Here We Go Again: Zoltan Warns Repo Market On Verge Of Major Shock As Key Funding Rate Turns Negative

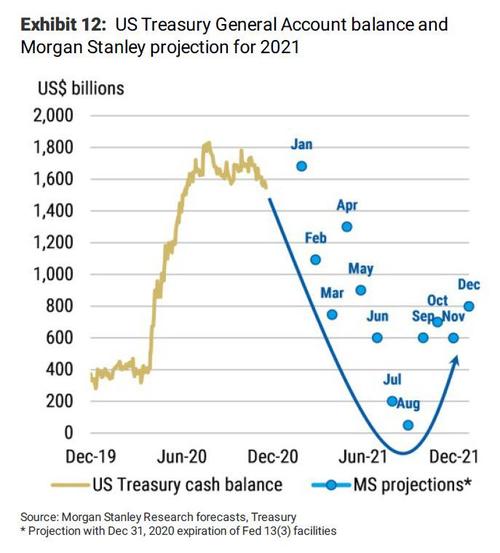

Two weeks ago, when discussing the imminent avalanche of cash set to be unleashed by the Treasury - as a tsunami of $800BN in extra liquidity hits markets over the next 6 weeks, and a total of $1.1 trillion in the next 10 weeks - we said that "nobody was paying attention" to this coming flood of liquidity.

Since then, some have started to pay attention, with Bloomberg writing an article yesterday titled "Yellen Shift on Vast Treasury Cash Pile Poses Problem for Powell" in which it described the liquidity "tsunami" as a move which aims to return its cash position at the central bank to more normal levels, and which "will flood the financial system with liquidity and complicate Powell's effort to keep a tight grip over money market rates."

Sounds awfully familiar... as does this:

"All this cash from the Treasury's general account will have to go back from the Fed and into the market," said Manmohan Singh, senior economist at the International Monetary Fund. "It will drive short term rates lower, as far as they can go."

Ok, fine - people are finally paying attention.

So what does this mean for markets? Well, traders are clearly pricing in the impact of this liquidity tsunami with the S&P trading at an all time high just shy of 4,000. That was to be expected: after all every previous liquidity deluge has resulted in sharply higher risk prices and there is no reason why the algos should trade this one any different.

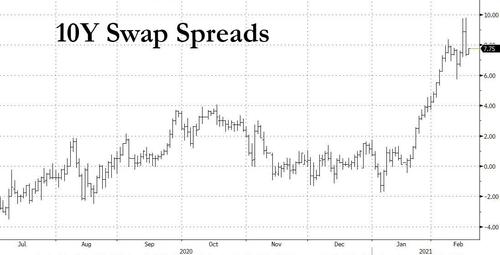

But while the surge in stocks is in line with expectations, we have also observed several other more concerning developments. The first is the recent surge in 10Y swap spreads...

... which is factoring the coming inflation that will be released courtesy of the Treasury's soon-to-be unlocked $1.1 trillion.

A more troubling side-effect of this "liquidity supernova" is the ongoing collapse in short-term rates, which - as a reminder - we also warned about saying "the plunge in short-term debt (Bill) issuance (since there will no longer be an urgent need to keep cash balances in the $1+ trillion range) will compress short-term spreads (effective FF through 3M) to zero - or even negative - as there is suddenly a flood of liquidity which could prompt the Fed to engage the fixed-rate borrowing facility or even nudging the IOER higher."

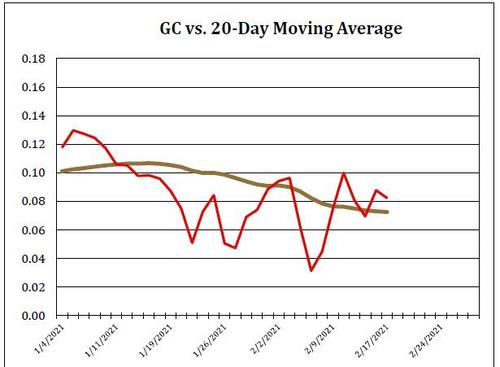

This, to be sure, is another point which suddenly has everyone's attention and as Curvature's repo export Scott Skyrm writes today in his repo market commentary, "The market is preparing for a deluge of cash. REG markets are progressively trading at lower rates each day and term markets are well bid."

Yes, the GSEs already have more cash in the Repo market these days, but now the monthly cash is about to enter the market - typically from the 19th to the 24th of the month. That means even more cash chasing the same amount of collateral. Given where term rates are trading, the market is pricing GC to trade around .03% to .02% early next week."

And on, and on, until GC repo hits 0%... and then goes negative sparking another mini repo market crisis, similar to the one from September 2019 only in reverse.

That's the point made by repo guru Zoltan Pozsar, who in his latest Global Money Dispatch note lays out the problem by comparing it to Sept 2019, similar to what we said two weeks ago when we explained that "what is happening now is just the opposite and many, many times bigger, as almost one trillion reserves are about to be injected into the system as cash is drained from the Treasury's account at the Fed."

Here's Zoltan:

During September 2019, we argued that the system was running out of reserves – too much Treasury collateral was entering the system and we needed a fixed-price, full allotment o/n repo facility to absorb all the excess collateral. Banks' binding constraint was intraday liquidity, which constrained their ability to lend into the o/n repo market. When their lending stopped, repo popped…

Today, the banking system is running out of balance sheet, and money funds are running out of collateral. Soon there will be too much cash in the system; TGA balances will decline from $1.6 trillion to $500 billion by the end of June.

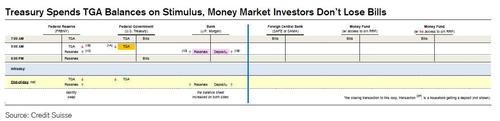

As the Credit Suisse plumbing experts writes next, "this roughly $1 trillion decline will occur either through waves of fiscal spending, which will expand deposits and reserves at large banks...

... or, if spending is too slow to meet the $500 billion target, through bill paydowns. Coupon issuance will be $1.4 trillion over the first half, and depending on whether the spending or paydowns scenario dominates, coupons will be bought mostly by banks, or shadow banks."

Which brings us to the key part: why we are about to see another burst of fireworks in the repo market where rates are about to go negative:

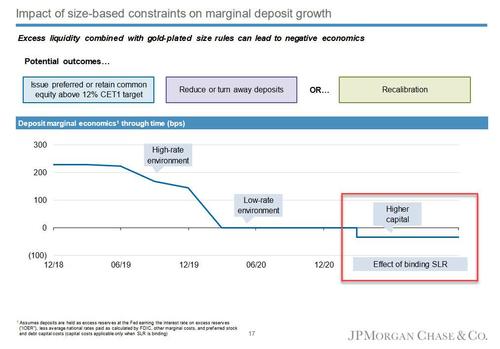

Banks don't have the balance sheet at the bank operating subsidiary level to add $1 trillion of deposits, reserves, and Treasuries: J.P. Morgan can't grow more due to G-SIB constraints; Citibank flat-lined its balance sheet growth already; Bank of America has the capacity to add only $150 billion of deposits and HQLA; and Wells Fargo's $500 billion capacity is constrained by its asset growth ban.

Unless we get SLR relief at the bank opco. level, or Wells Fargo's ban is lifted, banks will have to turn away wealthy households' and institutions' deposits, which will then go to money funds. But money funds will face a constraint too: the marginal asset they will direct inflows into – the o/n RRP facility – is capped; each money fund can place only $30 billion into the facility, which is too little.

Banks' balance sheet constraint becomes a collateral constraint for money funds, and collateral constraints may surface in both the spending and paydown scenarios. Collateral supply from coupon issuance will absorb this cash over time, but money markets react to what happens now, and with $1 trillion of new cash, there may be many pockets of collateral scarcity as these flows play out in real time.

Which means that it will be up to the Fed to intervene once again and allow intermediaries to park the extra trillion in cash somewhere, in this case with the reserve currency's central bank:

The Fed can hike the o/n RRP rate to 100 bps, but unless it uncaps the facility, bills and repo can still go negative.

And besides the repo market, the one place where this particular inversion will unleash shockwaves is the old, familiar FRA-OIS spread which - as everyone remembers from last March - emerged as the financial system's key funding indicator. Only this time instead of blowing wider as it did last March...

... FRA-OIS, already at the tightest level in at least a decade, is about to go negative. Zoltan has more:

To have a view on FRA-OIS, we need to have a view on who will warehouse $1 trillion of reserves that will flood the system by June. Large U.S. banks won't be able to unless they get SLR relief at the bank operating subsidiary level.

We don't think that SLR relief is coming, so as the stimulus checks go out, banks will have to turn away institutional non-operating deposits to money funds. The "natural" outlet for these institutional inflows will be at the o/n RRP facility, but the use of this facility is capped at $30 billion per fund. The use of this facility will be tested not only by stimulus-driven inflows but also by bill paydowns: as bills mature, money funds will look to the RRP facility as a substitute for bills.

Uncapping the o/n RRP facility is more important than adjusting its price; the use of banks' reserve accounts, the foreign repo pool, or Treasury's account aren't capped, so why impose a per-counterparty cap on the o/n RRP facility?

The RRP cap is a key piece of our warehousing puzzle: the $1 trillion of reserves we're trying to find a warehouse for are currently warehoused by the Treasury; U.S. banks can't add another $1 trillion to their warehouses, and money funds can't warehouse $1 trillion unless the Fed decides to uncap the RRP facility.

In practical terms, this means that "unless the RRP facility gets uncapped, bill and repo rates can trade negative and money funds may turn away inflows, as they won't invest at negative rates."

And yes, unless the Fed steps in, we may have NIRP among US commercial banks as soon as a few weeks from today:

J.P. Morgan's SLR problem points to negative deposit rates, and money funds' RRP capacity problem points to negative bill and repo rates.

And yes, somehow everyone missed that JPM's earnings release itself warned very clearly that negative deposit rates are coming in 2021 should "excess liquidity" and "higher capital" become a fixture - which is about to be the case:

The practical implications for a market trading at all time highs, where there does not appear to be a single cloud in the sky, are alarming:

The implications for FRA-OIS from here are obvious: if U.S. banks are full and money funds can't take new money either, foreign banks will warehouse reserves at rates below those of J.P. Morgan but above those available in the bill market – and both are negative. The price of warehousing is a fee, i.e. a negative rate…

And so, unless the Fed steps in aggressively and either grants banks SLR relief and/or the overnight Reverse Repo Facility is uncapped - so that banks have a place to park the flood of $1.1 trillion in excess cash instead of turning it away - Zoltan expects U.S. dollar Libor-OIS spreads to reach zero by June, with risks to the downside. Needless to say, this would be the first time in US history that the key funding metric has dipped into negative territory. The problem is that just like with oil - which imploded instantly the moment it dipped below $0 on April 20, 2020, nobody knows just how negative FRA-OIS will drop, with the potential to unleash major money-market shockwaves growing by the second.

Commenti

Posta un commento