Between global central bank money-printing, government fiscal support out the wazoo, and hopes for vaccine-related developments, the world and his pet rabbit is betting on inflation (and just as confidently, central planners are sure they can tame the beast should it ever get out of hand).

"It's hard to resist this reflation trade at the moment," said Christoph Rieger, head of fixed-rate strategy at Commerzbank AG.

"With policy all one-way and U.S. refunding coming up this week, we may require some more concessions."

'Inflationary' signals are evident everywhere :

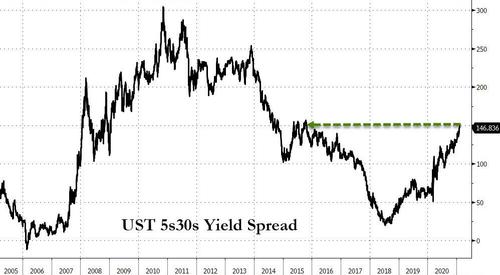

The Treasury curve is at its steepest since 2015...

Source: Bloomberg

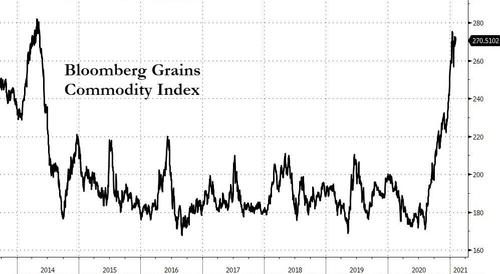

Commodity prices are exploding...

Source: Bloomberg

and oil prices are surging...

Source: Bloomberg

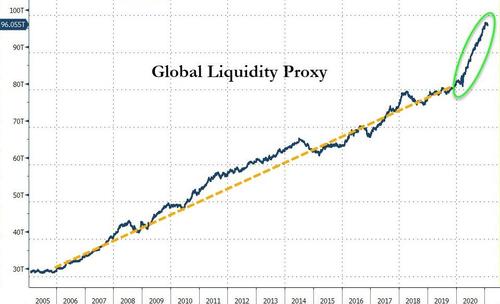

As Global liquidity spews forth...

Source: Bloomberg

And the expectations for inflation are just as global, with US breakevens at their highest since 2014...

Source: Bloomberg

And European inflation swap rates also surging...

Source: Bloomberg

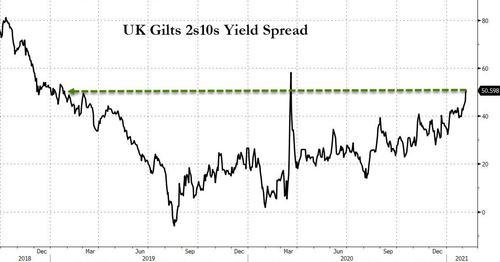

Along with the UK yield curve...

Source: Bloomberg

And judging by Goldman's Growth Growth factor, breakevens are set to keep rising...

Source: Goldman Sachs

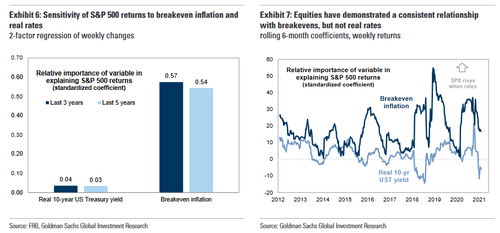

Why does this matter?

Simple - stocks have become tethered to inflation as a driver and entirely ignorant of fundamentals like, oh let's say, earnings!!

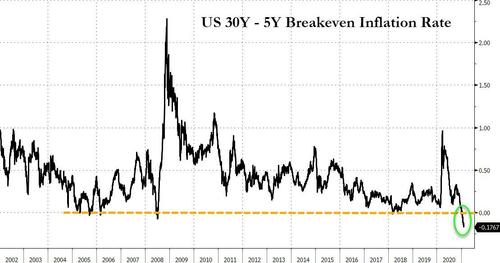

But, some might see the following chart as a moderator of inflation-gasms as it signals longer-term expectations for inflation are lower than the short-term spike expected...

Source: Bloomberg

A short-term inflationary boom followed by a longer-term deflationary depression?

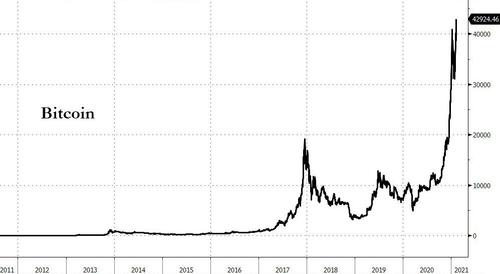

But arguably, the cleanest indicator of 'inflation' is racing ahead to record-er and record-er highs...

Source: Bloomberg

"Inflationary moves are the right moves," said Peter Chatwell, head of multi-asset strategy for Mizuho International Plc.

"When economic growth accelerates and goes above trend, that is when the inflation signals will really start flashing red."

Perhaps all those corporations building reserves of crypto on their balance sheets are on to something after all?

Commenti

Posta un commento