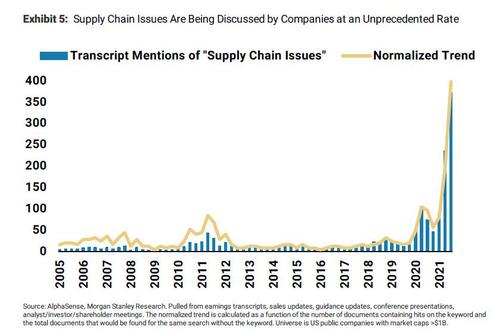

Earlier this week, Morgan Stanley showed that more than inflation, more than concerns about the historic labor crisis, definitely more than covid, one thing has preoccupied the minds of most management teams this quarter: "supply chain issues", a topic which has seen an explosion of mentions on Q3 earnings calls.

But while by now everyone is aware that the global supply-chain shock is truly historic and getting worse by the day, with used car prices rising sharply again and over 30 million tons of cargo waiting outside US ports ahead of the holiday season, few have considered what realistically could normalize these frayed supply chains.

To address this topic, we discussed a research report from Goldman Sachs in which the bank's economists listed what they viewed as the three key drivers of supply chain normalization and their most likely timing:

- improved chip supply driven by post-Delta factory restarts (4Q21) and eventually by expanded production capacity (2H22 and 2023);

- improved US labor supply (4Q21 and 1H22); and

- the wind-down of US port congestion (2H22).

While some viewed Goldman's forecast for a Q4 improvement in chip supply chains - a critical factor for renormalizing auto production - as overly optimistic a little noticed comment in today's US Steel conference call suggests that Goldman may have been spot on.

Earlier today, US Steel jumped as much as 15%, its biggest gain since March 8, after the company announced a stock buyback, a hike in dividends and third-quarter EPS that beat analyst expectations. But it's what US Steel CEO David Burritt said toward the end of the prepared remarks in its conference call that was most surprising.

Discussing the demand picture heading into Q4 and the new year, Burritt said that he was "delighted to hear from multiple auto customers, who are foreshadowing that the trough of the chip shortage could be behind us. They're beginning to add to the fourth quarter and first quarter build schedules, and indicating to us, increasing usage rates, starting as early as next week."

No surprise that former JPMorgan news aggregation maven and current publisher, Adam Crisafulli, called US Steel's observation "the most important (macro) comment from any earnings call this morning."

While it isn't clear what specific macro economic shift may have catalyzed this improvement: after all, West Coast port logjams are about the worst they have ever been, if US Steel's channel checks are accurate and automakers are indeed ramping up production, then one of the biggest supply chain bottlenecks may indeed now be behind us (even if there is still along way to go before the bigger picture renormalizes).

Commenti

Posta un commento