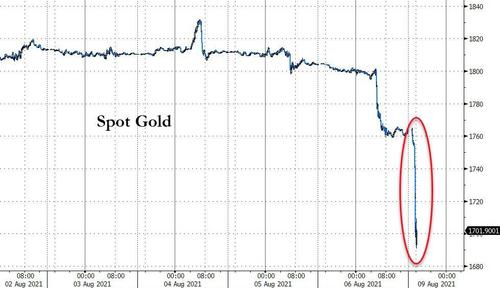

In the liquidity void that follows the resumption of futures trading, and which saw US futures trade modestly lower, a sudden burst of selling in the gold futures contract sent Gold pries plunging to as low as $1,677.0 or almost $100 lower from the Friday close of $1,761.50.

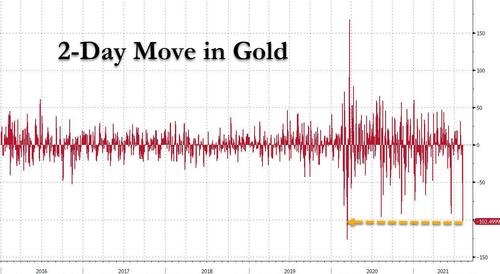

Together with Friday's post-payroll plunge, this has been the biggest 2-day drop in gold (in dollar terms) since the March 2020 crash.

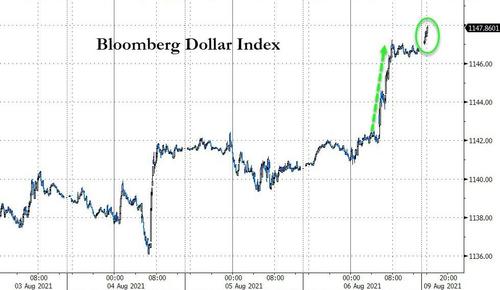

However, unlike Friday when gold moved in response to the spike in the dollar and the surge in yields...

However, unlike Friday when gold moved in response to the spike in the dollar and the surge in yields...

... there was no offsetting move in any securities after the futures reopen (the 10Y traded back over 1.30% but the move was orderly) when over $4 billion notional, or some 24,000 contracts...

... were suddenly and furiously dumped in a completely price-indiscriminate manner whose apparent intention was to nuke the entire bid-stack.

While there was no news or even pair-trade correlation catalyst behind the move, technicians have noted a "death cross" alongside a technical breach of USD 1,750/oz which triggered liquidation stops to the downside.

Silver was also slammed...

And equity futures have tumbled to Friday's post-payrolls lows...

For now, gold appears to have stabilized around the $1700 level.

Commenti

Posta un commento