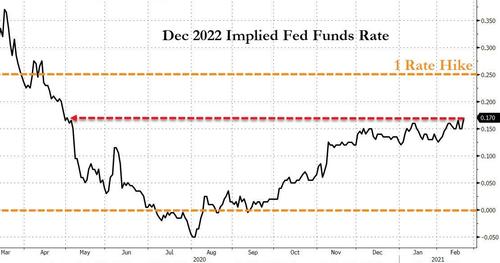

US money markets are starting to show signs of anxiety about the stimulus-squared flood into the US economy, bringing forward expectations of the timing of the start of The Fed's next rate-hike cycle.

Fed funds futures markets now imply a 70% chance of a 25bps Fed rate hike by the end of 2022 (compared to 50% last week)...

Source: Bloomberg

And March 2023 is almost a certainty...

Source: Bloomberg

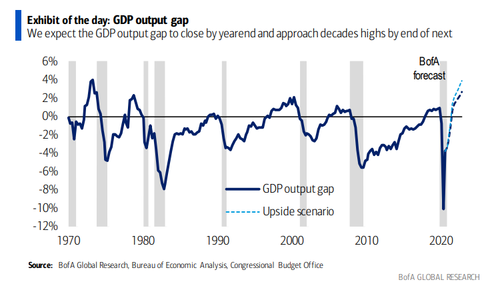

BofA highlights the central planners' dilemma as short-run gain opens the door for long-run potential pain.

This is illustrated by the rapid closing and then overshooting of the output gap.

Normally, BofA notes that this happens many years into the recovery and is followed by a recession as the Fed puts on the brakes. This time around the Fed has more breathing room as inflation and inflation expectations are low and they are willing to allow a modest overshoot. This gives them time to gradually hit the brakes.

But, the market is painting a story of optimism: strong growth and rising, but not troublesome, inflation.

BofA sees upside risk to our 6.0% forecast for GDP growth this year, owing to stronger 1Q GDP tracking and prospects for a larger stimulus in March.

Consensus growth expectations are soaring...

There is a delicate balance: strong growth could prompt a faster rise in rates, driving up borrowing costs and weighing on risky assets, limiting economic growth upside.

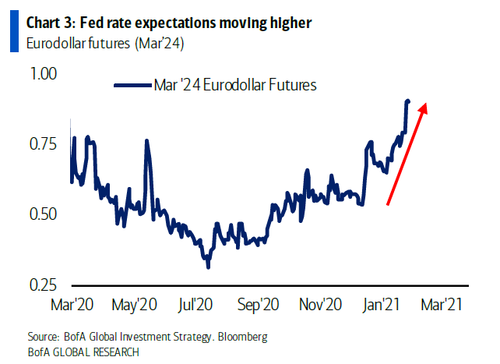

And further out in time, that balance is quickly pivoting against risk assets as the pace of rate-hikes accelerates further...

Source: Bloomberg

As Deutsche's Jim Reid notes, we basically saw nearly one incremental 25bps hike priced into the Dec 24 contract over the last week.

Commenti

Posta un commento