| This is Bloomberg Opinion Today, a circuit breaker of Bloomberg Opinion's opinions. Sign up here. Today's AgendaGameStop Saga Enters Inevitable 'Recriminations' PhaseWhen tweeting yesterday's newsletter, I wrote there were five stages of GameStop: - Rage

- Boredom

- Laughter

- Greed

- Tears

The stages in this "joke" refer to: - The John Authers Theory of GameStop, which is that redditors and other day traders pumped up its stock out of rage at the Wall Street establishment;

- The Matt Levine Theory, which is that redditors and other day traders did it out of boredom and for the lulz;

- The Greater Fool Theory, which is that people piled into this trade because they saw quick fortunes being made and wanted to make some themselves; and

- The inevitable sadness of unlucky latecomers losing their rent money.

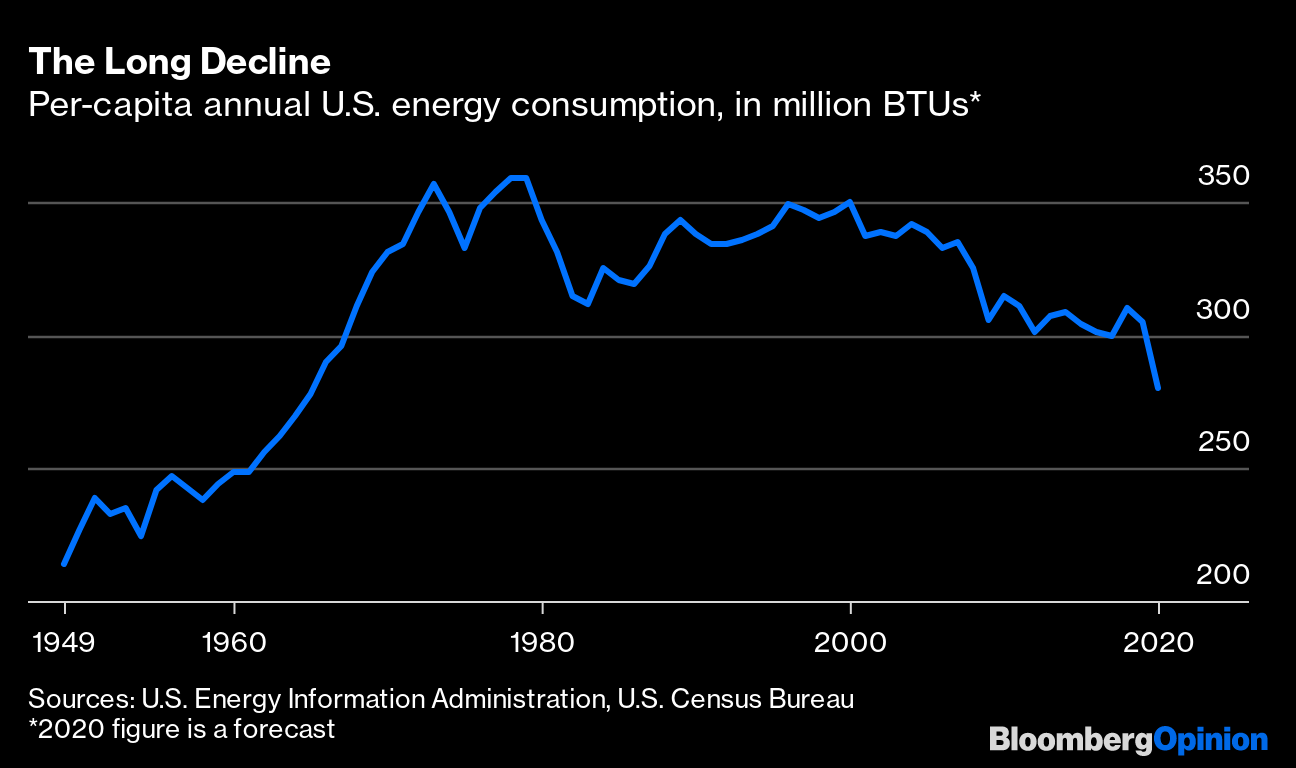

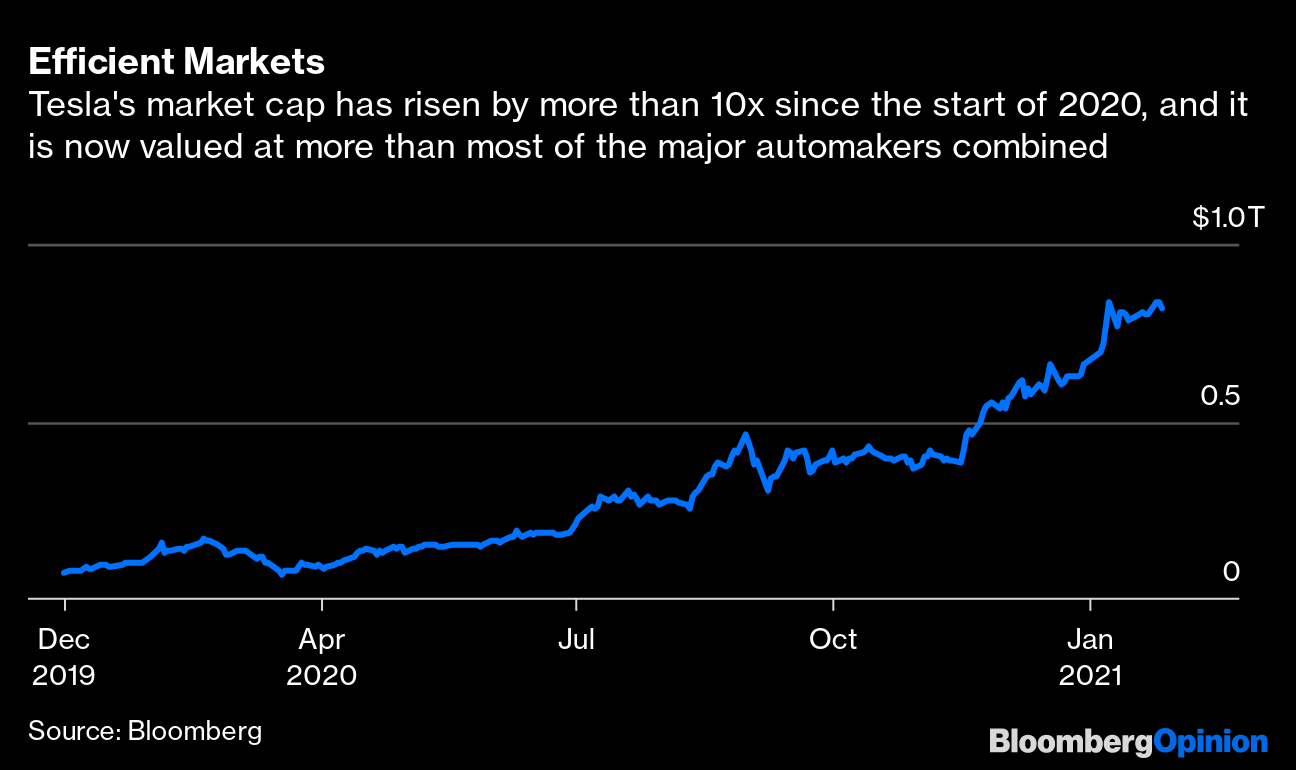

It hasn't taken long to cycle through these stages. In fact, it's happened so quickly they essentially coexist and repeat. Today, for example, after hilariously rising to the stratosphere on wax wings of rage and boredom, GameStop tumbled so fast that at one point it triggered circuit breakers, along with the tears of any greedy people who bought at the top. As Matt Levine writes today, there are a few ways this story can end well for most day traders, but many many more ways it can end badly. Then again, as Matt notes, losing money is just part of the fun for some. You sure can't expect much good to come of pumping up, say, American Airlines, as the lulzing throng did. This stock passes the redditor screen for heavily shorted household names. But as Brooke Sutherland writes, given the airline's debt load and uncertain near future in a pandemic, it's an awfully risky plaything. Nokia was another such target, threatening a whole new set of unintended consequences. Alex Webb notes Nokia isn't just a mall store selling Halo 3; it's a critical telecom provider. European companies may shy away from U.S. markets if they fear such shenanigans will be the norm. The establishment is doing everything it can to avoid such a fate. Robinhood and other platforms clamped down on trading in GameStop, American Airlines, Nokia and other targets. But that triggered new flavors of rage. Day-trading pied piper Dave Portnoy called for prison for all involved and even got into an online spat with Steven Cohen, who had helped bail out one of the short-selling hedge funds caught in the crossfire. With such strange political bedfellows as Alexandria Ocasio-Cortez and Ted Cruz taking Portnoy's side, it's easy to think all this indignation is righteous. But Lionel Laurent suggests the "Trade Free or Die" rhetoric is a tad hypocritical. What traders care about most is making money in the stock market, not building a shining city on a hill. And you can imagine there would be even more political outrage if brokers and regulators just let the GameStop mania run wild and collapse in an even more spectacular way, writes Conor Sen. Though they face some bad days online and maybe in court, Robinhood and others are right to protect traders from themselves, Conor writes. Regulators don't have many fun options, either. One involves, um, options: The Fed could tighten margin requirements under Regulation T, writes Brian Chappatta. This wouldn't exactly stop anything but could keep traders from levering up quite so much to buy call options (themselves a form of leverage). It's worth a try. The GameStop cycle may end soon, but others will eventually take its place. There's Got to Be a Better Way: Schools EditionThe only thing that makes Americans angrier than not being able to buy stocks is the debate over whether to send kids to school in a pandemic. The issue is dividing families, neighborhoods and Facebook groups all over the country. Some parents, and many teachers, say schools aren't doing enough to make going back safe. Other parents point to data showing little Covid transmission in schools and say keeping kids in dismal home-learning environments does more harm than good. President Joe Biden has called getting kids back to school a priority, and Bloomberg LP founder Mike Bloomberg writes he should use every bit of his political and economic power to make it happen safely. Further Back-to-School Reading: Public schools refusing to open is making an argument for school choice. — Ramesh Ponnuru The EU Is Failing Its Vaccine TestThe rollout of Covid vaccines in the U.S. has been sluggish and unsatisfying, but it has also been among the best in the world. The U.K. has done even better, one triumph in Boris Johnson's anything-but-triumphant Covid response, Therese Raphael notes. He would be wise to learn lessons from both the U.K.'s vaccine success and its other Covid failures to guide him the rest of the way. Meanwhile, the EU lags far behind both in inoculating its population, which Tyler Cowen warns will fray already strained bonds between European countries. The EU is also fighting with AstraZeneca over a shortage of vaccine doses. It wants the company to pull the needed doses from the U.K., which is awkward for all concerned, writes Chris Hughes. Such tussles won't encourage pharma companies to jump into the fray in the next pandemic. Further Covid Reading: If AI ran the world, lockdowns would be much stricter. — Leonid Bershidsky Telltale ChartsDefying expectations, American energy use has been slipping for decades, writes Justin Fox.  Tesla is the original GameStop, its price driven higher because YOLO, but its massive valuation builds in some unrealistic scenarios, writes Liam Denning.  Further ReadingAn interview with John Kerry about his plans to fight climate change. — Amanda Little Regulators and banks must get ready for the end of Libor this year. — Tom Wipf SPACs get away with wild claims about the future that IPOs don't. Maybe their treatment should be equal. — Chris Bryant Some advice for investing late in the cycle. — Barry Ritholtz A form of the NFL's Rooney rule won't go far enough to improve diversity at banks. — Sarah Green Carmichael ICYMIBiden reopened the federal Obamacare marketplace. Ray Dalio praised Bitcoin. Vaccines might not eliminate Covid. KickersCentral Park has its first snowy owl in more than a century. (h/t Alistair Lowe) Supposedly extinct Tasmanian tiger possibly spotted in the wild, in Australia of course. (h/t Scott Kominers) People sleep less before full moons. These are the highest-ever-resolution photos of snowflakes. Note: Please send snowflakes and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Commenti

Posta un commento