Cow farts are the new 'public enemy No. 1' when it comes to the global battle against climate change.

Source: FT

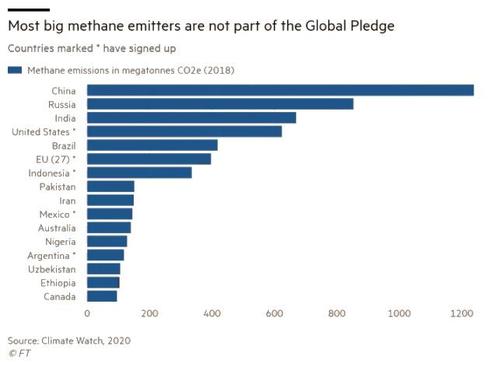

During the COP26 conference in Glasgow on Tuesday, more than 100 countries, including the US, committed to reducing methane emissions by 30% by 2030 - although a handful of major emitters including - of course - China, Russia as well as India did not sign the "global methane pledge", which was spearheaded by the EU and US.

It also doesn't include Australia, where major plumes of methane from coal mines have been identified.

The pledge commits countries to reducing their emissions of methane from agriculture and waste.

Still, the US, which helped spearhead the pledge, has helped recruit dozens of new countries after only a handful were willing to sign on back in September. Per the FT, the number of countries that supported the initiative has grown from just six members when it was initially announced in September, to 105 at its official launch at the Glasgow world leader talks Tuesday.

President Joe Biden described the methane plan as a "game-changer" as he announced the plan on Tuesday, which he introduced alongside a new, separate plan outlining rules on US emissions.

"One of the most important things we can do in this decisive decade to keep 1.5 degrees [global warming] in reach is to reduce our methane emissions as quickly as possible."

According to the FT, methane has 80x the warming potential of carbon dioxide over a 20-year period, making it key to efforts to tackle global warming. The initiative has estimated that a 30% drop in methane emissions by 2030 would reduce global warming by at least 0.2C by 2050. The new White House plans, which were proposed by the EPA, go beyond any prior regulation of methane in the US, which could force operators of new and existing infrastructure to be especially vigilant about monitoring gas leaks.

Global temperatures have reportedly risen by an estimated 1.1 degrees Celsius since pre-industrial times. The fact that the US was able to convince more than 100 nations to sign on to the methane plan means President Biden can declare at least one victory for his presidency as his domestic agenda collapses back at home, especially as W.Va. Sen. Joe Manchin has opposed certain aspects of the climate piece of the Biden spending bill.

"Putting methane at the top of the agenda for these talks is a critical move that will improve the lives of millions at home and around the world by holding off climate chaos," said Fred Krupp, president of the Environmental Defense Fund.

"It will be one of the major success stories of the Glasgow talks."

Dave Lawler, the head of US BP, welcomed the new rules, describing them as "a critical step toward helping the US reach net zero by 2050 or sooner."

Contrary to what one might expect, the oil and gas industry has long been split over its stance on methane. Many large energy producers, under pressure from investors to improve environmental performance, have supported limitations on methane, while some smaller producers have opposed new rules (largely because they produce more methane). The Texas Alliance of Energy Producers claimed that small energy businesses will bear the brunt of the new rules in the US.

"Rushing this proposal to meet a global conference agenda does not make for good environmental or economic policy," said the group's president Jason Modglin.

Commenti

Posta un commento