(Update 8:45am ET): The euro dropped to session lows, erasing earlier gains as Lagarde speaks. She said the euro-area economy is clearly rebounding but the speed of recovery depends on the pandemic and valuations. EUR/GBP fell through its 55-DMA to a two-week low. The ECB released new GDP and inflation forecasts which looked as follows:

GDP:

- 2021 at +5.0% vs +4.6% prev.

- 2022 at 4.6% vs +4.7%

- 2023 at 2.1% vs +2.1%

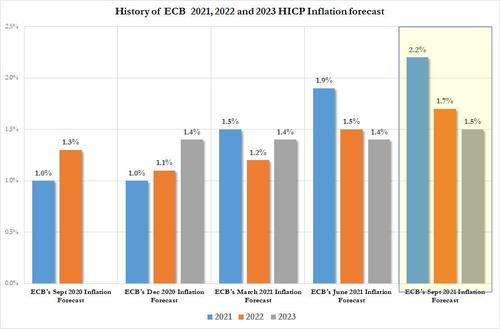

Inflation:

- 2021 at +2.2% vs +1.9%

- 2022 at +1.7% vs +1.5%

- 2023 at +1.5% vs +1.4%

Ominously, as the following chart shows, despite the current surge in inflation the ECB still does not see inflation hitting its 2% target durably...

... which as Viraj Patel asks "what's the point of the ECB if they can't influence inflation."

So the ECB's inflation targets suggests they will never get to the new 2% inflation target durably in this cycle...........

— Viraj Patel (@VPatelFX) September 9, 2021

What's the point of the ECB if they can't influence inflation $EUR pic.twitter.com/jvIUp3ioYN

Or, as Bloomberg's Ven Ram echoes:

The key number in all of ECB President Christine Lagarde's projections is the HICP inflation number of 1.5%, which shows a modest revision that was expected by the markets. In other words, there's still no sight of 2% inflation over the medium term.

So after all these years of negative rates, APP and PEPP, there will be no end to yet-more accommodation and the ECB is saying its inflation target is still very much work-in-progress. And that against a backdrop where the ECB's own estimates show growth this year and next will be better than it has been in a long, long time. Little wonder that BTPs and bunds are bid.

But most hilarious, as noted earlier, is that even though it is tapering, Lagarde still can't bring herself to say that she is, in fact, tapering, and instead claims that "the lady is not tapering" but merely recalibrating stimulus for the next 3 months.

Here are some key headlines:

- LAGARDE: POLICY SUPPORT ESSENTIAL TO PREVENT STRAINS

- LAGARDE: ECB RECALIBRATING STIMULUS

- LAGARDE: FINANCING CONDITIONS REMAIN FAVORABLE

- LAGARDE: EXPECT UNDERLYING INFLATION TO RISE IN MEDIUM TERM

- LAGARDE: UNDERLYING INFLATION IN 2023 SEEN AT 1.5%

- LAGARDE: LONG-TERM INFLATION EXPECTATIONS SOME DISTANCE FROM 2%

- LAGARDE: WAGES EXPECTED TO GROW ONLY MODERATELY

- LAGARDE: UNDERLYING INFLATION PRESSURES HAVE EDGED UP

- LAGARDE: TEMPORARY FACTORS SHOULD EASE IN COURSE OF 2022

- LAGARDE: TEMPORARY UPSWING IN INFLATION MAINLY REFLECTS OIL

- LAGARDE: SEEING IMPROVEMENT ON MANY FRONTS

- LAGARDE: INFLATION RATES TO DECLINE AGAIN NEXT YEAR

- LAGARDE: INFLATION RATES TO INCREASE FURTHER IN AUTUMN

- LAGARDE: EXPECT ECONOMY TO REBOUND FIRMLY IN MEDIUM TERM

- LAGARDE: CONSUMERS REMAIN CAUTIOUS IN LIGHT OF PANDEMIC

- LAGARDE: MANUFACTURING HELD BACK BY SUPPLY SHORTAGES

- LAGARDE: ECONOMY ON TRACK FOR STRONG GROWTH IN THIRD QUARTER

* * *

Earlier: As noted in our ECB preview, where we discussed that the biggest question facing investors today would be whether the ECB would taper the pace of PEPP purchases in the fourth quarter, moments ago the ECB published its statement which confirmed that the central bank would indeed taper (but don't call it that or else stonks can get spooked).

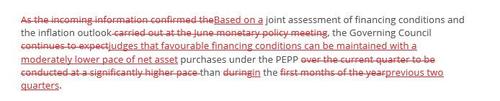

While keeping the bulk of its policy in place (rates unch, APP unch) the ECB Governing Council decided to conduct purchases at a "moderately lower pace" than the roughly 80 billion euros ($95 billion) of monthly acquisitions deployed in the past two quarters, according to a statement on Thursday, to wit:

"Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the PEPP than in the previous two quarters."

As a reminder, this is how Nomura sees the ECB's taper proceeding:

The world's largest hedge fund also reiterated a pledge to keep the €1.85 trillion program running until March 2022 or later if needed, signaling they're not yet ready to discuss how and when to end emergency stimulus even as they are starting to taper it.

The tapering comes as some governors have started to warn publicly that maintaining an ultra-accommodative stance for too long also carries risks. Austria's Robert Holzmann and Klaas Knot of the Netherlands both told Bloomberg in separate interviews last week that emergency asset purchases should end in March, hinting at heated discussions about the policy path in the months ahead.

Some more highlights from the statement:

- Deposit rate kept at -0.5%, main refinancing rate at zero

- Inflation may moderately exceed goal for transitory period: "In support of its symmetric two per cent inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target."

- Price pressures have sufficiently strengthened

- Net purchases under the APP will continue at a monthly pace of €20 billion. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end "shortly before" it starts raising the key ECB interest rates.

- The Governing Council will continue to conduct net asset purchases under the PEPP with a total envelope of EUR 1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over.

- Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the PEPP than in the previous two quarters.

And now attention turns to ECB President Christine Lagarde who will speak at 2:30 p.m. in Frankfurt.

Below is the key redline comparison of the ECB statements:

In kneejerk response, the euro extended its earlier advance, trading up 0.2% at around $1.1838. Italy's 10-year yield premium over its German counterpart fell to 104 basis points, the lowest since August 25, while European stocks faded earlier losses.

While the ECB tapering its PEPP bond buying to a "moderately lower" pace was priced in, the market appears to have been expecting a more hawkish commitment, which it did not get.

Monetary policy decisions

9 September 2021

Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the previous two quarters.

The Governing Council also confirmed its other measures, namely the level of the key ECB interest rates, its forward guidance on their likely future evolution, its purchases under the asset purchase programme (APP), its reinvestment policies and its longer-term refinancing operations. Specifically:

Key ECB interest rates

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively.In support of its symmetric two per cent inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.

Asset purchase programme (APP)

Net purchases under the APP will continue at a monthly pace of €20 billion. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.The Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Pandemic emergency purchase programme (PEPP)

The Governing Council will continue to conduct net asset purchases under the PEPP with a total envelope of €1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over.Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the PEPP than in the previous two quarters.

The Governing Council will purchase flexibly according to market conditions and with a view to preventing a tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation. In addition, the flexibility of purchases over time, across asset classes and among jurisdictions will continue to support the smooth transmission of monetary policy. If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.

The Governing Council will continue to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2023. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Refinancing operations

The Governing Council will continue to provide ample liquidity through its refinancing operations. In particular, the third series of targeted longer-term refinancing operations (TLTRO III) remains an attractive source of funding for banks, supporting bank lending to firms and households.***

The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation stabilises at its two per cent target over the medium term.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:30 CET today.

Commenti

Posta un commento