"I Haven't Seen This In Over 9 Years": Small Business Employment Collapses "Like In March 2008"

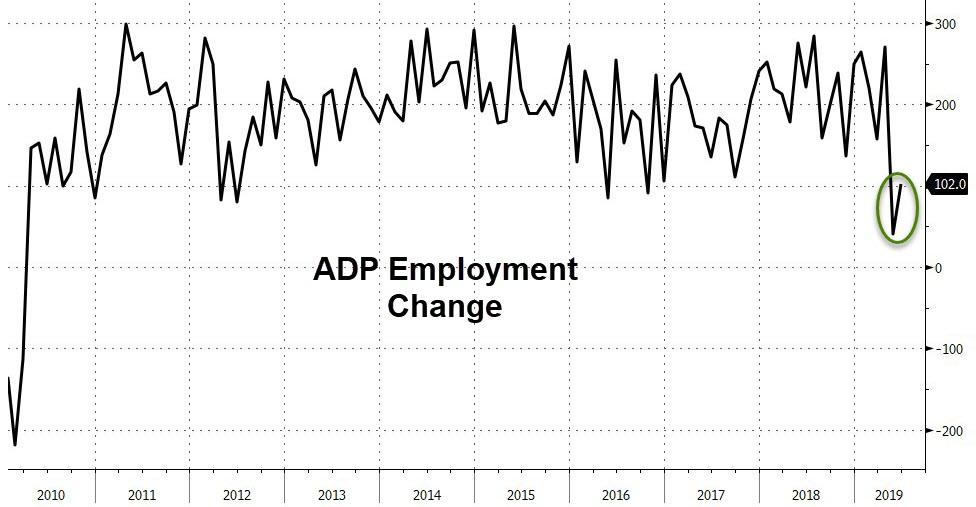

After ADP printed the biggest miss since Feb 2010 in May (adding the lowest amount of jobs since March 2010), expectations for June have been ratcheted down to just a 140k growth in jobs.

May also saw a collapse in construction jobs and so all hope was that this 'blip' was transitory... it wasn't! But, June's ADP print was +102k, an improvement over the May (which was revised up from +27k to +41k), but below expectations of a +140k job gain.

"Job growth started to show signs of a slowdown," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute.

"While large businesses continue to do well, small businesses are struggling as they compete with the ongoing tight labor market. The goods producing sector continues to show weakness. Among services, leisure and hospitality's weakness could be a reflection of consumer confidence."

Mark Zandi, chief economist of Moody's Analytics, said:

"The job market continues to throttle back. Job growth has slowed sharply in recent months, as businesses have turned more cautious in their hiring. Small businesses are the most nervous, especially in the construction sector and at bricks-and-mortar retailers."

The biggest shock in today's number was the small businesses and goods-producing sector, which lost the most jobs (with mining and construction hardest hit). Goods-producers saw jobs contract for the 2nd month in a row...

But it was the plunge in small business employment...

And specifically companies with 1-19 employees, that cratered in both May and June:

Why does this matter? Because as David Rosenberg pointed out, "the small business sector leads the cycle and employment here has plunged 61k in the past two months." Adding that he hasn't "seen this in over 9 years", the Gluskin-Sheff economist notes that he saw that "same decline in Feb-March of 2008 when the consensus was busy calling for a soft landing. This isn't a repeat of 2016 by any stretch."

Commenti

Posta un commento