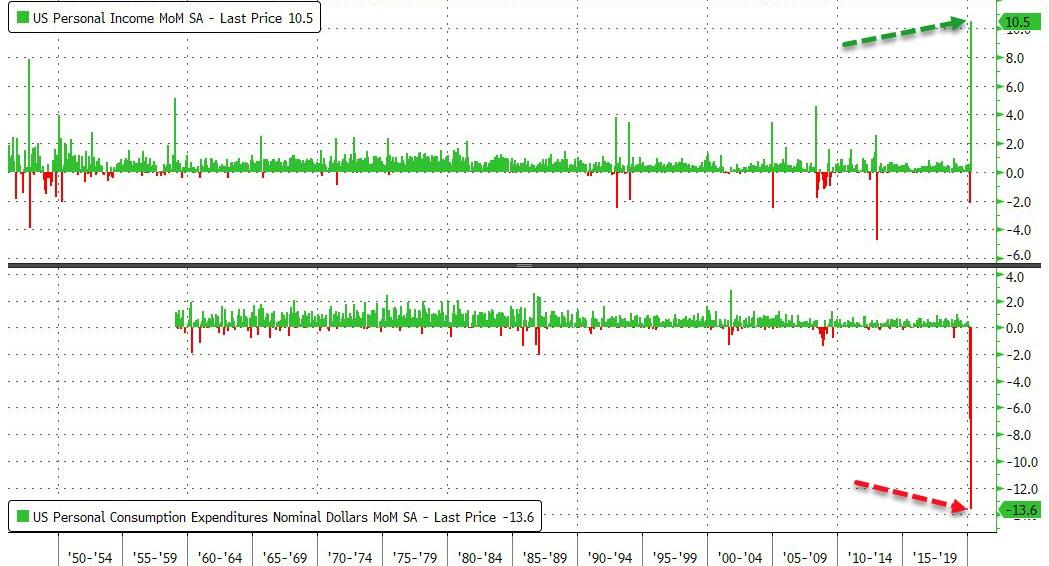

While spending collapsed 13.6% MoM (the biggest drop on record), incomes soared 10.5% MoM (the biggest surge on record) as we assume that this reflects massive government transfer payments...

Source: Bloomberg

And on a YoY basis, the shift is massive... an 11.7% surge in incomes and 3.1% slump in spending...

Source: Bloomberg

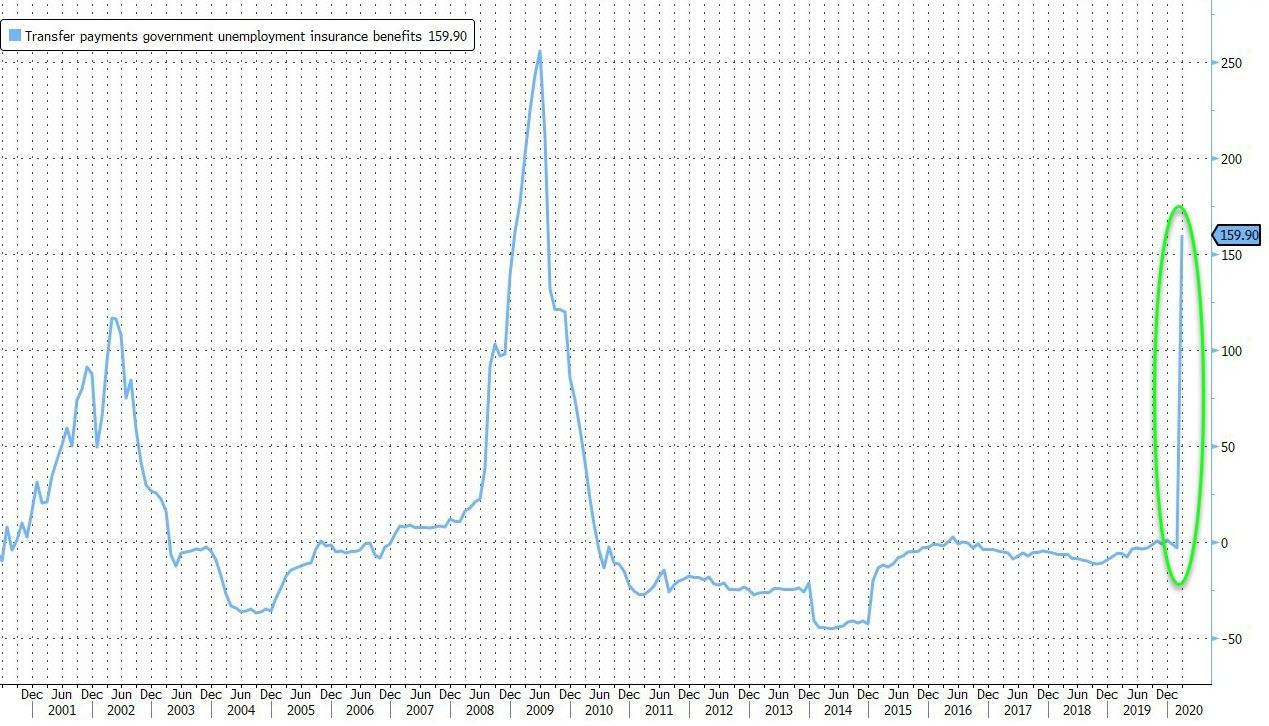

The surge in incomes is entirely due to massive government transfer payments...

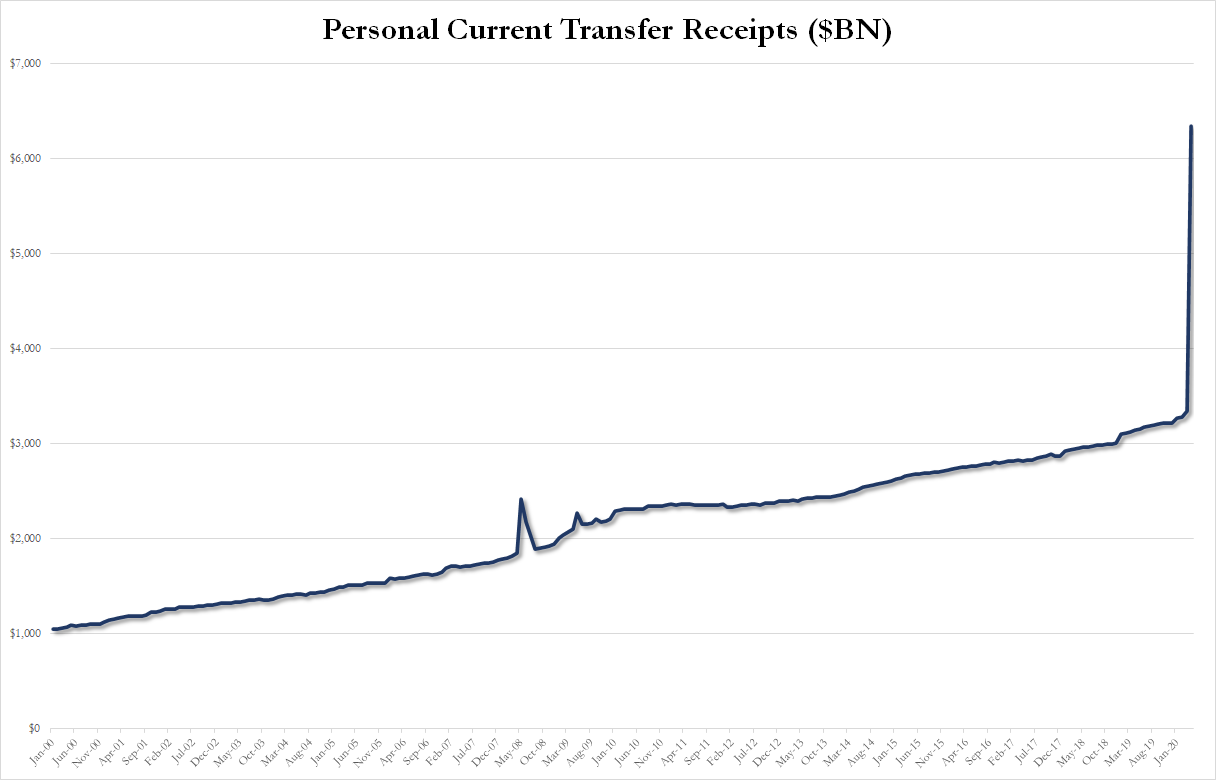

Here is that percentage change put in absolute context... basically, the government has added $3 trillion in annualized income... from $3.348TN in March to $6.367TN in April (both annualized)

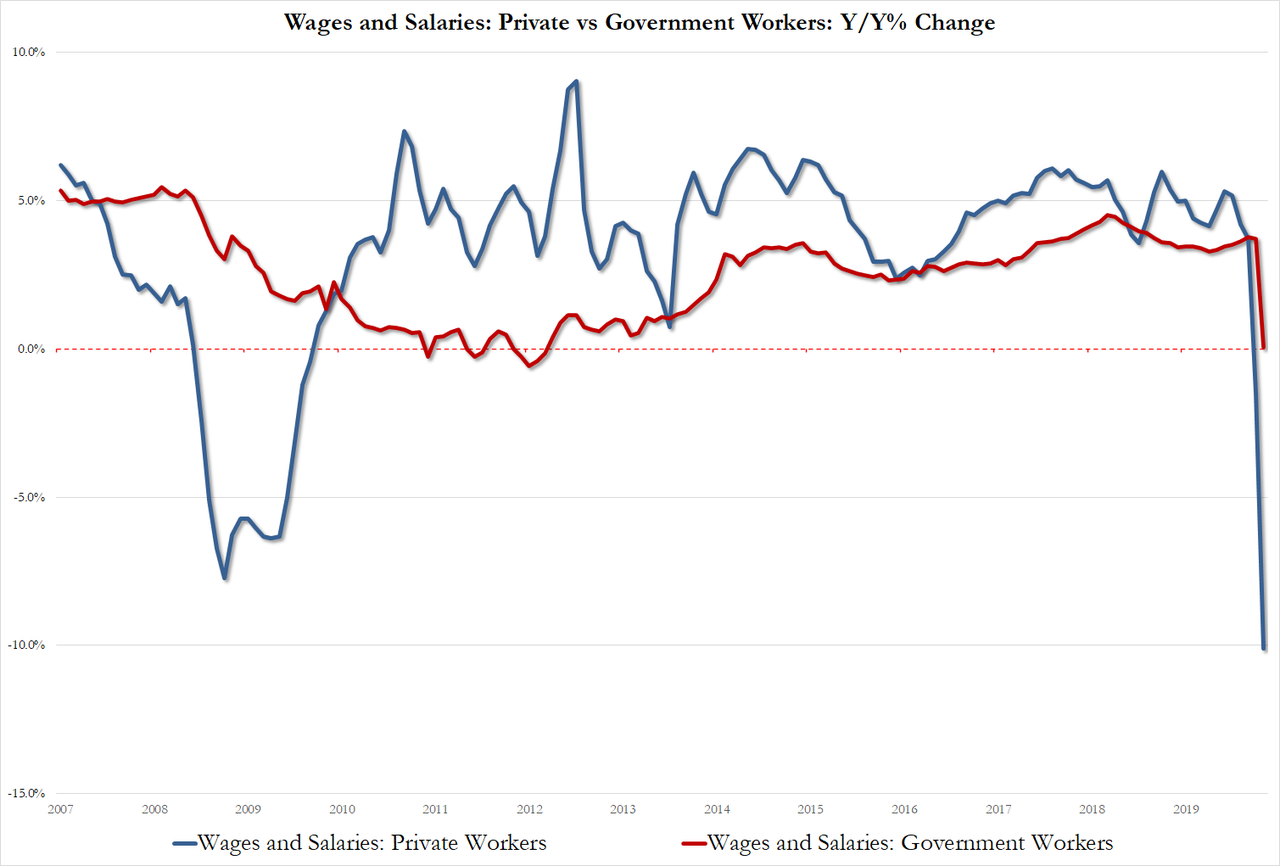

As private and government wages collapsed...

Consumer spending decreased in April, reflecting decreases in both goods and services.

Within goods, the leading contributor to the decrease was spending on food and beverages data. Spending on prescription drugs

also decreased.Within services, the leading contributor to the decrease was spending on health care, based primarily on employment, hours, and earnings data as well as credit card data. Other contributors to the decrease in services were spending on food services and accommodations.

And finally, The Fed's favorite inflation indicator - Core PCE Deflator - collapsed to 9 year lows...

Source: Bloomberg

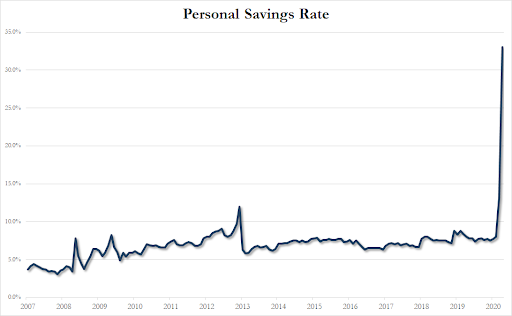

The surge in incomes and plunge in spending sent the savings rate to record highs...

The question is - what happens when that government transfer runs out? Are people changing their behaviors? Is the uncertainty forcing a desire to save more and if so, will that wind up having a lasting effect on consumer spending? That has to be watched out for.

Commenti

Posta un commento