While China's trade data published overnight may have smashed expectations, with both exports and imports coming far stronger than expected, and surprising China watchers who were expecting a far worse print amid the the disruptions to operations at Ningbo port in August (with Goldman pointing out that "the impact on trade activities was limited likely because lockdown restrictions at ports were relatively targeted and throughput volume was redirected to nearby ports"), the reality is that China's economy continues to flounder as the most recent set of contractionary PMI prints indicated.

The latest proof of China's economic deceleration, came from the latest consumer spending data which showed that Chinese consumers cut back sharply on buying cars and apartments in August as stronger regulation of the property market and a broad Covid outbreak in the country further undercut the economy's already slowing recovery.

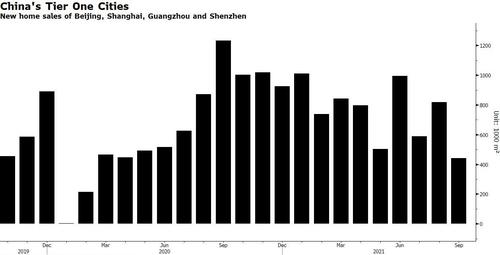

Property sales in the four first-tier cities declined 16% in August from a year ago, according to Bloomberg calculations based on weekly data.

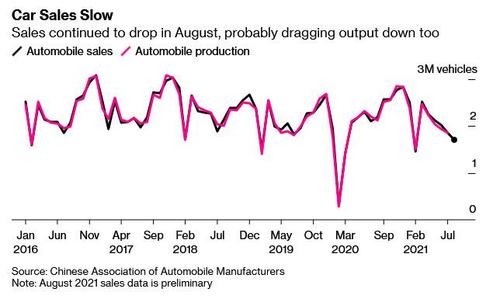

At the same time, total automobile sales (including to companies) plunged about 22% over the same period, the biggest decline since last March when the nation was still in lockdown to control the initial Covid cases.

While China's economic growth was already slowing in July, with private consumption weakening faster than industrial and export sectors, Bloomberg notes that that was made worse by the Covid outbreak in August as cities nationwide reintroduced lockdowns during the summer holidays, a time when consumers usually travel and spending on cars traditionally starts to pick up.

Economic activities slowed further in August on a year-on-year basis, especially consumption and service activities, partly due to the flood shocks and Covid restrictions, UBS AG economists wrote in a note last week. "We see property activities weakening further in the second half on continued hawkish property policies," they said.

The continued shortage of computer chips and weakening demand has hit vehicle output and sales this year. The slump likely undermined retail sales growth for August, which the government is due to release next week: and since cars make up about 10% of the value of retail sales each month, expect a very bad number.

But it was the housing print that was the shocker: after all, unlike the US where the stock market is where the bulk of household net worth resides, in China it's the opposite and housing represents the biggest household asset by far. As such "a rapid slowdown in property sector activities could lead to a significant spillover effect on both upstream industrial demand and consumption," Bank of America economists wrote in a report this week. They estimate that more than 28% of China's gross domestic product is related to the property sector, and said more policy stimulus in the housing sector is needed to support growth.

In other words, while the latest service PMI prints hinted that far from growing, China's economy is now in contraction, the next batch of economic data, and specifically retail sales, may confirm that after the trillions in stimulus injected into the economy, China's economy is indeed on the verge of contraction, an unheard of development for a world desperate for China's massive stimulus to kickstart the next reflationary cycle. However, as recent events with Evergrande clearly demonstrate - with China's largest developer on the verge of collapse - Beijing has vastly different plans for this particular economic cycle.

Commenti

Posta un commento