"Every policy-type person is asking – what is the cost of hiking interest rates early?" said Marcel, our head of research, updating us on the state of such chatter.

"Historically, an extrapolation of rate hike expectations leads to a material jump in terminal real rates and an undue tightening in credit conditions," he explained. "The most obvious recent analog branded in policy minds is the 2013 taper tantrum. 5y5y real OIS jumped from -0.75% in 2012 to +1.50% in 2013 with ~75% of that move happening on Bernanke's misstep. A lot of factors contributed to the reversal – 5y5y real OIS returned to –0.75% in 2016."

"The bond market is giving policy makers a free pass, at least for now," continued Marcel. "Bloomberg headlines about bond market carnage are true for some micro, leveraged funds but not accurate for the broader asset class. Treasury total return indices were up on the week (+0.5%) and virtually unchanged for the month (-0.07%). If you told the market in August that the Fed might be preparing to hike in early 2022, most traders would have anticipated a harsh outcome for the broader bond market."

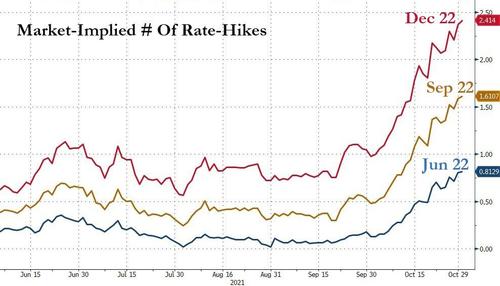

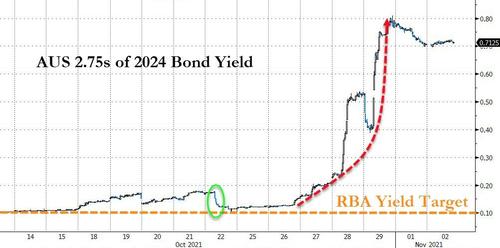

"The re-pricing of the front-end is very narrowly defined. It is also clear in Australia where the 2024 bond with a 0.1% yield target now trades at 0.8% despite central bank attempts to hold it down. That kind of move amounts to a 1.5% price decline for unleveraged bond owners. So does anyone care?" asked Marcel.

"The only players who do are those with leveraged longs. And these were hedge funds that wanted to be short bonds but tried to reduce the negative carry. They bought lots of leveraged short term bonds (sold vol too) and then shorted longer-dated bonds. That trade stung. But it's a small group of players."

"The UK short-sterling strip tells an important tale of what is to come," explained Marcel.

"It says short-term rates will peak in 2023 and decline thereafter. The terminal real rate remains steeply negative. The bond market is saying financial repression is a permanent part of the financial architecture. It says that if you pull forward hikes to show you're responding to inflation, there's no possibility to achieve sustained, positive real short-term rates."

"There is too much capital in the world, and it needs to be destroyed. Financial repression is the most painful destruction tool as it provides no quick recovery, it instead stretches losses over a generation."

Commenti

Posta un commento